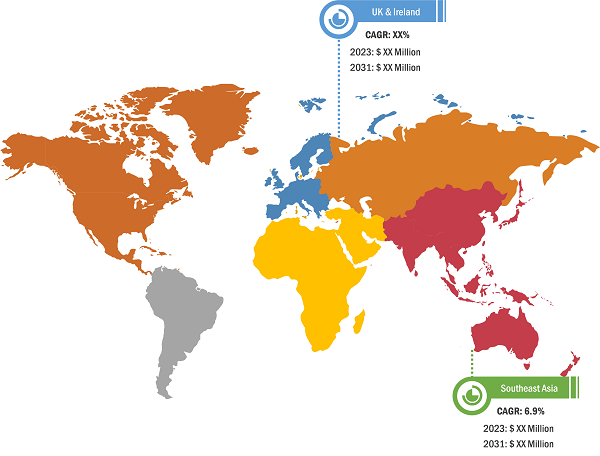

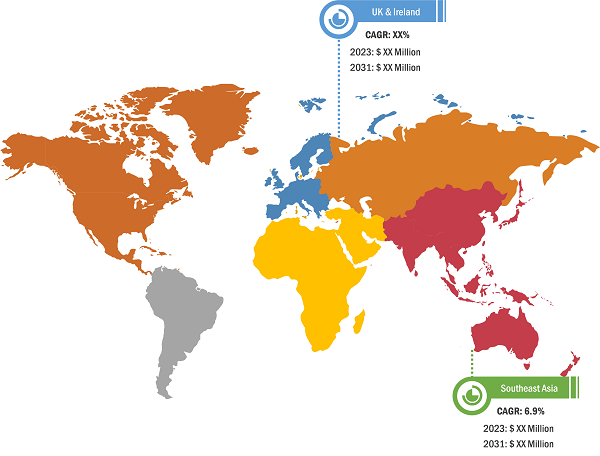

UK, Ireland, and Southeast Asia spark detection system market

Integrating Internet of Things (IoT) technology with spark detection systems can improve fire safety measures in various businesses. This integration can enable real-time monitoring and data processing, which can significantly enhance the effectiveness of spark detection systems. In addition, by combining IoT capabilities, spark detection systems can continuously monitor ambient conditions and detect sparks or ignition sources more accurately. Also, IoT sensors can offer real-time data on temperature, humidity, and particle levels, allowing proactive steps to be implemented before a spark ignites a fire.

Data acquired from IoT-enabled spark detection systems can be used to observe patterns and trends associated with spark occurrence. This predictive analytics technology enables businesses to implement maintenance schedules and operational changes that reduce the likelihood of fire accidents. Furthermore, IoT connectivity allows for smooth communication between spark detection devices and other safety and operational systems in a facility. This interconnection enables coordinated reactions to possible fire threats, such as automatically turning off machinery or activating fire suppression systems when a spark is detected. Such extensive safety precautions can considerably lower the possibility of catastrophic accidents. Thus, the integration of IoT is expected to bring new trends in the UK, Ireland, and Southeast Asia spark detection system market growth during the forecast period.

Vietnam Holds Second Largest UK, Ireland, and Southeast Asia spark detection system market Share in Asia Pacific

Vietnam has emerged as a global leader in the export of wood and wood products. On an international scale, Vietnam is the world’s fifth largest wood exporter, second in Asia, and first in Southeast Asia. The export value of wood and wood products from Vietnam was US$ 17.01 billion in 2022, up 7.1% from 2021. Since 2018, Vietnam has become one of the top five plywood exporters in the world, owing to the rapid development of the domestic wood processing industry. Its total plywood exports increased from US$ 774 million in 2018 to US$ 1.1 billion in 2022. Thus, the growing wood and wood product industry in Vietnam is fueling the spark detection system market growth.

Furthermore, the wood industry is experiencing significant growth in Indonesia. According to data from the Ministry of Environment and Forestry (KLHK), analyses by the Association of Indonesia Forest Concession Holders (APHI) show that in 2022, the exports of wood products in Indonesia reached US$ 14.51 billion. This was a significant increase in export values compared to 2021, which was US$ 13.56 billion. In 2022, paper products contributed the most to export earnings at US$ 4.37 billion, an increase of 18% y-o-y. This was followed by wood pulp at US$ 3.73 billion, an increase of 15% y-o-y. The other wood products that made a large contribution were wood panels (US$ 2.86 billion) and furniture (US$ 2.26 billion). Such growth in the wood industry in Indonesia is expected to fuel the growth of the market in the country.

UK, Ireland, and Southeast Asia spark detection system market Analysis: Segmental Overview

Based on type, the UK, Ireland, and Southeast Asia spark detection system market is bifurcated into infrared spark detection systems and ultraviolet (UV) spark detection systems. The infrared spark detection systems segment held the largest UK, Ireland, and Southeast Asia spark detection system market share in 2023 and is anticipated to record the highest CAGR during 2023–2031. In terms of application, the market is segmented into wood-based panel industry, pulp & paper industry, bioenergy, food industry, textile industry, and others. The wood-based panel industry segment held the largest market share in 2023 and is anticipated to record the highest CAGR during 2023–2031.

UK, Ireland, and Southeast Asia spark detection system market: Competitive Landscape and Key Developments

Fagus-GreCon Greten GmbH & Co. KG; Fire Shield Systems Ltd; Minimax GmbH; IEP Technologies, LLC; Firefly AB; Fike Corporation; ELECTRONIC WOOD SYSTEMS GMBH; Raille Limited; Blazequel; and BS&B Safety Systems, LLC are among the key players profiled in the UK, Ireland, and Southeast Asia spark detection system market report. Several other major players were also studied and analyzed in the UK, Ireland, and Southeast Asia spark detection system market report to get a holistic view of the market and its ecosystem. The report provides detailed market insights to help major players strategize their growth. As per the company press releases, below are a few recent key developments:

- In May 2023, The “next generation” Atexon Spark Detection and Extinguishing System by IEP Technologies recently received third-party approval by Factory Mutual (FM), meeting the detailed requirements of the latest version of FM 3265:2020. Spark Detection and Extinguishing Systems are widely used to protect and mitigate against fires and explosions in many industrial facilities, by continually monitoring for ignition sources (e.g. sparks, embers, hot particles and overheated fan components) within pneumatic process lines, and activating rapidly when required to prevent the potentially serious safety and financial consequences for the plant, the process, and any people working in the vicinity of the operation.