Industrial Explosives Market

The industrial explosives market has been experiencing significant growth driven by the growing global mining industry and the increasing application of industrial explosives in the construction industry. Mining and construction industries require explosives to fragment or loosen rock and consolidate material prior to excavation. Explosives are essential in breaking mineral rocks. Surface mines in the coal and metal/nonmetal sectors rely extensively on explosives to uncover mineral deposits. The mining industry is the major consumer of explosives, accounting for ~75–80% of the market share. The mining industry considers blasting an essential component for the success of their operations. Ammonium nitrate is a widely used component for formulating explosives and blasting agents. Utilization of high-energy explosives enhances the fragmentation of rocks, which helps conduct mining operations efficiently. This also has a positive impact on overall production costs.

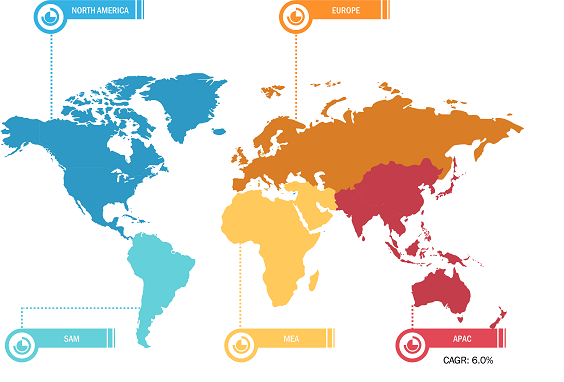

Asia Pacific held the largest share of the industrial explosives market in 2023. The region’s rapid industrialization drives substantial demand for industrial explosives across diverse sectors such as mining and construction. Countries such as Australia, China, India, and Indonesia are renowned for coal and metal production through mining. As countries in Asia Pacific invest heavily in mining activities, the need for explosives significantly contributes to the market growth. The key market players are exploring environment-friendly alternatives and practices to reduce the ecological impact of explosive use, such as reducing emissions and minimizing blast-related vibrations. The demand for industrial explosives is dependent on the economic cycles of the mining and construction industries.

Growth of Global Mining Industry Drives Industrial Explosives Market Growth

Manufacturing high-end products require a steady supply of raw materials such as metals and minerals. The higher demand for metals necessitates increased mining activity to extract and produce the required raw materials, ultimately leading to extensive use of mining explosives to access ore deposits, remove overburden, and fragment rocks. In addition, with the growing demand for metals, mining companies increasingly focus on improving safety measures and operational efficiency. This includes advancing mining explosive technologies and formulations that can optimize blasting operations.

As per the Ministry of Industry and Mineral Resources of Saudi Arabia, in 2022, ~2,272 valid mining licenses were registered, including 1,383 licenses for building materials quarry; 635 licenses for exploration; 178 licenses for mining and small mine exploitation; 43 licenses for reconnaissance; and 33 licenses for surplus mineral ores. As per US Geological Survey, Mineral Commodity Summaries published in January 2024, the global iron ore production increased from 2.45 billion metric tons in 2019 to 2.5 billion metric tons in 2022. Thus, the growth of the mining industry propels the industrial explosives market growth.

Industrial Explosives Market: Segmental Overview

The industrial explosives market analysis has been carried out by considering the following segments: type and application. Based on type, the market is segmented into high explosives, blasting agents, and low explosives. In 2023, the blasting agents segment held the largest industrial explosives market share, and it is expected to register the highest CAGR from 2023 to 2031. High explosives are a chemical mixture that detonates with a reaction velocity of more than 5,000 feet per second. Dynamite is a highly acceptable explosive made of nitroglycerin, sorbents, and stabilizers. The classification of dynamite is based on the percentage of nitroglycerin, which ranges from 15% to 60%. RDX is a nitramine explosive compound that can be used as a propellant, gunpowder, or high explosive, depending on the industry’s application.

Based on application, the market is segmented into mining, construction, and others. The mining segment held the largest industrial explosives market share in 2023. The mining application majorly consists of coal mining and metal mining. Explosives used in coal mines need to be efficient in blasting rock and coal; simultaneously, these explosives must not ignite the flammable atmosphere. Coal mining is the largest consumer of industrial explosives. In construction applications, explosives are used frequently for developing new roads, excavating ground for the foundations of buildings or basement areas and in demolition work. Quarrying removes rock, sand, gravel, and other minerals from the ground to manufacture materials used in the construction and other end-use industries.

Industrial Explosives Market: Competitive Landscape and Key Developments

Orica Ltd, AECI Ltd; Austin Powder Company, Dyno Nobel Ltd; Enaex SA; MaxamCorp Holding, S.L.; Solar Industries India Ltd; EPC Groupe; Keltech Energies Ltd; and Hanwha Corp, are a few players profiled in the industrial explosives market report. Players operating in the market focus on providing high-quality products to fulfill customer demand.

Key Developments

- Omnia Holding Ltd’s Bulk Mining Explosives signed a Conditional Sale and Purchase of Shares Agreement with PT Multi Nitrotama Kimia and formed a joint venture. The joint venture named PT Kemitraan MNK BME has integrated offering of explosives range for both surface and underground mines. (Source: Omnia Holding Ltd, Press Release, March 2024)

- Orica and Fertiberia have announced a collaboration to bring low-carbon Technical Ammonium Nitrate (TAN) to customers interested in sustainable blasting solutions in the region. (Source: Orica Ltd, Press Release, September 2024)

- Austin Powder announced that it has received a strategic investment from American Industrial Partners (“AIP”). (Source: Austin Powder, Press Release, July 2024)