Sawmill Machinery Market

The sawmilling industry plays a crucial role in exploiting one of the earth’s most valuable natural resources, i.e., wood. Sawmill machinery is employed to cut logs into lumber, a process that supports a wide variety of manufacturing businesses, from building materials to furniture. The tools and materials required for this work have changed significantly over time. In the past, sawmills were predominantly operated manually, which relied on manual labor and simple machines. In recent years, there has been a significant shift toward automation and robotics, changing the way sawmills operate. Automated machines handle tasks that were once performed manually, from cutting logs to sorting the finished lumber. This change accelerates the production process and makes it safer. Moreover, workers are less exposed to the dangerous aspects of sawmill work owing to the robotics and automation in sawmill machinery.

Wravor d.o.o., a sawmill machinery manufacturer, incorporates automation and optimization systems to streamline operations and maximize efficiency in Wravor WRC1250AC. These systems use sensors, computer algorithms, and real-time data analysis to optimize wood positioning, cutting patterns, and material flow. By automating repetitive tasks and optimizing production, sawmills can achieve higher throughput and less waste. Sawmill market players are engaged in adopting collaborative strategies such as partnerships to develop technologically advanced products. In May 2022, Wolftek partnered with Linck Holzverarbeitungstechnik GmbH. In partnership, the companies aimed at advancing sawmill machinery solutions and technical assistance on the market in Canada. Such initiatives toward modern technological developments in sawmill machinery are expected to be the key future trend in the sawmill machinery market in the coming years.

Sawmill Machinery Market Share: Application Overview

Sawmill machinery is increasingly used in the woodworking industry and forestry applications. Modern sawmills utilize a motorized saw to cut logs lengthwise (into long pieces) and crossway, depending on standard or custom size. Sawmill types used in the woodworking industry and forestry include fixed sawmills or portable sawmills, depending on the requirement. The woodworking industry segment held the largest sawmill machinery market share in 2023.

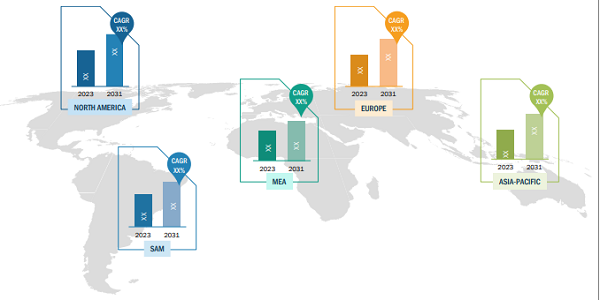

The scope of the sawmill machinery market report focuses on North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America). Europe held the largest sawmill machinery market share in 2023 and is projected to maintain its dominance during the forecast period. France, Germany, Russia, Italy, and the UK are the major countries in the sawmill machinery market in Europe. These countries are known for their strong focus on the development of the construction sector in Europe. With rising initiatives for carbon emission reduction, many developed and developing European countries are adopting sustainable energy production practices, including the use of pellets. According to the European Pellet Council, the annual consumption of 27 million metric tons of pellets makes Europe the world’s largest pellet consumer. The European Union (EU28) witnessed a considerable increase of ~1.8 million metric tons in 2018, with the UK leading the industrial use of pellets. As per the data provided by Foreign Agriculture Services in 2023, the EU’s wood pellet consumption reached a new high of 24.8 million metric tons in 2022, owing primarily to growing household use. Thus, the demand for wood is high in the region, driving the need for woodworking tools such as sawmill machinery.

Germany has an enormous number of businesses engaged in the fabrication of roundwood for the construction sector. The roundwood production requires sawmill machinery to a large extent. The sawmill machinery market in Germany is primarily driven by aspects such as the continuously growing demand for wood and wooden products in the construction industry, the need for wooden pallets in the retail sector, and the vast presence of key companies in Germany. Key market players in the country undertake geographic expansions, product launches, and acquisitions. Government initiatives for sustainable infrastructure development projects also make Germany one of the crucial markets for sawmill machinery in Europe. According to the Hauptverband Deutsche Bauindustrie (HDB), the construction industry is anticipated to contribute substantially to Germany’s GDP in the coming years. The expansion of this industry is majorly attributed to a surge in commercial infrastructure construction projects, as the country serves as one of the key tourist destinations in Europe. In addition, export activities of wood and wood-based products are supporting the sawmill machinery market growth.

The demand for sawmill machinery in the French wood industry is growing continuously owing to the increased adoption of timber in construction. In 2020, the French government stated new guidelines for the construction of public infrastructure. As per the plan, public buildings must be built using ~50% timber or other natural materials. Further, France has the fourth highest forest cover in Europe, accounting for ~31% of its total land area. Every year, 38.8 million cubic meters of wood is produced, of which 10.3 million cubic meters is used for industrial wood, 20 million cubic meters is used for timber, and 8.5 million cubic meters is used for energy. Owing to the high forestation and wood production capacity in the country, the export activities of wood products are also high. France exports wood products to Germany, Belgium, Spain, Italy, and the UK. The construction industry is a major part of the French economy. It retains more than ~25% of the total financing and accounts for ~5% of the country’s GDP. The developing construction of commercial and residential buildings is anticipated to boost the application of the sawmill machinery market in France.

Sawmill Machinery Market: Competitive Landscape and Key Developments

HewSaw, BID Group Technologies Ltd., Esterer WD GmbH, Mendes Maquinas, SAB Sagewerksanlagen GmbH, Real Performance Machine, and Linck are among the key players profiled in the sawmill machinery market report. Market players mainly focus on product and service enhancements by integrating advanced features and technologies into their offerings.