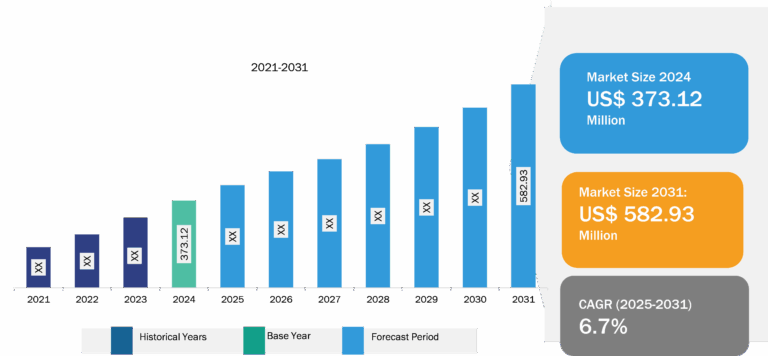

Asia Pacific Industrial Chillers Market

Surge in Demand for Industrial Chillers in Growing Chemical Industry to Fuel Asia Pacific Industrial Chillers Market Growth During Forecast Period

Asia Pacific has one of the largest chemical industries as it is home to various major chemical companies such as Asahi Kasei, Formosa Plastics Corporation, LG Chem, Mitsubishi Chemical Holdings, Reliance Industries, Sinopec, Sumitomo Chemical, etc. According to The European Chemical Industry Council—AISBL, China, Japan, South Korea, and India are among the top chemical producers across the globe. China dominates the chemical sales worldwide, as the country holds more than 40% of global sales. For domestic use and export trade activities, various chemical plants are settled up and launched to meet the global demand for chemicals. A few new constructions of chemical plants are mentioned below:

- In May 2024, Asahi Kasei launched a new hydrogen pilot plant in Japan. The plant is built to test the company’s new alkaline water electrolyzer system, Aqualyzer, under realistic conditions.

- In June 2024, Sika opened a new plant in Liaoning, the largest province in Northeastern China. This site will manufacture a full range of products, including mortars, tile adhesives, and waterproofing solutions.

Governments of numerous countries in Asia Pacific are raising investment, initiatives, and FDIs to remain competitive in the global chemical market. For example, the Union Cabinet of India approved a Production Linked Incentive (PLI) Scheme in 2021 for establishing manufacturing facilities for Advanced Chemistry Cell (ACC) Battery Storage, with an overall manufacturing capacity of 50 Giga Watt Hour (GWh) for 5 years. This factor enhances the country’s manufacturing capabilities and exports. Further, chemical plants require industrial chillers for the efficient processing and storage of chemicals from their raw material to the final product stage. As many chemicals are hazardous and exhibit various reactions at different temperatures, maintaining a constant and required temperature becomes essential for the chemical producers to strengthen the safety and product quality. Industrial chillers ensure the quality, safety, and efficiency of the chemical products. Thus, the surge in demand for industrial chillers in the growing chemical industry boosts the Asia Pacific industrial chiller market growth.

Asia Pacific Industrial Chillers Market: Industry Overview

The Asia Pacific industrial chiller market is segmented on the basis of chiller type, process, and application. Based on chiller type, the industrial chiller market is segmented into water cooled chillers and air cooled chillers. In terms of process, the industrial chiller market is segmented into continuous flow chillers and immersion chillers. Based on application, the industrial chiller market is segmented into food & beverage processing, medical equipment, industrial manufacturing, and others. The scope of the Asia Pacific industrial chillers market report focuses on Asia Pacific (China, Japan, South Korea, India, Australia, Indonesia, Rest of Asia Pacific).

In terms of revenue, China dominated the Asia Pacific industrial chillers market share. China has one of the most robust manufacturing across the globe. According to the Organization for Economic Co-operation and Development (OECD) TiVA database 2023, China holds 35% of the global manufacturing sector on the basis of gross production. China is the leading chemical producer in the world and is the home to leading chemical companies such as Sinopec, CNPC, Hengli Group, etc. According to BASF SE, chemical production in China grew by 7.5% in 2023 compared to the previous year. Thus, the presence of a strong chemical industry in China demands the technology for efficient process cooling in manufacturing processes. Industrial chillers are essential to maintain the chemical processing processes at a significant temperature for safe and efficient finished products.

The manufacturing industry in China is subsegmented into different sectors, such as chemicals, textiles, oil & natural gas, transportation equipment, shipbuilding, etc., that foster the country’s industrial production. For example, according to Trading Economics, China’s industrial production advanced by 5.1% year-on-year in July 2024. In addition, the new plants launched in the country led to growth in the manufacturing industry. For example, in June 2024, Sika opened a new plant in Liaoning, the largest province in northeastern China. This facility will manufacture a wide variety of products, including mortars, tile adhesives, and waterproofing solutions. In January 2024, Plastic Omnium, through its PO-Rein joint venture, started construction on its high-pressure hydrogen vessel mega-plant in Jiading, Shanghai. The new plant, which is set to open by 2026, will produce up to 60,000 hydrogen vessels and high-pressure hydrogen storage systems each year for the commercial vehicle industry in China. Thus, the growing manufacturing industry fosters the requirement for industrial chillers that help dissipate heat from various manufacturing processes such as filtration, processing, etc

Asia Pacific Industrial Chillers Market: Competitive Landscape and Key Developments

Dimplex Thermal Solutions; Blue Star Ltd; Panasonic Holdings Corp; Johnson Controls International Plc; Mitsubishi Heavy Industries Ltd; Sanhe Tongfei Refrigeration Co., Ltd.; Guangzhou Teyu Electromechanical Co., Ltd; Shenzhen Envicool Technology Co., Ltd.; Wuhan Hanli Refrigeration Technology Co.,Ltd.; WERNER FINLEY PRIVATE LIMITED; Advance Cooling Systems Pvt. Ltd.; Prasad GWK Cooltech Pvt. Ltd.; Reynold India Private Limited; and Nu-Vu Conair Pvt. Ltd are among the leading players profiled in the Asia Pacific industrial chillers market report. Several other essential market players were analyzed for a holistic view of the market and its ecosystem. The Asia Pacific industrial chillers market report provides detailed market insights, which help the key players strategize their market growth. As per the company press releases, below are a few recent key developments:

- Panasonic Corporation announced that its Cold Chain Solutions Company (hereinafter referred to as Panasonic) has agreed with Cooling Solutions S.L. to purchase all the shares of its subsidiary Area Cooling Solutions Sp. z o.o. , a Polish refrigeration equipment manufacturer.

(Source: Panasonic Corporation, Press Release, July 2024)

- TEYU Water Chiller Maker unveiled the CWUP-20ANP, an ultrafast laser chiller that sets a new benchmark for temperature control precision. With an industry-leading ±0.08degree stability, the CWUP-20ANP surpasses the limitations of previous models, demonstrating TEYU’s unwavering dedication to innovation.

(Source: TEYU, Press Release, July 2024)