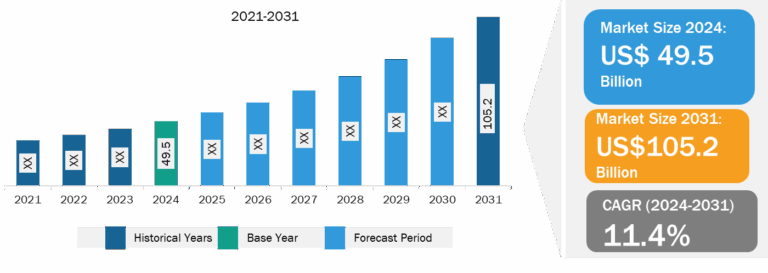

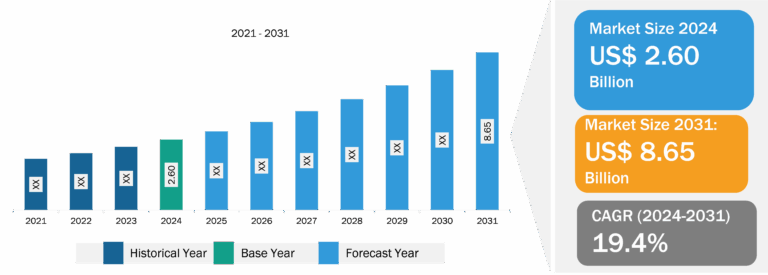

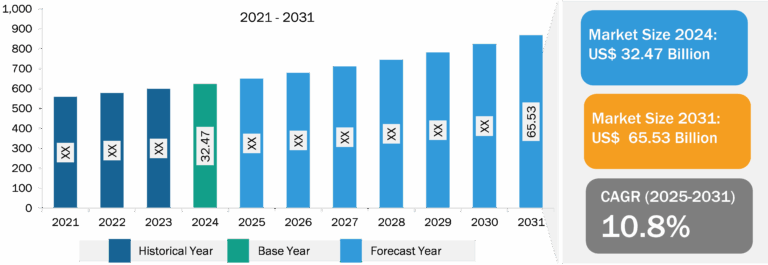

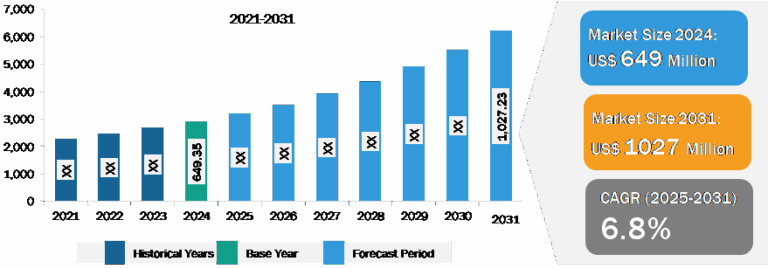

Quantitative PCR (qPCR) Market

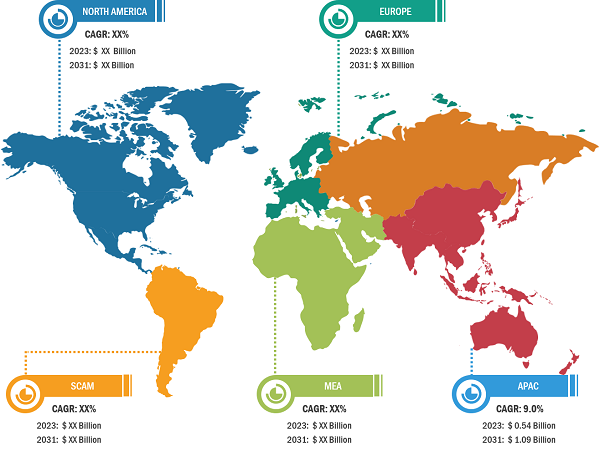

Quantitative PCR (qPCR) quantifies the process of PCR amplification as the reaction proceeds. It is an extensively used diagnostic technique in diverse sectors such as research, pharmaceuticals, and biotechnology, offering a wide range of applications. qPCR technologies have experienced significant market growth due to their numerous advantages over traditional PCR methods. These advantages include increased sensitivity, improved accuracy, and faster turnaround time, in addition to the ability to detect rare or low-abundance targets. Advancements in qPCR and the rising demand for qPCR systems in infectious disease detection are noteworthy factors contributing to the growing quantitative PCR (qPCR) market size. The presence of key market players and extensive R&D conducted across various academic and research institutes in regions such as North America and Europe contribute to the expansion of the quantitative PCR (qPCR) market. Moreover, the market is expected to grow in the coming years with the rising popularity of modern PCR systems in emerging countries. However, the high cost of real-time PCR systems hinders the growth of the quantitative PCR (qPCR) market.

