Genotyping Market

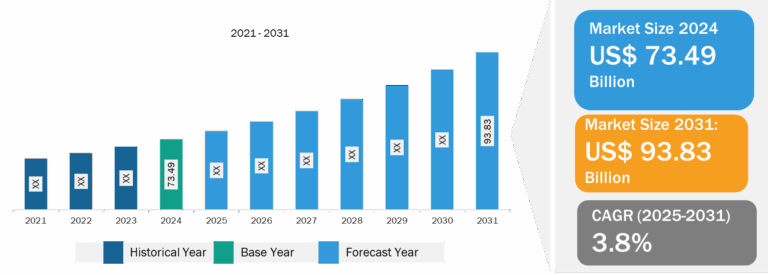

Use in the diagnosis of genetic and rare diseases, and technological advancements and rising R&D investments in the biotechnology and pharmaceutical industry are among the crucial factors propelling the genotyping market growth. However, the high cost of equipment and shortage of skilled professionals hamper the market growth. The burgeoning popularity of personalized medicine is expected to bring new trends to the market in the coming years.

Increasing Popularity of Personalized Medicine to Act as Trend in Genotyping Market During Forecast Period

According to the National Health Service of England, personalized medicine is the medical treatment tailored to the unique traits of each patient. The method is based on scientific advancements that provide an understanding of a person’s unique genetic and molecular profile that contributes to their susceptibility to diseases as well as helps determine the safest and most effective medical treatments. Genomic medicine, guided by each person’s unique genetic, clinical, and environmental information, is a fundamental component of personalized medicine. Standardization, development, and integration of various essential tools into health systems and clinical workflows for the whole-genome studies of transcription, sequence variation, proteins, and metabolites are the crucial stages of personalized medicine. Health risk assessment, family health history, and clinical decision assistance for complex risk and predictive information are combined with genomic data to detect individual risks and guide clinical treatment, laying the groundwork for a more informed and effective patient care approach.

The potential of incorporating genomic information in the enablement of personalized healthcare is evident through the DNA-based risk assessment for common complex diseases, genome-guided therapy, dose selection, and molecular signatures for cancer diagnosis and prognosis, among others. The integration of personalized medicine with healthcare can aid in more precise diagnoses, enable the prediction of disease risk before the occurrence of symptoms, and provide individualized treatment plans with maximum safety and efficiency. Genomic analysis of tumors can help tailor therapeutic approaches for treating individuals with hereditary cancer. Genome-based data can also be utilized as a guideline to determine the correct warfarin dose. The Clinical Pharmacogenetics Implementation Consortium has developed genotype-based drug guidelines to assist physicians in optimizing pharmacological therapies based on genetic test results.

Although scientific discoveries related to personalized medicine are making their way from labs to clinics, the widespread acceptance of personalized medicine necessitates significant changes in regulatory, reimbursement procedures, and legislative privacy laws for the rapid adoption of these medicines. Thus, increasing awareness and popularity of personalized medicine due to ongoing research and the use of genome editing techniques is expected to act as a prominent trend in the genotyping market.

