Australia and New Zealand Thermal and Acoustic Imaging Market

According to a new comprehensive report from The Insight Partners, the Australia and New Zealand thermal and acoustic imaging market is observing significant growth owing to growing military expenditure, rising use of thermal imaging in the healthcare industry, and increasing demand for acoustic imaging for environmental monitoring.

The report runs an in-depth analysis of market trends, key players, and future opportunities. In general, the Australia and New Zealand thermal and acoustic imaging market comprises a vast array of thermal imaging and acoustic imaging products that are expected to determine market strength in the coming years.

Overview of Report Findings

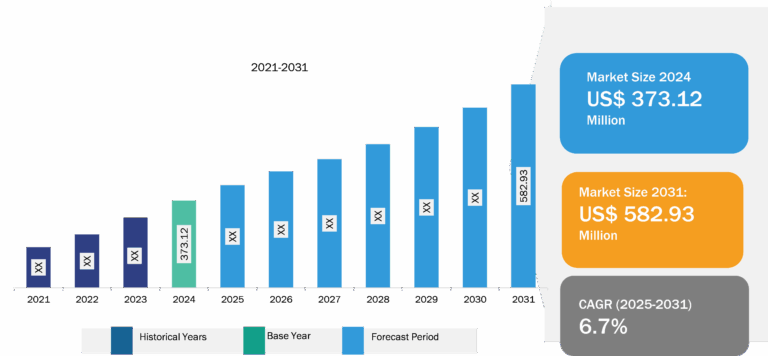

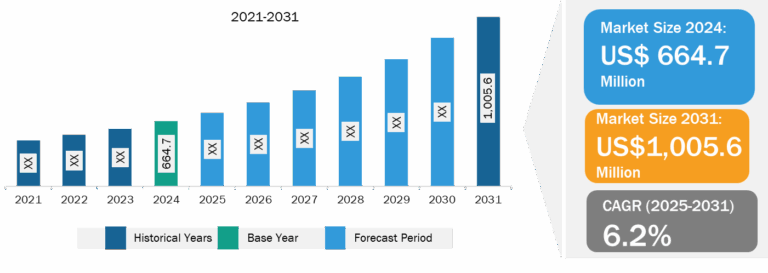

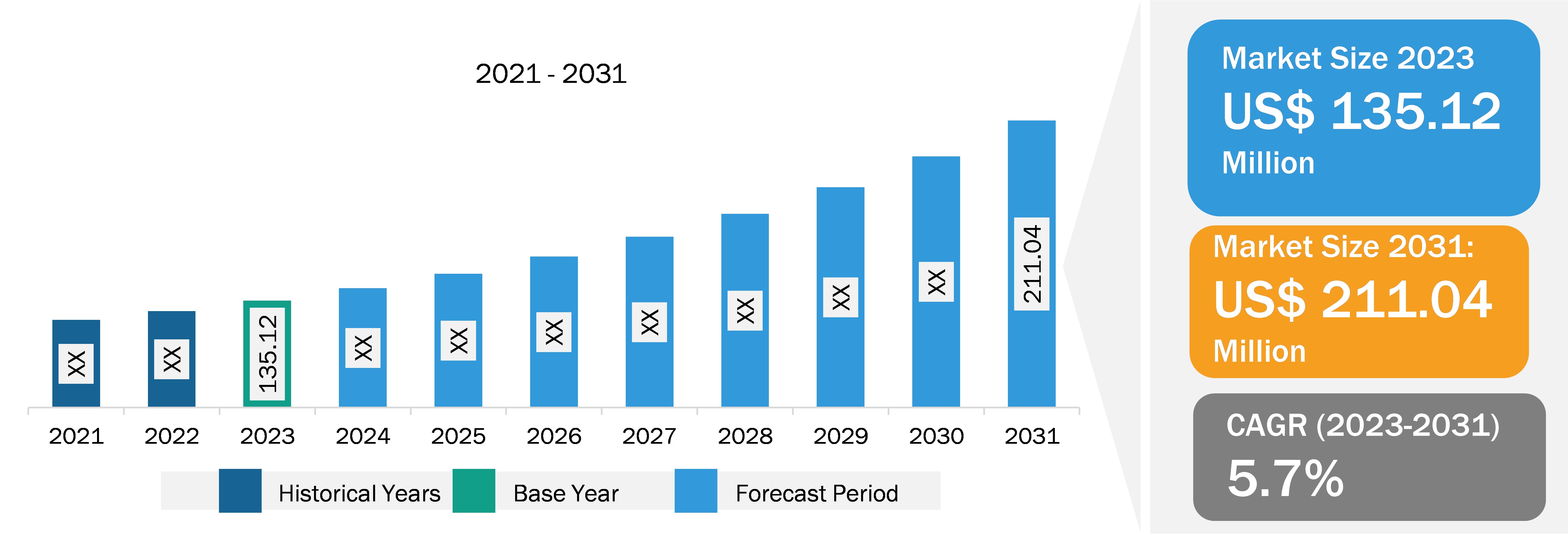

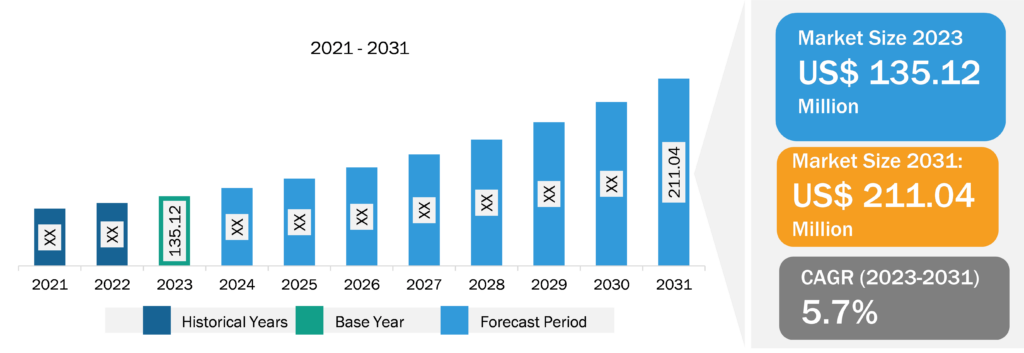

- Market Growth: The Australia and New Zealand thermal and acoustic imaging market was valued at US$ 135.12 million in 2023 and is projected to reach US$ 211.04 million by 2031; it is expected to register a CAGR of 5.7% during 2023–2031.

- Acoustic Imaging for Environmental Monitoring: Acoustic imaging has quickly become an invaluable tool for monitoring the environment, offering a creative and effective way to study both natural and human-made changes through sound. Using sound waves to collect data provides a noninvasive and affordable way to track the health of ecosystems, monitor marine life, and observe urban environments without disrupting the surroundings. For example, in July 2024, research led by Nelson’s Cawthron Institute shed new light on the underwater lives of Hector’s dolphins, including the animals’ feeding and diving behaviors, which experts have not previously recorded. The study used DTAGs (digital acoustic recording tags) fitted with suction cups and temporarily attached to Hector’s dolphins in Marlborough’s Te Koko-o-Kupe/Cloudy Bay. With the increasing environmental concerns and stringent safety regulations, industries are adopting acoustic imaging to monitor emissions and ensure compliance.

- Integration of Artificial Intelligence: The integration of artificial intelligence (AI) is transforming industries worldwide. The rise in AI technology, with its capabilities in machine learning, data processing, and pattern recognition, can enhance the performance and utility of thermal and acoustic imaging systems across multiple sectors, such as defense, environmental monitoring, healthcare, and industrial applications. AI can improve the accuracy and effectiveness of thermal and acoustic imaging systems with the help of advanced data analysis and interpretation techniques. These imaging technologies generate vast amounts of data, and AI algorithms can analyze hidden patterns in the data much faster and more accurately than traditional methods. AI can detect patterns, anomalies, or potential threats in the data.

