Aircraft Brackets Market

The rise in the adoption of lightweight materials to manufacture aircraft brackets is expected to be the key trend in the aircraft brackets market in the coming years. A composite material is a unique combination of two or more materials whose properties, when combined, exhibit exceptional physical and chemical properties. One such composite material is carbon fiber reinforced plastic (CFRP), in which microscopic carbon fibers are attached to a plastic resin. Individually, carbon fiber or plastic resin cannot provide mechanical and thermal properties required for an aircraft structure. However, by precisely combining the two, the composite’s strength exceeds that of many conventional metals, including aluminum and iron. In addition, the composite material is much lighter than aluminum and has significantly higher corrosion resistance. The use of lightweight composite material enhances net fuel efficiency and minimizes maintenance costs.

Currently, most aircraft manufacturers use composite material and composite material-based components in their aircraft structure. For example, more than 50% of the structure of the Airbus A350 XWB is made of composite material. The extensive use of lightweight materials on the A350 contributes directly to net fuel consumption. A lighter structure can carry more payload over a greater distance than a traditional aluminum structure. Due to the airframe’s overall strength, the A350 requires less maintenance during its operational life. In addition, the materials’ greater corrosion resistance increases the airframe’s lifespan.

The aircraft companies are adopting strategies such as collaboration, product development, and partnerships to increase the adoption of composite material-based aircraft brackets. For instance, in June 2024, Diehl Aviation and 9T Labs introduced an Eco Bracket solution for aircraft cabin equipment. This new solution uses 3D-printed carbon fiber elements and reused thermoplastic composites, which replace conventional aluminum components used in aircraft cabins. The Eco Bracket solution features a 50% weight reduction compared to aluminum, achieved through a combination of lightweight materials and design optimization. This significant weight reduction results in lower fuel consumption for airlines. In addition, in October 2021, Arris Composites collaborated with Airbus. This collaboration aimed to conduct a composite research project on the production of cabin brackets using innovative manufacturing techniques and materials. Key strategies and developments adopted by the companies operating in the aircraft brackets value chain will gain competition toward the development of lightweight material-based and efficient aircraft brackets, which in turn is projected to increase the adoption of lightweight material-based aircraft brackets from 2023 to 2031.

Aircraft Brackets Market Share: Material Overview

Based on material, the aircraft brackets market is segmented into aluminum, steel, and others. The others segment includes titanium, composites, copper, and nickel. Additionally, a few more materials such as Inconel, brass, beryllium copper, and phosphor bronze are also used in fabricating the aircraft brackets. The aluminum segment held the largest aircraft brackets market share in 2023. Aluminum brackets are lighter than iron brackets. Aluminum also prevents corrosion and has good conductivity, which can balance the current well and prevent hazards. Aluminum die-casting parts are easy to produce and convenient in terms of catering to further specifications by drilling, sawing, punching, folding, and other processes. Therefore, aluminum support brackets are quite easy to make. Additionally, aluminum is environmentally friendly and easy to recycle; hence, it is one of the highly used materials for fabricating aircraft brackets globally. Godrej Aerospace, Arconic, and 3D Systems, Inc. are among the key companies offering aluminum aircraft brackets.

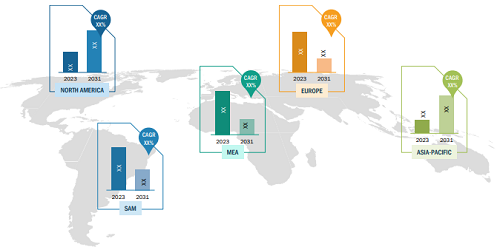

The scope of the aircraft brackets market report focuses on North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America). APAC held the largest aircraft brackets market share in 2023 and is projected to maintain its dominance during the forecast period. North America is the second-largest contributor to the global aircraft brackets market size, followed by Europe.

The aircraft brackets market in Europe is segmented into Germany, Italy, Russia, France, the UK, and the Rest of Europe. With more than 20,000 flights per day and ~500 million passengers per year, Europe is considered the busiest airspace in the world. In addition, defense and commercial aviation sectors in Europe are inclining toward advanced aircraft technologies. Strong economic conditions and increased initiatives by European governments to ensure aviation sector growth are the main factors driving the aircraft brackets market growth in Europe. Countries such as France, Germany, and the UK are the leading countries in Europe with a high number of aircraft and airports. Germany and France are major exporters of advanced aircraft technologies and are leaders in the aircraft brackets market in the region.

Countries in Europe, such as Poland, the UK, and Belgium, are initiating new airport projects, resulting in a significant demand for aircraft fleets. Poland, for example, has announced a plan to build a Solidarity Transport Hub in Baranow County, near Warsaw, by 2027 to handle almost 40 million passengers. The renovation of Son Sant Joan Airport in Mallorca, Spain, began in the first quarter of 2023 and is expected to be completed by 2026. Therefore, the construction of new airports and renovation of existing airports will increase the aircraft fleet in the region, driving the global aircraft brackets market size.

Aircraft Brackets Market: Competitive Landscape and Key Developments

Hexagon AB, Singapore Technologies Engineering Ltd, Legend Aerospace, RTP Company, Triumph Group Inc, Spirit AeroSystems Holdings Inc, Premium Aerotec GmbH, Hutchinson SA, Arconic Corp, SEKISUI Aerospace, Godrej & Boyce Manufacturing Co Ltd, Avantus Aerospace Inc, Precision Castparts Corp, Meena cast Pvt Ltd, and STROCO Manufacturing Inc are among the key players covered in the aircraft brackets market report. Companies in the market mainly focus on product and service enhancements by integrating advanced features and technologies into their offerings.