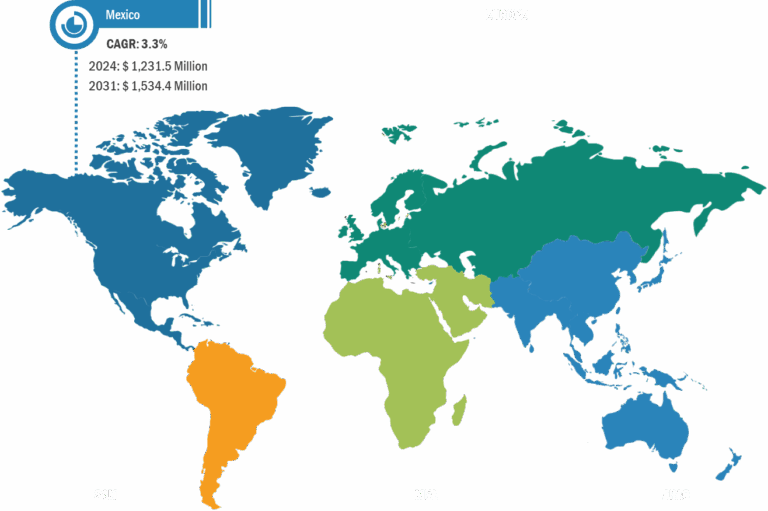

The geographic scope of the genotyping market report covers North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and Rest of Asia Pacific), and the Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa). The US held the largest share of the market in North America in 2023. The ongoing “All of Us Research Program” led by the National Institutes of Health (NIH) provided US$ 28.6 million in funding to develop three genome centers across the US. This research program aims to accelerate precision medicine discoveries through genotyping services in different institutions in the US. Similarly, the “My Life, Our Future” project was initiated to carry out genotyping of hemophilia patients and to build a biorepository as a research resource for the future. Further, a rapid surge in healthcare expenditure reflects the increasing availability of new diagnostic tools for genetic diseases and cancer. The flourishing pharmaceutical and biopharmaceutical industries create a conducive environment for the genotyping market in the US. Market players in this country have registered various patents for their innovations.

Governments and private agricultural associations are highly focused on advancements in crop genomics to improve the characteristics of crops. The Agricultural Genome to Phenome Initiative (AG2PI) of the National Institute of Food and Agriculture focuses on collaborative engagements to develop a community of researchers studying both crop and animal genetics, which would lay the foundation for expanding knowledge about genomes and phenomes that are important to the agriculture sector in the US. The initiative is likely to result in the development of approaches to understanding how variables such as weather, environments, and production systems impact genetic diversity in crops and animals. Thus, the rising number of initiatives taken to foster studies related to the genetic makeup of crops for yield and quality improvement are likely to favor the genotyping market in the US in the future.

A large number of research institutes, diagnostics, and biopharmaceutical and pharmaceutical companies are operational in Canada, which contributes to the demand for genotyping products and services. The Institute of Genetics (IG) community formed by the Canadian Institutes of Health Research primarily focuses on supporting research activities on the human genome. It looks after the work on parts of genetics, basic biochemistry, and cell biology linked to human health and disease, including gene interactions. The pharmaceutical industry has a vital role in the growth of the genotyping market owing to the ongoing research on the development of therapeutics for cancer and various genetic diseases. As per the Government of Canada, the country ranks ninth among the largest pharmaceutical markets in the world in terms of sales value. Innovative pharmaceutical companies, drug manufacturers, contract research organizations (CROs), and small and medium-sized biopharmaceutical companies are among the significant enablers of such a huge sales value. According to Statistics Canada 2020, 6,280 companies were operating in Canada. Moreover, the pharmaceutical sector accounts for 41%, and the research and development sector accounts for 31% of its overall healthcare sector. Thus, the rapidly growing pharmaceutical and biopharmaceutical industries generate a massive demand for genotyping products and services in Canada.

The genotyping market analysis has been carried out by considering the following segments: product type, technology, application, end user, and geography. Based on product type, the market is segmented into instruments, reagents and kits, bioinformatics, and genotyping services. Based on technology, the market is divided into microarrays, capillary electrophoresis, sequencing, matrix-assisted laser desorption/ionization-time of flight (MALDI-ToF) mass spectrometry, polymerase chain reaction (PCR), and others. By application, the genotyping market is segmented into pharmacogenomics, diagnostics and personalized medicine, animal genetics, agricultural biotechnology, and others. Based on end user, the market is segregated into pharmaceutical and biopharmaceutical companies, diagnostic and research laboratories, academic institutes, and others.

Genotyping Market: Competitive Landscape and Key Developments

F. Hoffmann-La Roche Ltd, QIAGEN NV, Merck KGaA, Eurofins Genomics, Thermo Fisher Scientific Inc, BioTek Instruments Inc, Xcelris, Trimgen Corporation, Illumina Inc, Danaher Corp, Bio-Rad Laboratories, HE Healthcare Technologies, Standard Biotools Inc, Laboratory Corp of America Holdings, Beckmann Coulter, BGI, Takara Bio, and Diasorin Spa are among the prominent players profiled in the genotyping market report. In addition, several other players have been studied and analyzed during the study to get a holistic view of the market and its ecosystem. These companies focus on geographic expansions and new product launches to meet the increasing demand from consumers worldwide and diversify their product range in specialty portfolios. Their global presence allows them to serve a large customer base, subsequently facilitating market expansion.