Growing Demand of qPCR for Detecting Infectious Diseases Drives Market Growth

Nearly all COVID-19 diagnostic tests were based on RT-PCR. The progress of the COVID-19 pandemic sparked interest in qPCR as the technique provides fast and reliable results and can be leveraged for multiplexed testing in which many samples are simultaneously tested for numerous viruses. Such tests are also valuable during flu seasons when symptomatic patients need a quick diagnosis to distinguish between influenza and SARS-CoV-2. The demand for effective, accurate, and rapid testing increased as the COVID-19 pandemic intensified, and qPCR kits became more popular procedures in the healthcare sector. Many research institutions and universities are delivering excellent assistance by providing qPCR platforms for performing various tests, which is one of the most accurate laboratory techniques for detecting, tracking, and researching the SARS-CoV-2 virus.

Most biotechnology and pharmaceutical businesses began concentrating their efforts on research and development to find novel diagnostic and therapeutic approaches for COVID-19. In February 2022, Roche added the Cobas 5800 System, a new molecular laboratory instrument, to its COVID-19 PCR portfolio for use in nations that accept the CE certification. These products include the Cobas SARS-CoV-2 and influenza A/B tests, as well as the Cobas SARS-CoV-2 qualitative test. In March 2020, Thermo Fisher introduced one of the first qPCR testing kits, which received the Emergency Use Authorization from the US FDA and the CE mark in Europe.

Moreover, science-based startups are playing an essential role in proactively bringing technologies for reducing COVID-19 among the people. The Indian Council of Medical Research (ICMR) released recommendations for COVID-19 fast antibody test kits. Pune-based Mylab Discovery was the first indigenous company to develop a qPCR-based molecular diagnostic kit that screens and detects samples of people displaying flu-like symptoms. In a short time, the kit was developed, approved by CDSCO and ICMR, and distributed for commercial application. The Technology Development Board helped to quickly ramp up kit production from 30,000 tests to 2 lakh tests per day. It also offered Compact XL to automate RT-PCR testing as well as to address challenges associated with delays and errors in diagnostics for millions of Indians. Thus, the need for qPCR-based kits for the diagnosis of infectious diseases supports the quantitative PCR (qPCR) market growth.

Quantitative PCR (qPCR) Market: Segmental Overview

The quantitative PCR (qPCR) market is segmented on the basis of type, product, application, and end user. Based on application, the market is categorized into research, clinical, and forensics. The clinical segment held a significant quantitative PCR (qPCR) market share in 2023, and it is further anticipated to record the highest CAGR in the market during 2023–2031. qPCR technologies have been in use in procedures to detect mutations in genes, which helps diagnose cancer. The qPCR technique is being used in the diagnosis of many diseases, including infectious diseases and noncommunicable diseases such as diabetes. For instance, RIDA GENE kits, enabled by real-time PCR technology, were created to diagnose gastrointestinal infections, hospital-acquired infections, respiratory infections, sexually transmitted infections, and so on. Thermo Fisher Scientific introduced 37 CE-IVD-marked real-time PCR assay kits for its QuantStudio Dx series of instruments in April 2023 to detect numerous infectious diseases.

Quantitative PCR (qPCR) Market: Competitive Landscape and Key Developments

Abbott Laboratories, Thermo Fisher Scientific Inc., Standard Biotools Inc., F. Hoffmann-la Roche Ltd, Qiagen, Lepu Medical Technology Beijing Co Ltd, Bio-rad Laboratories Inc., Takara Bio Inc., Agilent Technologies Inc., and Fujirebio are a few of the key companies operating in the quantitative PCR (qPCR) market. These companies focus on product innovation strategies to meet evolving customer demands, along with maintaining their brand name in the quantitative PCR (qPCR) market.

A few recent developments in the quantitative PCR (qPCR) market report, as per company press releases, are mentioned below:

- In November 2023, Roche launched the LightCycler PRO System based on the proven gold standard technology of its previously manufactured LightCycler Systems. The LightCycler PRO System is designed to be the most advanced qPCR technology for clinical diagnostics and research. This new system raises the bar for performance and usability while bridging the gap between translational research and in-vitro diagnostics.

- In October 2022, Standard BioTools Inc. launched the X9 Real-Time PCR system, an innovative high-capacity genomics instrument offering superior efficiency. X9 provides high data output with over 9,000 individual nanoliter-volume reactions in a single run, ensuring cost-economic, comprehensive sample profiling with minimal operator involvement. The X9 platform, powered by single-touchpoint operation, streamlines laboratory processes by incorporating reaction setup into an automated workflow that generates up to 46,080 data points per 8-hour shift.