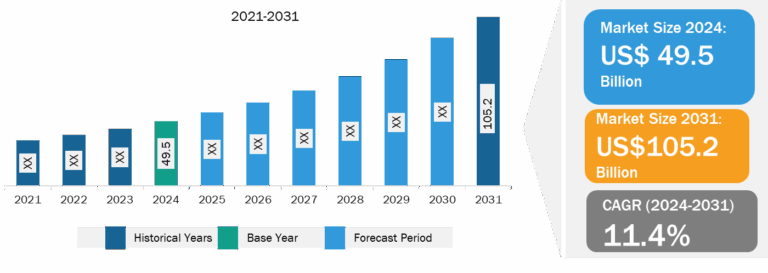

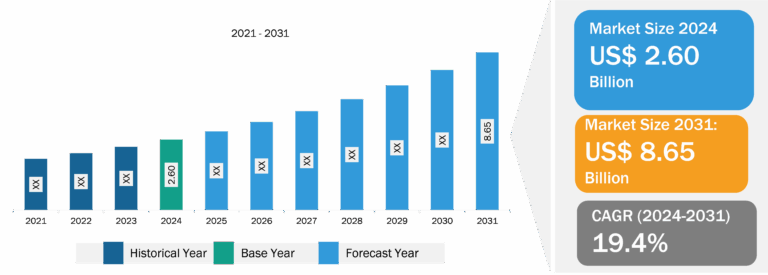

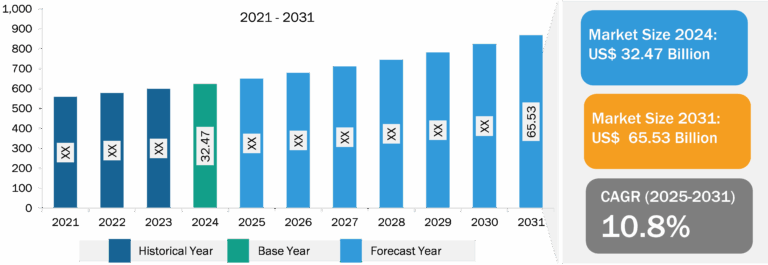

dPCR and qPCR Market

The increasing incidence of genetic and infectious diseases, rising investments and funds for gene synthesis, and technological advancements in PCR technologies are among the major factors contributing to the growing dPCR and qPCR market size. However, the high costs of PCR systems and technical limitations associated with qPCR hinder the dPCR and qPCR market growth.

Technological Advancements in PCR Technologies Drive dPCR and qPCR Market Growth

Polymerase chain reaction (PCR) is a nearly ubiquitous, robust, and reliable technology used in most molecular biology labs to amplify specific stretches of DNA for genotyping, cloning, and analysis of single nucleotide variations and even serves as the basis for most next-generation sequencing (NGS) preparation. Technological advances are yielding different types of PCR techniques. The use of PCR technology has now been explored into several non-conventional applications, making molecular diagnosis easier and faster. In particular, advances in digital and real-time PCR are used to diagnose diseases, identify viruses and bacteria, and aid forensic investigations.

Moreover, the researchers are trying to reduce test time using some nanomaterials. In March 2023, the Center for Augmented Safety System with Intelligence, Sensing of the Korea Institute of Science and Technology (KIST, President: Seok Jin Yoon) announced the development of an ultrafast PCR technology by Dr. Sang Kyung Kim (Director) and Dr. Seungwon Jung’s research team. The ultrafast PCR reduces the test duration by ten times compared to the previous test by utilizing photothermal nanomaterials. The diagnostic performance of the new method is comparable to the current test method, and it can be finished in 5 minutes. Thus, technological advancements in PCR technologies propel the dPCR and qPCR market growth.