- Rising Demand for Miniaturization: Miniaturization is leading to the development of compact, portable thermal and acoustic cameras that can be easily integrated into handheld devices, drones, and even smartphones. This makes thermal and acoustic imaging more accessible to a broader range of end-use industries such as healthcare, aerospace and defense, and automotive. Thus, the rising miniaturization trend will drive the demand for compact thermal and acoustic imaging solutions, which will further contribute to Australia and New Zealand thermal and acoustic imaging market.

Market Segmentation

- Based on thermal imaging, the market is segmented into type, technology, wavelength, and end user. In terms of type, the market is subsegmented into thermal cameras, thermal scopes, and thermal modules. The thermal cameras segment dominated the market in 2023. Based on technology, the market is subsegmented into cooled and uncooled. The cooled segment dominated the market in 2023. In terms of wavelength, the market is subsegmented into SWIR, MWIR, and LWIR. The MWIR segment dominated the market in 2023. Based on end user, the market is subsegmented into aerospace and defense, automotive, healthcare and life sciences, oil and gas, food and beverages, mining, utilities, data centers, and others. The aerospace and defense segment dominated the market in 2023.

- In terms of acoustic imaging, the Australia and New Zealand thermal and acoustic imaging market is segmented into end user. Based on end user, the market is further segmented into food and beverages, mining, utilities, and others. The others segment dominated the market in 2023.

Competitive Strategy and Development

- Key Players: A few major companies operating in the Australia and New Zealand thermal and acoustic imaging market include Teledyne FLIR LLC; Testo SE & Co. KGaA; Fluke Corporation; UNI-TREND TECHNOLOGY (CHINA) CO., LTD.; Hangzhou Microimage Software Co., Ltd.; Megger Group Limited; and SDT International SA/NV

- Trending Topics: Thermal Scanners Market, Thermal Camera Market, Acoustic Emission Testing Market

Global Headlines on Australia and New Zealand Thermal and Acoustic Imaging Market

- HIKMICRO launched two products featuring a cutting-edge 1280 thermal detector and other top configurations for the very first time in the hunting market..

- Teledyne FLIR launched its improved K-Series firefighting and search and rescue (SAR) thermal imaging cameras (TICs).

Conclusion

Australia is an economically strong country in Asia Pacific; the country encourages the adoption of technologically advanced solutions in various sectors. In the 2024–2025 Budget, the defense funding increased to US$ 764.6 billion for the next decade to support the Australian defense industry. Such investments contribute to the demand for thermal and acoustic imaging technologies in the country. Australia also focuses on using imaging technology to tackle trespassing. For example, in January 2021, Metro Trains Melbourne, the operator of Melbourne’s train network, started using thermal imaging cameras to crack down on illegal trespassing on rail tracks and keep passengers and train staff safe.

Environmental monitoring is considered a crucial aspect of promoting health and safety in Australia. Thermal imaging fire detection systems are employed as dependable systems for monitoring and detecting spontaneous fires inside bunkers, coal conveyors, garbage dumps, paper and cardboard recycling plants, etc. The risk of spontaneous combustion is high in these areas, with disastrous consequences for personnel and the environment. Thermal imaging detection systems use high-performance infrared cameras and a powerful software package to analyze thermographic images and detect hot spots, which underlines their role as early-warning fire detection systems. Fire Protection Technologies is one of the prominent providers of these technologies in Australia. Researchers at Curtin University, among other institutions, are studying thermal imaging techniques for their use to discover the impact of climate change on Australia’s numbats.

The report from The Insight Partners, therefore, provides several stakeholders—including solution providers, system integrators, and end users—with valuable insights into how to successfully navigate this evolving market landscape and unlock new opportunities.