End Mills Market

High-performance end mills are primarily designed to achieve higher speeds and feeds, which would help machinists reap the full benefits of this popular machining method. High-efficiency and high-speed end mills increase the material removal rate while decreasing cutting pressure, reducing and dispersing heat, lowering tool wear, and improving surface finish. High-speed cobalt steel offers higher performance compared to traditional high-speed steel. Moreover, owing to increased hardness, high-performance end mills exhibit higher heat resistance and aid in the efficient handling of hard materials. Aluminum chromium nitride-coated (Hybrid AlCrN) end mills are less prone to wear and show greater heat resistance. These end mills are ideal for high-speed machining and high-efficiency milling of stainless steels, cast iron, steel, and other high-temperature alloys, as they aid in improved material removal rates and smooth surface finishes.

Hybrid cutting technologies using end mills and plasma contribute to the safe and competent dismantling of nuclear facilities. End mills are suitable for the safe cutting of metal structures contaminated with radioactive substances. Moreover, they deliver advanced cutting performance without the need for cutting fluids. The implementation of a plasma cutting torch combined with an end mill on the three-axis numerical control milling machine is likely to emerge as a new trend in the end mills market over the forecast period.

End Mills Market Share: End-Use Industry Overview

Based on end-use industry, the end mills market is classified into automotive, heavy machinery, semiconductors and electronics, medical and healthcare, energy, aerospace, and others. Ongoing developments in the automotive, aerospace, and semiconductor and electronics industries favor the end mills market growth across the world. The automotive segment held the largest market share in 2023.

New cutting techniques such as high-speed cutting and milling, hard machining, and dry machining have transformed the traditional process of milling. In the automotive sector, end mills are employed in the manufacturing of various auto parts through crankshaft metal machining process, face milling applications, and machining hole-making processes. The ability to curve or mill metal accurately and consistently is crucial for achieving the desired fit and finish in automotive manufacturing. End mills enable efficient production processes, allowing manufacturers to meet high-volume production demands while maintaining quality standards. With continuous innovations in the automotive industry, the demand for advanced end mills to handle different materials and complex geometries is increasing at a significant pace.

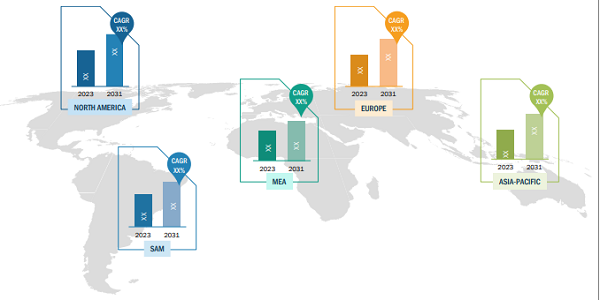

The scope of the end mills market report includes North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America). North America held the largest end mills market share in 2023 and is projected to maintain its dominance during the forecast period.

The Asia Pacific end mill market is segmented into Australia, South Korea, India, China, Japan, Thailand, Vietnam, Singapore, and the Rest of Asia Pacific. The availability of low labor costs, low taxes and tariffs, and a robust business ecosystem attract manufacturing companies from other regions to expand their production facilities in this region. In November 2022, Kennametal Inc. announced the opening of its new metal-cutting insert manufacturing facility in Bengaluru, India. With this strategic development, the company aims to enhance its capabilities and capacity to meet the growing demand in the region.

Economies such as India, China, Thailand, Vietnam, Singapore, Taiwan, and New Zealand are experiencing a gradual increase in the adoption of advanced technologies. Progress in automation and digitalization has been supporting the modernization and standardization of the manufacturing sector in this region, which in turn is expected to fuel the demand for metal-cutting machines. Thus, the rapidly growing manufacturing sector is projected to offer lucrative opportunities for metalworking and metal-cutting machinery businesses in Asia Pacific, in turn, fueling the end mills market growth in the coming years. Moreover, the fast-paced electronics, electric vehicles, and aviation industries, among others, are anticipated to contribute significantly to the growth of the end mills market size.

Manufacturing, energy, gas, heavy machinery, metals, and electronics are the key industries contributing to the growth of the Australian economy. In 2023, Australia’s manufacturing output grew at an annual rate of 3.8%. The country is home to several domestic engineering, procurement, and construction (EPC) groups—some having considerable experience in overseas projects—which is anticipated to have a positive influence on the end mills market in Australia. The industrial sector utilizes pallet trucks, forklifts, and aisle trucks to carry the material from one place to another. The need for metalworking machines rises with an increase in demand for industrial vehicles. Thus, the growing industrialization and rapidly developing manufacturing sector favor the growth of the end mills market.

End Mills Market: Competitive Landscape and Key Developments

NS Tool USA, Inc.; TOWA Corporation; SDK Tool (China) Co. Limited; Karnasch Professional Tools GmbH; Hoffmann Group USA; Kodiak Cutting Tools; Harvey Tool Company; Fullerton Tool Company, Inc.; Precision Technology Co., Ltd; Union Tool Co.; Osg Usa, Inc; Kyocera Sgs Precision Tools, Inc.; and IZAR CUTTING TOOLS S.A.L. are among the key players covered in the end mills market report. Companies in the market mainly focus on product and service enhancements by integrating advanced features and technologies into their offerings.