US Mail Order Pharmacy Market

Factors such as the increasing incidences of chronic diseases and surging adoption of mail order pharmacy services for various healthcare needs fuel the US mail order pharmacy market growth. However, security concerns originating from counterfeit products and lack of pharmacists counselling hinders the market growth. Further, increasing adoption of mail-order pharmacy services for specific healthcare needs is creating opportunities for the US mail order pharmacy market.

Increasing Incidences of Chronic Diseases Drives US mail order Pharmacy Market Growth:

Chronic diseases such as diabetes, cardiovascular disorders, autoimmune disorders, and various cancer types are the leading causes of mortality worldwide. According to the National Association of Chronic Disease Directors 2022 report, nearly 40% of American adults have multiple chronic conditions (MCC). Additionally, the National Health Council report reveals that chronic conditions account for more than 75% of the total healthcare costs in the US. Heart disease, cancer, mental disorders, and pulmonary conditions rank among the 5 most expensive health conditions, based on total annual healthcare spending in the US. Medication adherence among chronic disease patients can offer positive health outcomes, with a reduction in hospitalizations and costs. Non-adherence to inhaled corticosteroids is responsible for ~24% of asthma exacerbations. There have been many attempts to increase medication adherence and improve patient care in the US. For instance, various insurance companies provide financial incentives to make filling prescriptions via mail-order pharmacies, which is considered less expensive for patients. Mail-order pharmacy services are typically offered for buying drugs prescribed for chronic conditions such as high cholesterol, asthma, high blood pressure, diabetes, and depression. Through this, the customer gets medicine for 90 days rather than getting prescriptions refilled every month. Therefore, in addition to the increasing incidences of chronic diseases—medication nonadherence, population aging, and convenience over traditional methods drive growth of the US mail-order pharmacy market.

Increasing Investment in Start-Ups is creating opportunities for US Mail Order Pharmacy Market

Mail-order pharmacy is becoming a lucrative business model for investors. As a result, the number of mail-order pharmacy start-ups is increasing in the US. Historically, major mail-order pharmacies have been associated with large retail chains such as Walgreens, Humana, and CVS Health. However, the growing inflow of investments, dependency on the Internet, and demand for hassle-free deliveries have led to a rise in number of independent mail-order pharmacies, thus offering numerous opportunities for the expansion of this business.

A few of the recent investments in mail-order pharmacy start-ups are mentioned below:

- In January 2020, Alto (San Francisco) raised US$ 250 million from SoftBank’s Vision Fund 2. The company delivers prescription drugs in California, Nevada, Washington, and Colorado.

- In July 2020, Medly Pharmacy (New York City) scored US$ 100 million in the series B funding round. The company provides same-day prescription delivery, and works directly with patients to manage adherence to medication and refills. It is currently operating through 5 pharmacies across New York, New Jersey, Pennsylvania, Maryland, and Miami. With the investment mentioned above, it is planning to expand to other metropolitan cities in the next 18 months.

- In July 2020, Truepill raised US$ 25 million to fulfill its plans to expand into the telehealth segment with a service that will connect physicians and patients in the US over real-time video communications. With this new investment, Truepill targets to serve the increasing demand of its wide base of customers across the healthcare sector.

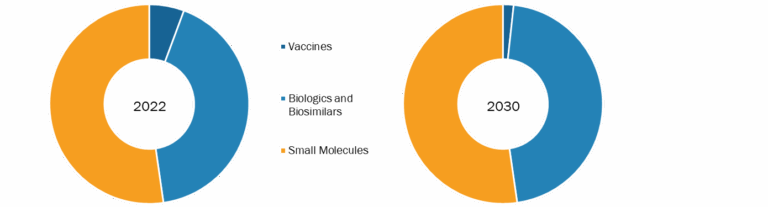

US Digital Pharmacy Market: Segmental Overview

The US Mail Order Pharmacy market is segmented on the basis of drug type, product, and mode of order. Based on drug type, the market is bifurcated into prescription and non-prescription drugs. The prescription medicine segment held a larger market share in 2022 and the same segment is anticipated to register a higher CAGR during 2020-2030. The increasing prevalence of chronic diseases such as cancer, cardiovascular diseases, and diabetes, and the rising cases of orphan diseases are likely to benefit the US mail order pharmacy market for the prescription drugs segment. By product the US Mail Order Pharmacy market is segmented into dermal care products, antidiabetic medicines, cardiovascular medicines, blood pressure medicines, asthma management products, cold & flu medicines, painkillers, antacids, and others. The dermal care product segment held a larger market share in 2022 and cardiovascular medicines segment is anticipated to register a higher CAGR of 22.89% during 2020-2030. In terms of mode of order, the market is segmented as online stores and pharmacy applications.

US Mail Order Pharmacy Market: Competitive Landscape and Key Developments

The major players in the US mail order pharmacy market are CVS Health Corp, Walmart Inc, Envirotainer AB, Able Freight Services LLC, Deutsche Post AG, GeniusRx, Geisinger Health, Geisinger Health, Humana, Inc., Ridgeway Pharmacy LLC and The Cigna Group. These leading players adopt strategies such as the launch of new products, expansion and diversification of their market presence, and expansion of new customer base for tapping prevailing business opportunities.

Key Developments in US Mail Order Pharmacy Market:

- In October 2022, Envirotainer offered their shipment report service for CryoSure using the Logmore Dry Ice logger. Logmore is a connected platform for modern condition monitoring.

- In June 2022, Humana Inc. a leading health and well-being company, rebranded Humana Pharmacy and Humana Specialty Pharmacy as CenterWell Pharmacy and CenterWell Specialty Pharmacy after making a seamless transition to the CenterWell healthcare services brand.

- In May 2021, Walmart Health and MeMD had entered into an agreement for Walmart Health to acquire MeMD. This acquisition allowed Walmart Health to provide access to virtual care across the nation including urgent, behavioral and primary care, complementing our in-person Walmart Health centers.