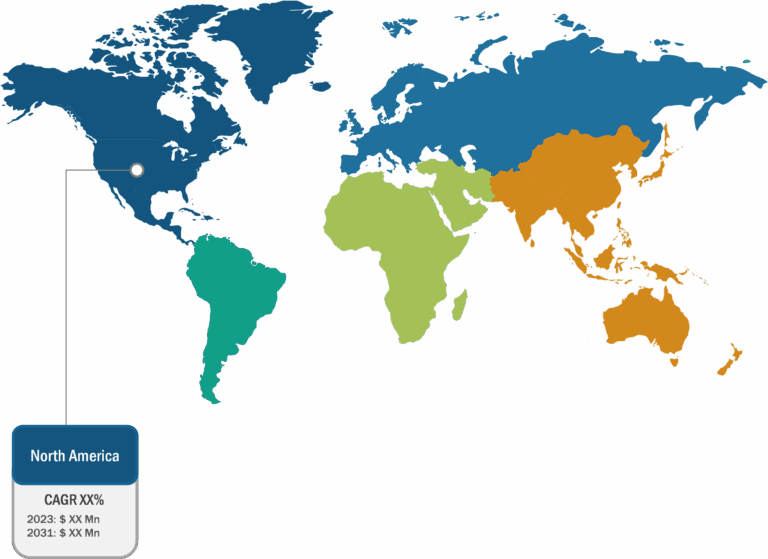

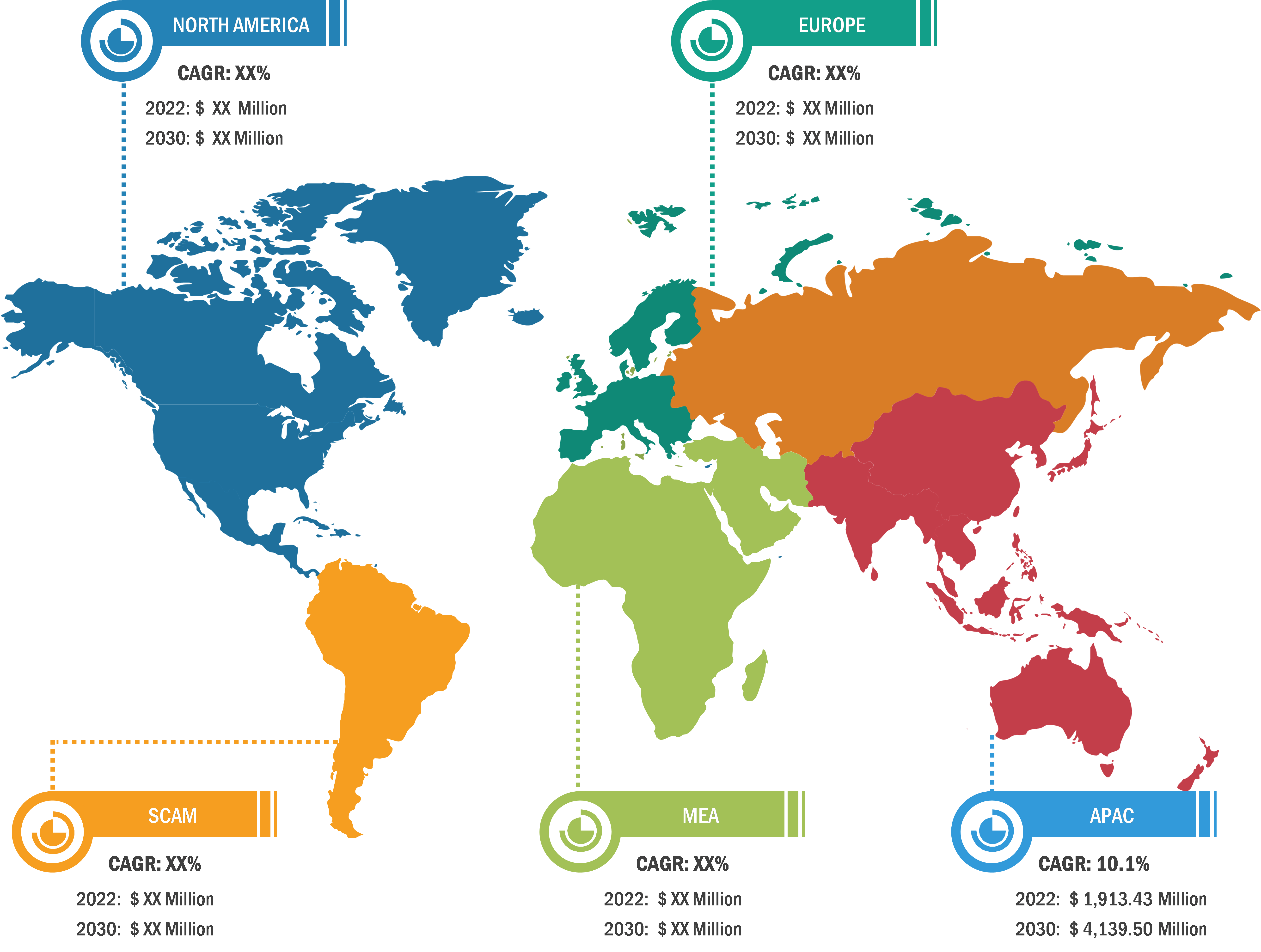

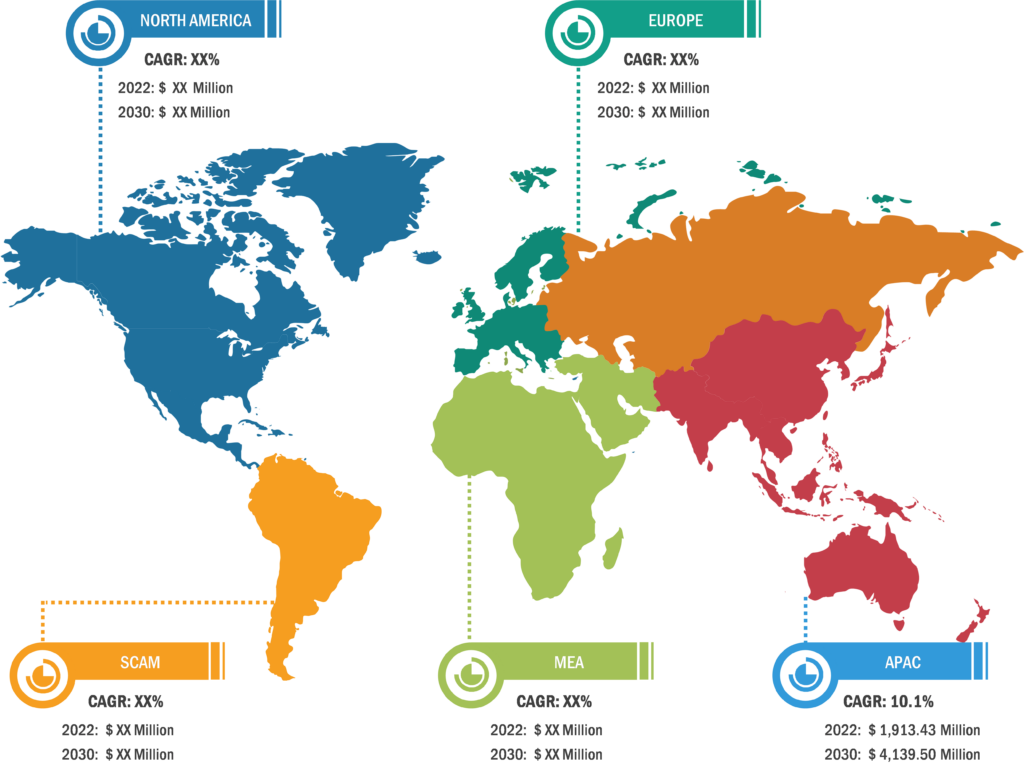

dPCR and qPCR Market: Regional Overview

Based on region, the dPCR and qPCR market is primarily segmented into North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. Asia Pacific is anticipated to register the highest CAGR in the market during 2022–2030. In the region, China held the largest share in the market. The market growth in China is attributed to increasing demand for high-quality healthcare products, growing prevalence of lifestyle diseases, rising developments in diagnostics, growing diagnostic centers and hospitals, and increasing medical facilities in hospitals in the country. In China, dPCR and qPCR techniques are used for preimplantation genetic diagnosis, cancer treatment, and noninvasive prenatal testing. According to the article titled “Rare Disease Day: why China’s rare disease burden could be an opportunity for innovation” published in February 2023, ~20 million Chinese people suffer from rare diseases. dPCR and qPCR techniques can be used for the diagnosis and treatment of such rare conditions.

The rising prevalence of cancer in China contributes to the growth of the dPCR and qPCR market. dPCR and qPCR methods are used for cancer diagnosis. According to the Global Cancer Observatory data, a total of 4,568,754 cancer cases were reported in the country in 2020. In addition, 3,002,899 deaths due to cancer are recorded in China. Thus, the above-mentioned factors fuel the dPCR and qPCR market growth in China.

dPCR and qPCR Market: Competitive Landscape and Key Developments

Abbott Laboratories, Thermo Fisher Scientific Inc., Takara Bio Inc., Qiagen NV, Standard Biotools Inc., Lepu Medical Technology Beijing Co Ltd, F. Hoffmann-la Roche Ltd, Bio-rad Laboratories Inc, Agilent Technologies Inc, and Genome Diagnostics Pvt Ltd. are a few of the key companies operating in the dPCR and qPCR market. These companies focus on product innovation strategies to meet evolving customer demands, along with maintaining their brand name.

A few of the recent developments in the global dPCR and qPCR market are mentioned below:

- In May 2023, Standard BioTools Inc. launched next-generation sequencing (NGS) library preparation functionality on the X9 High-Throughput Genomics System. For the first time, customers can perform real-time PCR and NGS library prep applications on a single benchtop system to support discovery through screening.

- In August 2022, Roche released the Digital LightCycler device, the company’s first digital PCR device. The Digital LightCycler System will enable clinical researchers to partition DNA and RNA from an already extracted clinical sample into up to 100,000 tiny individual reactions. The device can then run PCR and produce highly sophisticated data analysis on the results.