US Pharmaceutical Market

The US pharmaceutical market trends in the US pharmaceutical market is driven by rising workplace-associated disorders, rise in pharmaceutical production capacity, increased approvals of generic drugs, and escalating R&D investments in the pharmaceutical sector. However, the high cost of drug development and marketing approval hinders the US pharmaceutical market growth.

Rising Workplace Associated Disorders Drives the US Pharmaceutical Market:

According to the US Department of Labor, Survey of Occupational Injuries and Illnesses (SOII) data reported in November 2023, private industry employers recorded 2.8 million nonfatal workplace illnesses and injuries in 2022, i.e., up by 7.5% from 2021 data. To be precise, 2.3 million cases of injuries (i.e., up by 4.5%) and 460,700 cases of illnesses (i.e., up 26.1%) were reported in 2022. The growth in illnesses is due to the increasing number of respiratory illnesses, which was estimated to be 365,000 in 2022 (i.e., up by 35.4%). This comes after an undulating respiratory disease curve recorded in 2020 and 2021.

Counts of total nonfatal occupational injuries, illnesses, and respiratory illnesses (private industry, 2018–2022) (Thousand)

| Year | Total cases1 | Injuries | Illnesses | Respiratory illnesses |

| 2018 | 2,834.5 | 2,707.8 | 126.8 | 12.1 |

| 2019 | 2,814.0 | 2,686.8 | 127.2 | 10.8 |

| 2020 | 2,654.7 | 2,110.1 | 544.6 | 428.7 |

| 2021 | 2,607.9 | 2,242.7 | 365.2 | 269.6 |

Footnote: 1Excludes farms with fewer than 11 employees.

Source: Bureau of Labor Statistics, US Department of Labor, Survey of Occupational Injuries and Illnesses, in cooperation with participating state agencies

According to the data published by the American Institute of Stress,

- 83% of US workers suffer from work-related stress, with 25% affirming their job to be the top stressor in their lives.

- Each day, about 1 million Americans miss work due to stress.

- Depression-induced absenteeism costs US businesses US$ 51 billion a year and an additional US$ 26 billion in treatment costs.

- Over 50% of workers are unable to report to work due to stress-induced illnesses, leading to a loss of productivity.

- The top causes of workplace stress are excessive workload (39% of workers), juggling between work and personal life (19%), interpersonal issues (31%), and job security (6%).

However, work-related mental health conditions can be averted by managing psychological risks at the workplace and implementing organizational interventions that directly target working conditions and environments. Additionally, the implementation of health risk assessment at the workplace is one of the best solutions to tackle physical and mental health conditions.

As injuries and illnesses at workplaces are increasing, there is a significant need for treatment that includes medicines, physiotherapy, medical procedures, and psychological treatments. Thus, the US pharmaceutical market forecast is growing with an upsurge in workplace-associated disorders.

Rise in Pharmaceutical Production Capacity

In recent years, many US pharmaceutical market share companies have increased their production capacities to meet clinical needs and expand their global reach. For instance, in December 2022, Pfizer Inc., an American multinational pharmaceutical and biotechnology corporation, invested US$ 750 million to expand its primary manufacturing facility in Kalamazoo, Michigan. With this expansion, this pharmaceutical company is likely to increase its capacity for vaccine and medicine production using mRNA technology. Similarly, Hovione, a Portuguese pharmaceutical company, is expanding its manufacturing facility in New Jersey, as part of its US$ 170 million global expansion strategy. The development would boost its global production capacity by ~25%. With this expansion, the company aims to enlarge its commercial spray drying and active pharmaceutical ingredient (API) manufacturing capacities by the end of 2023. In December 2020, Piramal Pharma Solutions invested ~US$ 32 million to expand its manufacturing facility in Michigan, US, to add capacity and introduce new capabilities for developing and manufacturing APIs. In 2021, Amgen Inc. invested a total of US$ 550 million to build a new multiproduct drug-substance manufacturing facility in North Carolina. The construction of the new plant is expected to be completed by 2024.

Thus, such efforts by pharmaceutical companies to expand their production capacities lead to a more resilient supply chain and increase in customer base, thereby bolstering the US pharmaceutical market growth.

