Military Optronics Surveillance and Sighting Systems Market

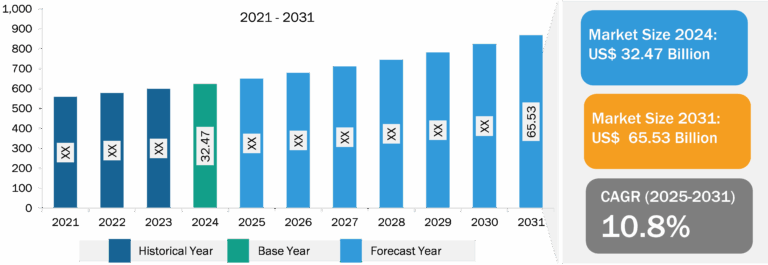

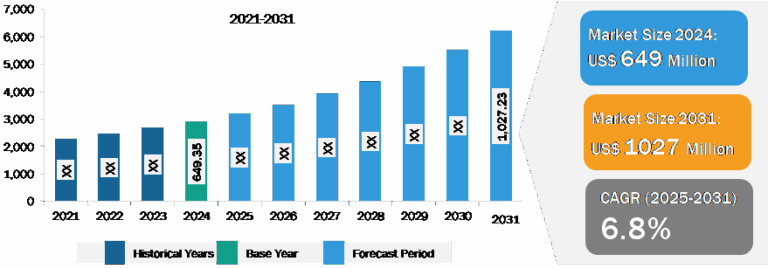

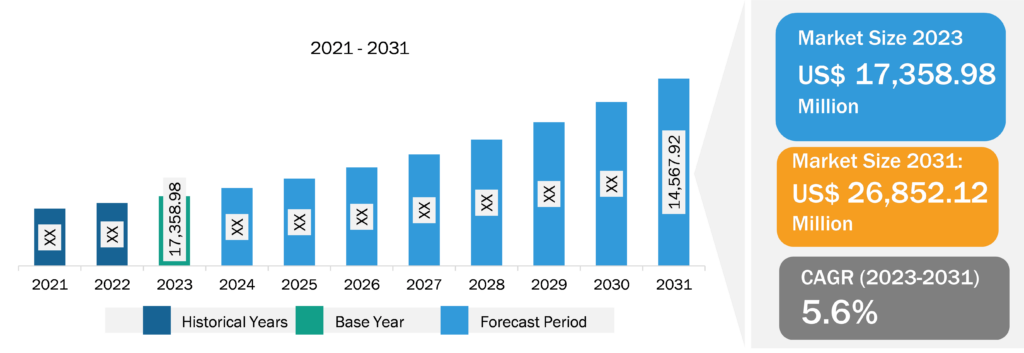

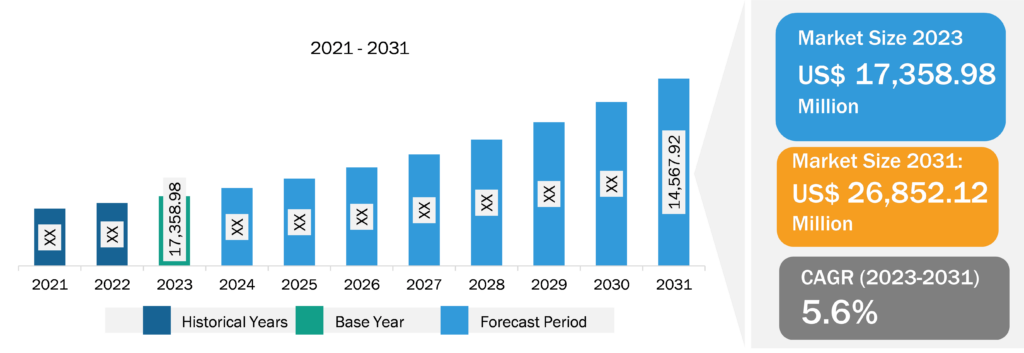

According to a new comprehensive report from The Insight Partners, the global military optronics surveillance and sighting systems market is observing significant growth owing to the increasing demand from commercial and military & law enforcement.

Types of smoke grenades include hand operated and launcher operated. Smoke grenade manufacturers procure specific grades of materials from raw material suppliers and process further to develop the final product. The report runs an in-depth analysis of market trends, key players, and future opportunities.

Overview of Report Findings

- Market Growth: In regions, especially Europe and North America, army forces are equipping their soldiers with optical night vision devices, personnel protective equipment, and advanced intelligence capabilities. For instance, in September 2024, the UK’s Ministry of Defence (MOD) signed a contract to procure night vision devices valued at US$ 155.54 million. The night vision devices procurement contract was signed under the Multi-Supplier Framework Agreement (FA) for seven years, with overall delivery dated October 2031. The framework is designed to offer the UK’s Front-Line Commanders with advanced night vision technologies to support operational requirements.

