Refrigeration Monitoring Market

According to a new comprehensive report from The Insight Partners, the refrigeration monitoring market is observing significant growth owing to the growing adoption of refrigeration monitoring systems in the food and pharma industries to ensure safety.

The report runs an in-depth analysis of market trends, key players, and future opportunities. In general, the refrigeration monitoring market is segmented on the basis of offering, industry, application, and monitoring type, which are expected to register significant growth in the coming years.

Overview of Report Findings

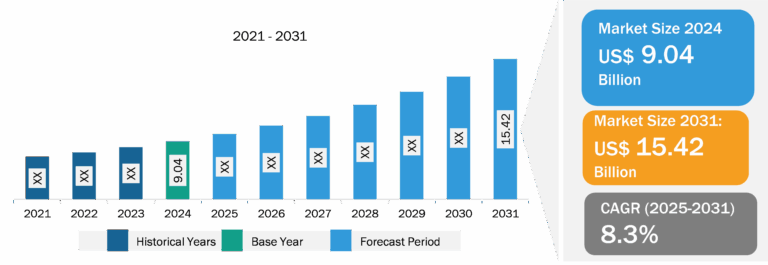

- Market Growth: The refrigeration monitoring market was valued at US$ 9.04 billion in 2024 and is projected to reach US$ 15.42 billion by 2031; it is expected to register a CAGR of 8.3% during 2025-2031. Refrigeration monitoring systems are essential for maintaining safety standards in the food and pharmaceutical sectors. They guarantee products are stored at optimal temperatures, mitigating the risk of spoilage and contamination. According to recent Centers for Disease Control and Prevention figures, ~48 million individuals in the US (1 in 6) become ill, 128,000 are hospitalized, and 3,000 die each year as a result of foodborne illnesses. Thus, implementing refrigeration monitoring systems enables businesses to comply with the rigorous standards set by the Food and Drug Administration (FDA) and other regulatory authorities. These organizations establish precise guidelines to ensure the safe storage and handling of perishable goods, such as food and pharmaceuticals. For example, the FDA’s Food Safety Modernization Act (FSMA) emphasizes preventive measures to avoid foodborne illnesses, prioritizing proactive actions over reactive responses to outbreaks. Moreover, Hazard Analysis and Critical Control Point (HACCP) guidelines provide a systematic method for identifying and addressing temperature-related hazards, emphasizing the significance of exact temperature control in maintaining food safety.

- Cloud and Blockchain Integration: The integration of blockchain and cloud platforms allows for secure and scalable data storage and sharing. Cloud-based blockchain technologies combined with refrigeration monitoring enable stakeholders to access and share important data in real time from anywhere. Blockchain technology promises to improve traceability by allowing all participants in the supply chain to view a product’s temperature history and route, hence increasing confidence and compliance. This results in a complete and unalterable history of the product’s journey. Stakeholders, such as manufacturers, shippers, and retailers, can use this data to check the product’s course and condition at each stage, ensuring complete traceability. Blockchain technology can be combined with the Internet of Things (IoT) sensors to allow real-time monitoring of temperature and ambient factors. Sensors record data on a blockchain ledger, ensuring that any temperature change is logged permanently. This real-time data enables prompt response if problems develop, preserving product quality. Thus, the integration of cloud and blockchain is likely to set a trend for the refrigeration monitoring market.

- Integration of AI and Machine Learning: Artificial intelligence and machine learning lead predictive analysis by anticipating probable difficulties such as fridge breakdowns and optimizing temperature management operations, ensuring products are preserved in ideal conditions, decreasing waste, and boosting overall cold chain efficiency. AI-powered systems anticipate maintenance requirements by analyzing real-time data, allowing for predictive maintenance and averting breakdowns. Machine learning algorithms improve energy use by changing cooling systems, lowering operational costs and carbon footprints. AI also enables smart control systems that automatically modify settings to achieve peak performance, improve temperature stability, and save waste. In the food and pharmaceutical industries, AI-powered monitoring ensures precise cold chain management, preventing spoiling and assuring regulatory compliance. AI-based anomaly detection identifies operational issues immediately, saving downtime and product loss.

Market Segmentation

- Based on offering, the refrigeration monitoring market is segmented into hardware, software, and service. The hardware segment dominated the market in 2024.

- In terms of industry, the refrigeration monitoring market is segmented into food and beverages, healthcare, chemicals, and others. The food and beverages segment dominated the market in 2024.

