US Pedicle Screw Market

Rising Number of Spinal Surgeries Using Pedicle Screw Systems

Pedicle screw systems play an important role in increasing strength and providing support to the damaged spinal cord. The escalating number of medical professionals specializing in spinal surgeries drives the pedicle screw market growth. According to data published in Health Central LLC in 2019, approximately 313 million surgeries are performed annually in the US, including ~1.62 million spinal procedures and 500,000 lumbar spine surgeries. Cost is an important factor in these types of surgeries. As per the data published in Health Trust-The Source Magazine in 2022, nearly 1.2 million surgeries are performed in the US, and a lumbar spinal fusion surgery cost ~US$ 80,000 on average.

Pedicle screw systems have developed significantly with the rising number of spinal surgeries. Incorporating a navigation system while placing the pedicle screw system is a major development. Moreover, robotics is used to augment accuracy and minimize surgical invasiveness while placing pedicle screws. Although robotics in elderly patients has not been studied at a larger scale, this population may benefit significantly from the application of robotic techniques to perform minimally invasive procedures to decrease operative time, minimize blood loss, and reduce postoperative pain, ultimately resulting in decreased complications.

The rising adoption of pedicle screw systems in treating degenerative spinal disorders is another factor driving the pedicle screw market growth. Moreover, a steep rise in sports-related injuries and spinal cord injuries (SCIs), and accidental fractures require surgical procedures, which bolsters the pedicle screws’ demand and use. According to the data published by the National Spinal Cord Injury Statistical Center in 2022, the annual incidence of traumatic SCIs in 2021 was ~54 cases per 1 million people in the US, which is equivalent to the addition of 18,000 new SCI cases every year. Vehicle crashes are the major cause of these injuries, closely followed by falls. Moreover, acts of violence (primarily gunshot wounds) and sports/recreation activities are relatively common causes. Thus, the rising prevalence of spinal surgeries boosts the demand for pedicle screws, thereby propelling the overall market growth.

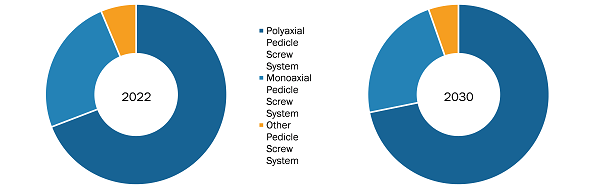

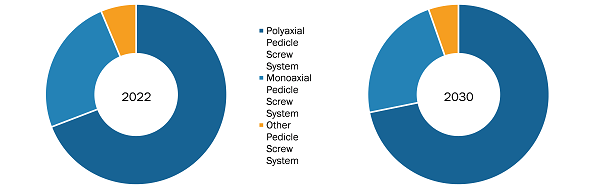

US Pedicle Screw Market: Segmental Overview

The US Pedicle Screw market, by product type, is segmented into polyaxial US Pedicle Screw systems, monoaxial US Pedicle Screw systems, and other US Pedicle Screw systems (including uniaxial US Pedicle Screw systems). In 2022, the polyaxial US Pedicle Screw system segment held the largest share of the market. The same segment is estimated to register a significant CAGR during 2022-2030. Polyaxial US Pedicle Screw systems are used in spinal surgeries to stabilize and immobilize the spine. Screws are anchored in the pedicle, which are small bony projections on the vertebral bodies. This type of screw can move in multiple directions, giving surgeons greater flexibility during pedicle placement. In recent years, minimally invasive surgery has been a preferred approach for spinal surgeries using posterior US Pedicle Screw fixation.

In terms of surgery type, the US Pedicle Screw market is bifurcated into open surgeries and minimally invasive surgeries. In 2022, the open surgery segment held a larger share of the market. The minimally invasive surgery segment is estimated to record a higher CAGR during 2022-2030. Minimally invasive surgeries (MIS) have gained traction owing to the rising application of technologically advanced robotic and image-guided (IG) surgeries. The market for the MIS segment is anticipated to grow six times faster as compared to the open surgeries segment during 2022-2030. These surgeries are associated with less damage to the surrounding muscles, lower bleeding, minimum pain, faster recovery, and shorter hospital stays. At present, MIS is considered a common procedure for spinal fusion.

US Pedicle Screw market, by application type, is segmented into thoracolumbar fracture, spinal tumor, failed spinal fusion, scoliosis, and spondylitis. In 2022, the thoracolumbar fracture segment held the largest share of the market. Thoracolumbar fractures can significantly affect the quality of life, resulting in neurological deficits, deformities, and pain. According to an article published in Orthopaedic Surgery in 2020, spinal fractures account for approximately 32.8/100,000 population, and thoracolumbar fractures account for ~90% of spinal fractures. In addition, nearly 20% of these fractures are burst fractures due to axial pressure. Most of the thoracolumbar fractures occur between T11 and L2, a stress concentration area.

Based on end user, the US Pedicle Screw market is divided into hospitals, ambulatory surgical centers, and specialty clinics. In 2022, the hospitals segment held the largest market share. US Pedicle Screw fixation systems are routinely used in lumbar, thoracic, and sacral spine surgeries to manage different pathological conditions. Hospitals are a vital part of the development of health systems worldwide. They play an important role in offering support to other healthcare providers. An increasingly large number of hospitals are attaining expertise to perform US Pedicle Screw fixation procedures to treat various spine disorders.

US Pedicle Screw Market: Competitive Landscape and Key Developments

DePuy Synthes; Zimmer Biomet; Globus Medical Inc.; B. Braun Melsungen AG; Stryker Corp; Medtronic PLC; RTI Surgical, Inc.; K2M, Inc.; Orthofix International N.V.; and Alphatec Spine, Inc. are among the leading companies operating in the US Pedicle Screw market. These players focus on expanding and diversifying their market presence, and acquiring a novel customer base, thereby tapping prevailing business opportunities in the US Pedicle Screw market.

A few of the notable key developments by companies in the US Pedicle Screw market are mentioned below.

- In March 2023, Orthofix Medical Inc. and SeaSpine Holdings Corporation completed their previously announced merger of equals to create a leading spine and orthopedics company.

- In November 2022, Zimmer Biomet Holdings, Inc. a medical technology leader across the world, completed the spinoff of its former Dental and Spine business-ZimVie.

- In April 2022, Surgalign Holdings, Inc. received FDA 510(k) approval for its CorteraTM spinal fixation system. This new flagship product is a key piece of the company’s portfolio designed to drive its growth over the next 10 years, with expected gains in shares worth ~US$ 2.2 billion in the US posterior fixation market.