Increasing government initiatives to develop and adopt advanced technologies-based lightweight night vision devices are fueling the demand for the military optronics surveillance & sighting systems market growth. For instance, in January 2022, The Defence Advanced Research Projects Agency (DARPA) of the US Department of Defence selected 10 defense and university research teams for the development of lightweight night vision optics for military soldiers in America. The department designed the Enhanced Night Vision in Eyeglass Form (ENVision) program to adopt the latest technology to develop night vision systems.

- Increasing Adoption of Lightweight Night Vision Devices: The US Army requires thousands of new, low-cost night vision devices for their military vehicle drivers and other combat troops. The US Army has focused on improving the situational awareness of combat units and infantry by developing systems such as Microsoft IVAS and Enhanced Night Vision Goggle-Binoculars. In March 2021, the US Army awarded a US$ 22 billion contract to Microsoft Corporation for producing IVAS and Enhanced Night Vision Goggle for around 120,000 soldiers in combat units. These goggles are designed to equip combat troops with a head-up display that allows them to view tactical maps and weapon sight. In 2022, the US Army budget requested a total of 108,251 sets of night vision devices to cover infantry, reconnaissance, and combat engineers. Thus, high budget allocation for advanced military systems and equipment procurement, territorial disputes among countries, and the increasing number of attacks accelerate the adoption of night vision optoelectronic devices.

- Increasing Implementation of Next-Gen Technologies in Defense Systems: The world is undergoing a ‘fourth industrial’ revolution, characterized by rapid and converging advances in multiple next-generation technologies, including artificial intelligence (AI). AI is not only undergoing a renaissance in its technical development but is also starting to shape deterrence relations among nuclear-armed states. The potential of nuclear-armed states can be increased with the integration of AI into their military platforms. In January 2021, Lockheed Martin Corp. announced to build three new next-generation infrared spacecraft to help detect enemy ballistic missile launches. In March 2021, Elbit Systems, the Israeli defense company, launched its next-generation advanced multi-sensor payload system (AMPS NG). Team Tempest (a UK technology and defense partnership formed by BAE Systems, Leonardo, MBDA, Rolls-Royce, and the RAF) announced the development of new radar technology by 2035 to deliver unparalleled data processing capability on the battlespace.

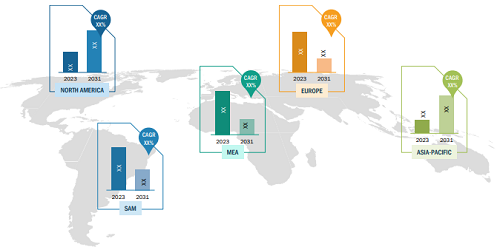

- Geographical Insights: In 2023, North America led the market with a substantial revenue share, followed by Asia Pacific and Europe. Asia Pacific is expected to register the highest CAGR during the forecast period.

Market Segmentation

- Based on type, the military optronics surveillance and sighting systems market is segmented into image intensification, military laser systems, and electro-optics/infrared. The electro-optics segment held the largest share of the market in 2023.

- By component, the market is categorized into night vision devices, handheld thermal imaging devices, integrated observation equipment, standalone infrared, seismic and acoustic sensors, and others. The seismic and acoustic sensors segment dominated the market in 2023.

- In terms of end users, the market is divided into ground, airborne, and naval. The ground segment held the largest share of the market in 2023.

- The military optronics surveillance and sighting systems market is segmented into five major regions: North America, Europe, APAC, Middle East & Africa, and South America.

Competitive Strategy and Development

- Key Players: A few major companies operating in the military optronics surveillance and sighting systems market are Airbus, Lockheed Martin Corporation, Thales Group, General Dynamics Corporation, L3Harris Technologies Inc., Israel Aerospace Industries, Leidos inc., Rafael Advanced Defense Systems Ltd., Raytheon Company, and Safran S.A.

- Trending Topics: Rising Development of Multiple Data Sharing and Storing Capabilities-Based Surveillance and Sighting Systems

Global Headlines on Smoke Grenade

- HENSOLDT presents new optronic systems for LEOPARD 2A8 and PUMA

- OCCAR awards consortium of HENSOLDT and THEON SENSORS with the delivery of Binocular Night Vision Goggles for Belgian Defence and German Army

- Lockheed Martin delivered the HELIOS Laser Weapon System to the US Navy for ship testing and integration

Conclusion

Australia is growing at a moderate pace in the military optronics surveillance and sighting systems market. This is owing to increasing military spending with the surge in the country’s demand for surveillance devices to protect the nation. Australia’s military spending reached US$ 32.3 billion in 2023, which was 1.9% of the country’s GDP. Further, in January 2021, Australia’s Defence Army Force awarded a contract worth US$ 233 million to L3Harris Technologies to deliver secure communications systems and advanced night vision goggle technologies to support the country’s modernization initiatives.

The report from The Insight Partners provides several stakeholders—including raw material providers, manufacturers, suppliers & distributors, and end users—with valuable insights into how to successfully navigate this evolving market landscape and unlock new opportunities.