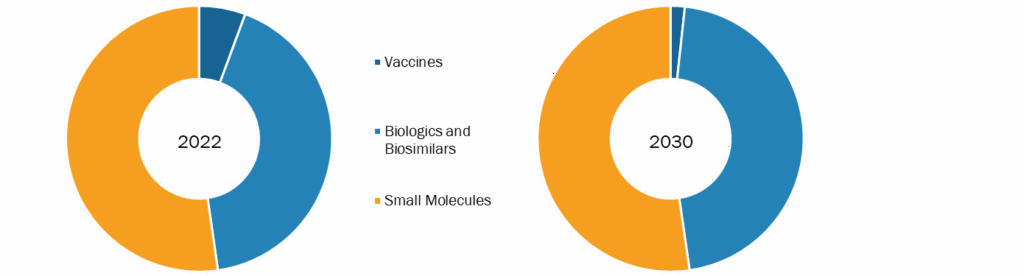

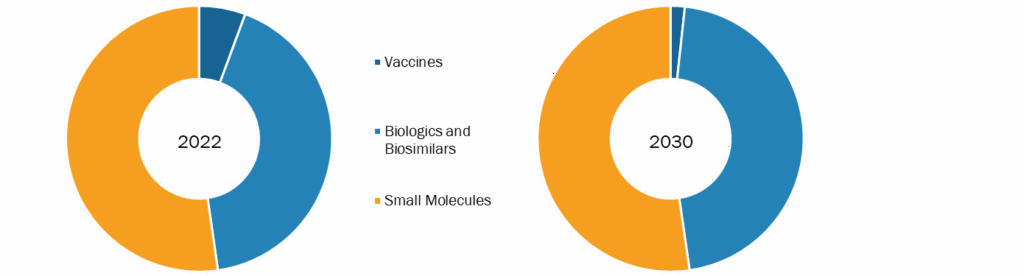

US Pharmaceutical Market Outlook: Segmental Overview

The US pharmaceutical market outlook, by product, is segmented into vaccines, biologicals & biosimilars, and small molecules. The small molecules segment is further bifurcated into generic and branded. The small molecules segment held the largest market share in 2022. The biologicals & biosimilars segment is expected to register the highest CAGR during the forecast period.

US Pharmaceutical Market, by Product – 2022 and 2030

Small molecules contribute over 70% of the total pharmaceutical drugs by volume (such as insulin, aspirin, and antihistamines). They also include molecules such as glucose, fatty acids, amino acids, and cholesterol and secondary metabolites such as lipids, glycosides, alkaloids, and natural phenols. A brand-name drug is a medicine discovered, developed, and marketed by a pharmaceutical company. Once a new drug is discovered, the research company files for a patent to protect it from other companies gaining access to it and selling it under their brand. Brand-name drugs are expensive because they don’t have any competition to drive their price down. When patents on branded drugs approach expiry, other manufacturers can apply to the FDA to sell generic versions. As manufacturers of generics do not need to repeat costly clinical trials and generally do not incur marketing, advertising, and promotional costs, they can sell their products for lower costs. On the contrary, companies that make branded drugs often spend massive amounts on research, development, and advertising, and they need to price their drug at a cost high enough to recoup their spending and turn a profit. For example, according to Kantar Media, AbbVie spent ~US$ 259 million in 2015 on direct-to-consumer advertising for Humira. Such a factor has assisted the growth of the US pharmaceutical market in the recent past and is expected to follow a similar trend during the forecast period.

As per separate QuintilesIMS data (on behalf of the Association for Accessible Medicines), in 2022, although branded specialty drugs comprise only 1% of prescription drugs, they account for more than 32% of total drug spending. Furthermore, brand-name products produce ~20% of approval claims but account for ~40% of all abandoned claims. Overall, new patient abandonment rates for generics are about two-thirds lower than branded abandonment. Specifically, 20.5% of brand-name prescriptions are abandoned, compared to 7.7% of generics. Brand drugs are only 11% of prescriptions but are responsible for 74% of drug spending.

The US FDA approved 37 novel drugs in the year 2022. Similarly, there were 50 new drug approvals in 2021, 53 in 2020, 48 in 2019, and the highest of all 59 in 2018. Seventeen of the new drugs in 2022 were small molecules, accounting for 46%. Pfizer Inc. and Johnson & Johnson are the top two players in the branded small molecules market in the US pharmaceutical market.

US Pharmaceutical Market: Competitive Landscape and Key Developments

Johnson & Johnson, Merck & Co Inc, Abbott Laboratories, Amgen Inc, Eli Lilly and Company, Bristol-Myers Squibb Company, Bayer AG, Takeda Pharmaceuticals, Zoetis Inc, Moderna Inc, AbbVie Inc, Pfizer Inc, Gilead Sciences Inc, and Regeneron Pharmaceuticals Inc are a few of the key companies operating in the US pharmaceutical market. Leading players focus on expanding and diversifying their market presence and clientele, tapping prevailing business opportunities. In August 2023, Bristol Myers Squibb acquired Mirati Therapeutics Inc. The goal of Mirati, a commercial-stage targeted oncology firm, is to find, create, and provide ground-breaking treatments that will improve the quality of life for cancer patients and their families. The assets of Mirati provide a compelling opportunity to expand Bristol Myers Squibb’s oncology trademark, as they complement the company’s portfolio and creative pipeline. By virtue of this acquisition, Bristol Myers Squibb will expand its commercial portfolio by incorporating KRAZATI, a significant lung cancer medication. The business obtains access to a number of intriguing clinical assets that enhance its pipeline for oncology treatments and make excellent prospects for both combination and single-agent development.