- Based on application, the refrigeration monitoring market is segmented into storage, transportation, inventory, protection, and others. The storage segment dominated the market in 2024.

- Based on monitoring type, the refrigeration monitoring market is segmented into real-time temperature tracking, energy management, product freshness monitoring, data logging and analysis, and others. The real-time temperature tracking segment dominated the market in 2024.

Competitive Strategy and Development

- Key Players: Major companies operating in the refrigeration monitoring market include Danfoss AS, TE Connectivity Ltd, KoolZone Ltd., Copeland LP, Samsara Inc, ORBCOMM Inc, Monnit Corporation, Tek Troniks Limited, Berlinger & Co. AG, Dickson Data, Sensaphone, Vaisala Oyj, OneEvent Technologies, Kitchen Brains, and Swift Sensors.

- Trending Topics: Refrigeration Leak Detector Market, Refrigeration Coolers Market, Refrigerant Compressors Market, among others.

Global Headlines on Refrigeration Monitoring Market

- ORBCOMM announced it has joined the Move to -15°C campaign as a technology provider to help track and share the telematics data that will help quantify the initiative’s impact.

- Danfoss is partnering with retail technology company Lizard Monitoring to aid North American retailers with their Zero Food Waste (ZFW) goals.

Conclusion

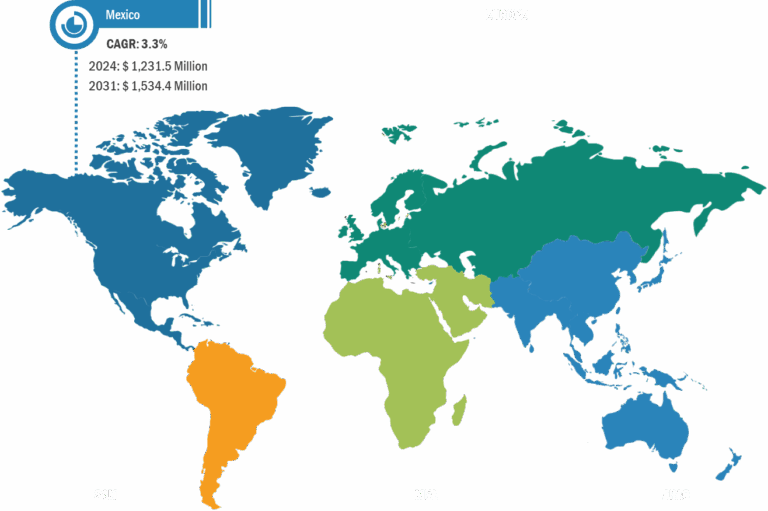

Technological developments in North America have contributed to a highly competitive market for all industries. Moreover, as food safety, pharmaceutical, and medical storage standards tighten, firms must guarantee that refrigeration systems stay within specific temperature limits. According to IQVIA (MIDAS), in 2023, North America accounted for 53.3% of global pharmaceutical revenues, compared to 22.7% in Europe. In May 2024, the US market accounted for 67.1% of new medication sales from 2018 to 2023, compared to 15.8% in Europe. Thus, the growing pharmaceutical production globally creates growth opportunities for the refrigeration monitoring market. Moreover, various players globally are launching temperature monitoring systems. For example, in April 2022, Squadle launched the Squadle Sense Remote Temperature Monitoring (RTM). This is a hands-free monitoring device to monitor freezer and refrigerator interiors. Using wireless temperature sensors, Squadle Sense RTM efficiently maintains store compliance. It frees up time formerly spent on food safety, allowing staff to focus on items that boost the bottom line.

The refrigeration monitoring market in Europe is expanding due to the rising demand for cold chain logistics, food safety, and regulatory compliance. Major supermarkets such as Tesco use monitoring systems to ensure temperature control throughout storage and transit, preventing food deterioration. In April 2024, Star Refrigeration and Tesco partnered on a cold store efficiency drive. Tesco used the technology to alter chiller temperatures at test sites in order to cut energy usage. Between January 2022 and September 2023, Tesco saved an average of 10% on energy at eight distribution hubs by improving the operation and maintenance of refrigeration on-site.

The report from The Insight Partners, therefore, provides several stakeholders—including component providers, product manufacturers, and end users—with valuable insights into how to successfully navigate this evolving market landscape and unlock new opportunities.