US Digital Pharmacy Market

Increasing Inclination Towards Online Platform Drives US Digital Pharmacy Market Growth:

The US has authorized accreditation bodies to safeguard consumers from fraud or possible mishaps associated with online purchases of prescription medicines. The US National Association of Boards of Pharmacy runs the Verified Internet Pharmacy Practice Sites (VIPPS) program to accredit virtual pharmacies complying with the inspection and licensing requirements, along with additional criteria, of states. These online or authenticated pharmacies are identified based on logos.

The survey conducted by Abacus Data on 1,500 American consumers in May 2021 revealed that 1 in 4 Americans risk purchasing prescription medicines online because it is convenient and confers high savings in returns. Moreover, 27% of the American population follows the guidance of healthcare professionals when searching for online pharmacies; 49% of these people consulted doctors/physicians, 30% consulted pharmacists, and 12% consulted nurses before the online purchases of prescription medicines. Further, 30% of the American population referred to popular search engines to locate online pharmacies. Thus, the inclination toward online purchase of prescription medicines bolsters the growth of the US digital pharmacy market trend.

Technologically Advanced Digital Pharmacy Solutions to Create Growth Opportunities in Market in US:

The adoption of digital pharmacy market landscape includes services increased gradually during the COVID-19 pandemic, which allowed pharmacists in many states of the US to process prescriptions and medication orders remotely, enabling community pharmacies to operate without interruption. The ability of digital tools to record personalized customer experiences further bolsters the adoption of digital pharmacy landscape includes solutions and services. For example, customer activity tracking tools assist pharmacies in determining customer preferences and developing data-driven services. Moreover, direct-to-patient channels can reduce the cost of delivery of prescription medicines to consumers, resulting in better customer satisfaction and convenience.

Campaigns authorized by the US Food & Drug Administration (FDA) assist buyers in purchasing prescription medicines online. The BeSafeRx campaign helps consumers learn how to safely buy prescription medicines online. Such campaigns also feature tools using which consumers can report important information regarding unexpected experiences or adverse effects of medications to the MedWatch portal. Such technologically driven initiatives by health authorities in the US would ultimately drive the growth of the digital pharmacy market in the country during the forecast period.

Several start-ups in the US have entered the online pharmacy space and received substantial venture capital funding. E-commerce giants such as Amazon have entered into this space through partnerships, while many physical stores are launching their online services. Small pharmacies and distributors in the US have established online shops, which have reported small-scale online sales. An upsurge in the popularity of online platforms and e-commerce has triggered the digitalization of pharmacy [prescription drugs and over-the-counter (OTC) medication] in the US.

The majority of people in the US live within 5 miles of community pharmacies, but rural and urban patients have difficulty accessing pharmacy services. A few of the factors affecting medication accessibility are nationwide pharmacy shutdowns, transportation problems, disability-related problems, and economic challenges, which lead to pharmacy deserts as stated by the US Department of Agriculture. A study from the Journal of the American Medical Association, published in 2023, reported that states that adopted telepharmacy policies experienced a decrease in pharmacy deserts, and telepharmacies are virtually closer to people with high medical needs than traditional pharmacies. There are currently 28 states in the US that permit the practice of telepharmacy, with differing statuses and regulations.

US Digital Pharmacy Market: Segmental Overview

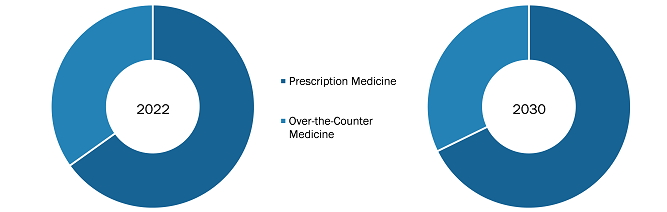

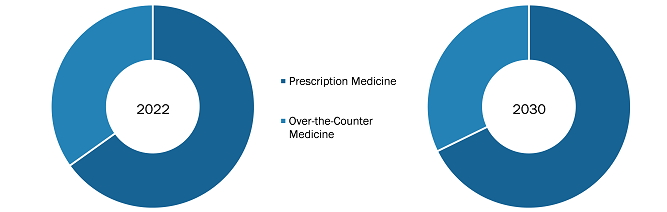

The US digital pharmacy market, based on drug type, is segmented into a prescription medicine and over-the-counter medicine. The prescription medicine segment held a larger market share in 2022. The US digital pharmacy market, by product, is segmented into personal care, vitamins and supplements, medicines and treatments, and other products. The medicines and treatments segment accounted for a larger market share in 2022. The medicine and treatment segment is further divided into sexual health, neurological disorders, heartcare, diabetes, weight loss, and others. The heartcare segment accounted for the largest share of the market in 2022, and it is expected to register the fastest CAGR during 2022–2030. The US digital pharmacy market, by platform, is segmented into app-based and website-based. The app-based segment is further segmented into telehealth pharmacy apps, medication management apps, health and wellness apps, compounding pharmacy apps, and other apps. Telehealth pharmacy apps accounted for the largest share of the US digital pharmacy market for the app-based segment in 2022. Based on gender usage, the US digital pharmacy market is segmented into male and female. The female segment led the market in 2022, and it is also estimated to record the highest CAGR during 2022–2030.

US Digital Pharmacy Market: Competitive Landscape and Key Developments

The Cigna Group, Good Rx Holdings Inc., CVS Health Group, Walmart Inc., Hims & Hers Health Inc., Roman Health Pharmacy LLC, Apex Pharmacy Inc., Lloyds Pharmacy, Pharmacy2U Ltd., Docmorris NV, True pill are a few of the key companies operating in the US digital pharmacy market. Leading players focus on expanding and diversifying their market presence and clientele, thereby tapping prevailing business opportunities.

In June 2022, Lloyds Pharmacy announced partnership with Deliveroo allowing customers to order toiletries and OTC medicines to be expanded to 110 stores. The expansion of the partnership was launched amid the pandemic in 2020, with 150 Lloyds stores participating in the scheme. Through this partnership the consumers can now order a range of top 50 selling products through the Deliveroo app, comprising cold relief medicines, OTC painkillers, and home pregnancy tests among the popular items.

In September 2023, GoodRx, announced collaboration with MedImpact for lowering drug prices on prescriptions at the pharmacy counter. The collaboration will integrate GoodRx’s prescription pricing into MedImpact’s pharmacy benefit manager (PBM) services offering a seamless experience for MedImpact members. Additionally, the collaboration will allow both companies to deliver more savings to consumers without any additional effort and offering program to seamless data integration. This is achieved by ensuring patients are given alert about any negative drug interactions through the MedImpact’s rigorous drug safety review.