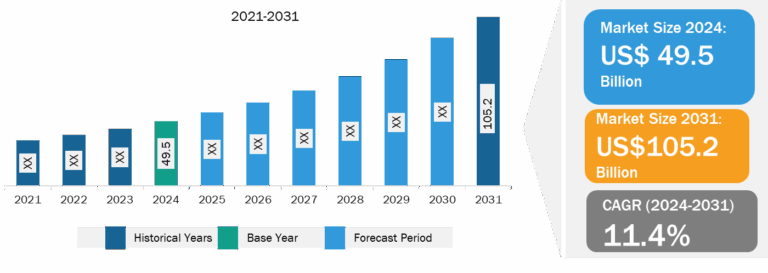

US Healthcare Insurance Third-Party Administrator Market

Rising Complexity of Healthcare Plans and Insurance Policies to Fuel US Healthcare Insurance Third-Party Administrator Market Growth

The rising complexity of healthcare plans and insurance policies has increased the demand for efficient and expert management services. TPAs offer a cost-effective solution for insurers by managing administrative tasks such as claims processing, billing, and customer service, which allows insurance providers to focus on core business operations. As healthcare insurance products become more diversified, insurers are increasingly relying on TPAs to streamline operations. Moreover, the increasing prevalence of chronic diseases and an aging population have placed greater pressure on healthcare systems. This has led to a surge in healthcare claims, further driving the need for TPAs to handle claims efficiently, ensuring timely reimbursements and reducing administrative costs.

Furthermore, TPAs are vital in managing the complexity of medical networks and facilitating smooth interactions between healthcare providers and insurers. Additionally, evolving regulatory requirements, such as compliance with the Affordable Care Act (ACA), have prompted insurers to increasingly outsource administrative functions to TPAs to ensure adherence to legal standards. The combination of these factors—complex healthcare plans, rising costs, technological progress, and regulatory pressure—has created a thriving market for healthcare insurance TPAs in the U.S.

US Healthcare Insurance Third-Party Administrator Market: Industry Overview

The US Healthcare Insurance Third-Party Administrator market is segmented into type, and enterprise size • In terms of type, the market is segmented into health insurance, disability insurance, workers’ compensation insurance, and others. In terms of enterprise size, the market is bifurcated into large enterprises and small and medium-sized enterprises

SMEs held a significant share

Small and medium-sized enterprises (SMEs) in the third-party administrator market tend to focus on providing more niche or specialized services to smaller, regional clients. These third-party administrators may cater to specific industries, offer personalized customer service, or target self-funded employers with fewer employees. SMEs in the third-party administrator space often provide more customized solutions for small businesses that cannot afford the extensive infrastructure of larger companies but still require professional claims management and benefits administration. An example of an SME third-party administrator is HealthSmart, which offers comprehensive third-party administrator services to employers of all sizes but especially focuses on delivering tailored healthcare plans to mid-market companies. Similarly, smaller companies such as Benefit Administrators provide highly specialized services such as employee wellness programs, health reimbursement arrangements (HRAs), and claims management, often focusing on small to medium-sized employers or specific regional markets. These smaller third-party administrators can be more agile and adaptable, offering personalized service and the ability to quickly adjust to the specific needs of their clients.

US Healthcare Insurance Third-Party Administrator Market Analysis: Competitive Landscape and Key Developments

The US Healthcare Insurance Third-Party Administrator market report emphasizes the key factors driving the market and prominent players’ developments. Sedgwick; Crawford and Company; CorVel Corp; UnitedHealth Group Inc; Arthur J Gallagher & Co; Meritain Health; EDISON HEALTH SOLUTIONS; ESIS; Cannon Cochran Management Services, Inc. are among the key players profiled during this market study. Several other essential companies were also studied and analyzed to get a holistic view of the US Healthcare Insurance Third-Party Administrator market and its ecosystem. The market players focus on new product launches, expansion and diversification, and acquisition strategies, which allow them to access prevailing business opportunities. A few of the key market developments are listed below:

- In July 2024, The State of Rhode Island has selected the UnitedHealthcare Community Plan of Rhode Island to serve Medicaid members through the Medicaid Managed Care Services (MMCS) program. UnitedHealthcare has served Rhode Islanders through the MMCS program since 1993, and this contract award will continue to provide access to UnitedHealthcare coverage and services through 2030.

- In October 2021, Crawford announced the acquisition of BosBoon Expertise Group B.V., a Netherlands-based specialist loss-adjusting company. The acquisition supports Crawford’s strategic aim of strengthening its on-the-ground presence in all key territories in which it operates. Bosboon offers a specialist range of loss-adjusting services that will be added to the existing Crawford Global Technical Services proposition in the Netherlands and internationally.

- In January 2021, CorVel and ReedGroup partnered to offer integrated disability management. The new partnership offers a faster return to work and a better employee experience within a single integrated program combining workers’ compensation and absence. It is creating ease for employees who cannot work due to illness or injury and are unfamiliar with the process of managing their absence and the intricacies of workers’ compensation, FMLA, or short-term disability management.