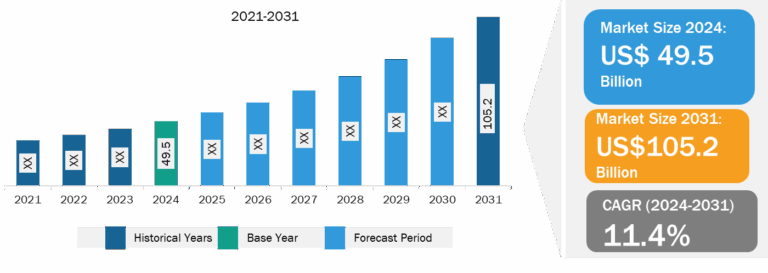

Resistant Starch Market

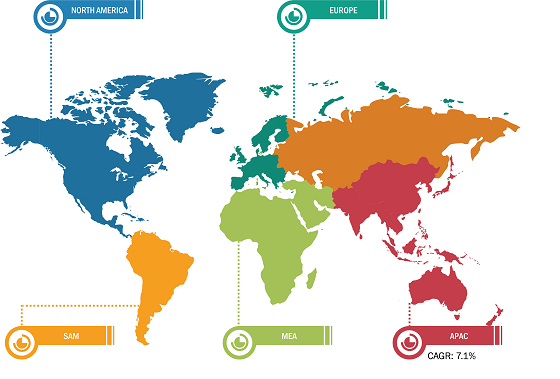

Asia Pacific dominated the resistant starch market in 2023. China, India, Japan, and Australia are a few contributors to the resistant starch market growth in Asia Pacific. The market in Asia Pacific is witnessing robust growth, driven by increasing consumer awareness about its health benefits and a growing demand for functional foods. Also, the rising health-conscious middle-class population of China is driving the demand for fiber-enriched products. The growing food processing sector and the rising chronic conditions such as diabetes, which affects over 100 million people, are also major factors boosting the demand for resistant starch in India. Functional foods, including resistant starch, are majorly consumed by the aging population in Japan, which support better digestive and metabolic health.

Food manufacturers in Asia Pacific are incorporating resistant starch into a range of products such as bread, cereals, pasta, and dairy alternatives. The market also benefits from innovations in food processing technologies that allow for better incorporation of resistant starch into products without altering taste or texture. Furthermore, the focus on clean-label and plant-based products is driving the use of naturally derived resistant starch from sources such as corn, potatoes, and bananas. This further contributes to the growth of the resistant starch market share in the region.

Resistant starch is a type of dietary fiber, defined as the total amount of starch and the products of starch degradation that resist digestion in the small intestine of a person. Resistant starch is a dietary fiber that can replace digestible starch in foods. In bakery food, it is used to improve the nutritional value of baked goods by reducing starch digestibility. Resistant starch is extracted from various sources such as wheat starch, oats, raw potato starch, legumes, green bananas, high-maize flour, and retrograded starches. Further, resistant starch as a prebiotic diet helps control the development of obesity. Resistant starch is a potential prebiotic, a non-digestible food ingredient that stimulates the growth and activity of gut microorganisms.

Rising Demand for Resistant Starch

The global food industry is growing tremendously owing to rising population, changing lifestyles, increasing per capita income, and surging demand for convenience food. According to the data published by the United States Department of Agriculture (USDA), in 2022, households with the lowest income spent an average of US$ 5,090 on food (representing 31.2% of income), while households with the highest income spent an average of US$ 15,713 on food (representing 8.0% of income) in the US. Further, various food and beverage products are made from clean label ingredients such as resistant starch extracted from banana, potato, grains, and cassava starch. Resistant starch is also used in food and beverages as additives to lower glycemic value and calorific value quality in baked food products, confectioneries, dairy products, thick beverages, savory snacks, sweets, sauces, and mayonnaise.

The growing population worldwide is increasing the demand for food and beverages. According to the United Nations, the global population is projected to reach 8.5 billion by 2030. There has been a substantial increase in demand for ready-to-eat or convenience food and beverage products due to increasingly busy lifestyles and a surge in the working population in developing countries such as India and China. Further, the manufacturers are also developing products that meet the changing consumer requirements for different food and beverage products, especially clean-label, gluten-free, vegan, non-GMO, and plant-based products. For instance, Roquette Frères, a France-based manufacturer of starches and other food ingredients, offers a clean-label, gluten-free, and plant-based resistant starch for bakery and snack products. Thus, the rising demand for resistant starch for various food and beverage products drives the market.

Resistant Starch Market Report: Segmental Overview

Based on form, the market is bifurcated into dry and liquid. The dry segment accounted for a larger market share in 2023. Dry resistant starch is a type of dietary fiber that resists digestion in the small intestine and passes into the colon. It gets fermented in the colon and produces beneficial short-chain fatty acids such as butyrate. This starch is not only found naturally in legumes, grains, and a few fruits but can also be manufactured or modified to enhance its resistance to digestion. There are four primary types of resistant starch (RS1, RS2, RS3, and RS4), with dry resistant starch being commonly associated with RS3, which is formed while certain starch-enriched foods are cooked and then cooled down. This process alters the structure of the starch molecules, thereby making them less accessible to digestive enzymes. It is also used as a functional ingredient to improve texture, increase fiber content, and lower the glycemic index of food products.

Based on type, the market is segmented into type1, type2, type3, and type4. The type2 segment held the largest share of the resistant starch market in 2023. Resistant starch type 2 (RS2) is naturally found in raw starchy foods such as unripe bananas, raw potatoes, and some legumes. The starch in these foods has a granular structure that resists digestion due to the molecules being tightly packed in crystalline forms, making it difficult for enzymes to break down. RS2 is unique for maintaining its resistance in raw form and becoming more digestible once cooked. For instance, when a green banana is cooked, the starches convert to digestible forms; however, when in its raw state, the resistant starch helps moderate blood sugar levels and promotes the growth of beneficial bacteria in the colon. This type of starch helps improve sensitivity to insulin and increase satiety, making it useful for weight management.

Based on application, the market is segmented into food and beverages, dietary supplements, and animal feed. The food and beverages segment held the largest share of the resistant starch market in 2023. The demand for resistant starch in the pharmaceutical and dietary supplements sector is rising due to its potent immunological and growth-promoting properties. Resistant starch has gained significant traction in the food & beverages industry owing to its unique health benefits and versatile functional properties. It has become a highly preferred ingredient in various food products as consumers are increasingly seeking food options that support digestive health, weight management, and metabolic control. Resistant starch present in baked goods such as muffins, bread, and cookies enhances texture and structure while lowering the glycemic index, making these products more suitable for people suffering from diabetes as well as health-conscious consumers. It is also used in pasta and noodles to improve firmness and reduce starch retrogradation, extending shelf life and enhancing nutritional value.

Resistant Starch Market Report: Competitive Landscape and Key Developments

Some of the key players in the market include Tate & Lyle, Archer-Daniels-Midland Co, Cargill Inc, Ingredion Inc, Arcadia Biosciences Inc, Roquette Freres SA, MGP Ingredients Inc, Crespel & Deiters GmbH & Co KG, American International Foods Inc, Agrana Beteiligungs AG, Lehmann Food Ingredients Ltd, KMC Amba, Emsland-Stärke GmbH, Kono Chem Co Ltd, and BS Starch Chemical Co Ltd, among others. These players are adopting various strategies such as mergers & acquisitions, product launches, expansions, partnerships & collaborations, and joint ventures to expand their market share and customer base and cater to the changing market demand.