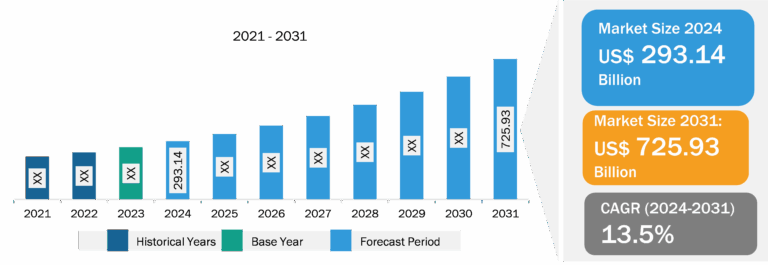

North America Surgical Navigation Systems Market

The report highlights trends prevailing in the North America surgical navigation systems market growth. The North America surgical navigation systems market growth is attributed to the rising cases of musculoskeletal and neurological disorders, and the integration of advanced technologies with surgical navigation systems.

Rising Cases of Musculoskeletal and Neurological Disorders

According to the United States Bone and Joint Initiative 2023 report, musculoskeletal diseases affect more than 50% of people aged 18 and above in the US. Trauma, back pain, and arthritis are the three most common musculoskeletal conditions reported in the country. Also, with the aging of the population, musculoskeletal diseases are becoming a greater burden annually. Osteoarthritis and inflammatory arthritis, including rheumatoid arthritis (RA), gout, psoriatic arthritis, and other conditions, are the most common types of arthritis. As per the United States Bone and Joint Initiative 2023 report, more than 25% of adults have doctor-diagnosed arthritis, and 78 million Americans are estimated to have this disease by 2040. Therefore, there is a high demand for surgical navigation systems intended for orthopedic surgery. These systems are among the most powerful and enabling tools for surgeons. Surgical navigation systems analyze pre- and post-operative data in multiple versions using augmented reality (AR) to improve clinical outcomes of orthopedic surgeries. For example, visualization systems allow surgeons to take suitable positions during surgeries without excessive exposure to X-ray radiation.

The Information Technology & Innovation Foundation report states mental and neurological disorders, and associated diseases account for the cost burden of more than US$ 1.5 trillion annually to the US government, totaling 8.8% of the national GDP. Additionally, the report reveals that more than 50 million American adults, accounting for 21.8% of the adult population, have experienced events associated with brain disease in the past. Navigation systems for neurological procedures assist in a range of procedures, from intracranial tumor resections to frameless biopsies and from pedicle screw placement to spinal stabilization. For example, in skull openings (small craniotomies), neuronavigation systems display anatomical structures and track the virtual axis of surgical instruments.

Medtronic provides innovative surgical navigation systems and related products for neurosurgery, spinal surgery, and cranial surgery. Its StealthStation S8 Surgical Navigation System comprises an intuitive interface that aids advanced visualization to navigate neurosurgery procedures. The system provides optical and electromagnetic (EM) tracking capabilities with the help of external devices such as microscopes and ultrasound, thus acting as a powerful tool for neurosurgical procedures. Thus, the need for effective surgical treatments for orthopedic and neurosurgery with the rising cases of musculoskeletal and neurological disorders, coupled with innovative product launches by top companies, propels the adoption of surgical navigation systems in North America.

North America Surgical Navigation Systems Market: Segmental Overview

The “North America Surgical Navigation Systems Market” is segmented on the basis of technology, application, end user, and region. Based on technology, the surgical navigation systems market is segmented into optical, electromagnetic, and others. The electromagnetic segment held the largest market share in 2022, and the same segment is expected to record a significant CAGR during 2022–2030. In electromagnetic tracking systems (EMTs), magnetic fields are generated, sensors are used to detect them, and finally, software is used to process them. In an electromagnetic field of known geometry, the coordinates of the pre-interventional patient scan and the coordinates of the tracking system are registered.

EMTs are used widely in neurosurgery, interventional bronchoscopy, urology, cardiology, and sinonasal cavity surgeries. EMTs utilize fluoroscopy to screen the patient without using ionizing radiation, and it does not expose the patient to any energy fields that are more harmful than ultrasounds.

In July 2021, TT Electronics—a provider of engineered electronics for performance-critical applications—partnered with US-based Radwave Technologies to develop advanced electromagnetic tracking technologies. These companies, in partnership, would focus on introducing a customizable electromagnetic tracking platform with minimally invasive diagnostic and therapeutic devices for use during surgical procedures.

Based on application, the surgical navigation systems market is segmented as orthopedic, ENT, neurology, dental, and other applications. The orthopedic segment held the largest market share in 2022, and the neurology segment is anticipated to register the highest CAGR during 2022–2030. Orthopedic surgery navigation systems or orthopedic surgical robots use a patient’s preoperative/intraoperative imaging data to plan the surgical path and then guide doctors through the planned surgical path using the robotic arm’s guiding function. The navigation system also captures a joint range of motion, laxity, and kinematics intraoperatively. HipNav is an image-guided surgical navigation system used in hip replacement surgery. With this system, prosthetic components can be measured and guided during total hip replacement surgery (THR). The system consists of a 3-dimensional preoperative planner, a simulator, and an intraoperative surgical navigator. The orthopedic segment is further classified into knee replacement and hip replacement.

According to the American Academy of Orthopaedic Surgeons, nearly 1 million knee and hip replacements are performed every year. An aging population, and an increase in obesity and osteoarthritis would cause that number to rise to 4 million by 2050.

DePuy Synthes offers a technology-assisted VELYS Hip Navigation platform for hip replacement. The surgeons use real-time data to help improve surgical outcomes. Thus, the growing advancement in orthopedic surgery navigation systems boosts the growth of the orthopedic segment of the North America surgical navigation systems market.

In terms of end user, the surgical navigation systems market is categorized into hospitals and ambulatory surgical centers (ASCs). The hospital segment held a larger share of the market in 2022 and is anticipated to register a higher CAGR during 2022–2030.

Surgical navigation systems are routinely used in orthopedic, neurology, and other surgeries to reach the target body site with greater precision. Hospitals are a vital part of the development of health systems. They play an important role in offering support to other healthcare providers. An increasingly large number of hospitals in North America are attaining expertise to use surgical navigation systems for surgeries. With the rising number of surgeries, the use of surgical navigation is expected to rise in hospital settings. Moreover, the rising number of hospitals is expected to continue the dominance of the hospitals segment in the North America surgical navigation market during the forecast period.

North America Surgical Navigation Systems Market: Competitive Landscape and Key Developments

B. Braun SE; DePuy Synthes Inc; Medtronic Plc; Siemens Healthineers AG; Stryker Corp; Zimmer Biomet Holdings Inc; Brainlab AG; CASCINATION; HEMOSTASIS, LLC; and Corin Group; are among the leading companies operating in the North America surgical navigation systems market. These players are focusing on expanding and diversifying their market presence and acquiring a novel customer base, thereby tapping prevailing business opportunities in the North America surgical navigation systems market. Many market players are launching their innovative products in the North America surgical navigation systems market with advanced features.