Dealer Management System Market

Growing Technological Advancements in Automotive Industry Drives Dealer Management System Market Growth

Over the past few decades, the automotive industry has experienced numerous technological advancements. The advent of digital technology across the globe made it possible for automobile makers to implement advanced solutions. The dealer management system is an optimal solution for companies working in the automobile sector that take part in spare parts inventory and work order management. The system incorporates customer relationship management (CRM) and business intelligence tools to track manufacturer and customer relationships. Several car dealers are also using this system to manage inventory and sales records. The dealer management system streamlines interactions between customers, dealers, and OEMs. The system supports the unique needs of the automotive retail industry. It facilitates the sale of new and used vehicles and includes various features such as repair and maintenance services, consumer financing, and vehicle and parts inventory management. The system also allows financial reporting, cash flow management, and payroll services. The system incorporates OEM data processing systems and allows automotive retailers to order vehicles and associated parts, process warranties, and receive vehicle records. All these features of a dealer management system is boosting its adoption in the automotive industry.

Many companies are implementing inorganic and organic strategies to expand their dealer management system market share in the automotive industry. For instance, in June 2023, HBS Systems, Inc. partnered with Record360 to accelerate the inspection process, reduce damage disputes, and manage their assets. With this partnership, Record360 efficiently improved equipment inspection processes by using HBS Systems, Inc.’s NetView ECO dealer management software. The system is used to add transparency to equipment rental transactions. In February 2020, Tekion Corp. rolled out a cloud-based platform with all the functionalities of a dealer management system—Automotive Retail Cloud. It connects major stakeholders of the industry, allowing them to maximize operational efficiencies, collaboration, and tailored retail experiences. Similarly, in January 2020, DealerSocket, Inc. announced the acquisition of Auto/Mate—a dealer management system provider for automotive dealerships. By merging Auto/Mate’s robust dealer management system with DealerSocket’s products, the company provides auto dealers with a unique platform where advanced software is coupled with the best services.

Thus, the growing technological advancements in the automotive industry boost the demand for these systems, which drives the dealer management system market.

Dealer Management System Market: Segment Overview

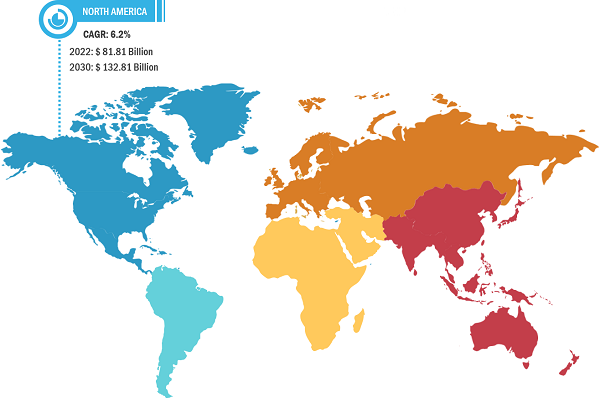

The dealer management system market is segmented on the basis of deployment, equipment type, and geography. Based on deployment, the dealer management system market is divided into on-premise and cloud. Based on equipment type, the dealer management system market is categorized into automobile, agricultural & forestry machinery, construction equipment, gardening equipment, heavy trucks, material handling & lifting equipment, mining equipment, and others. Geographically, the dealer management system market is segmented into five major regions—North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM).

In 2022, North America held the largest global dealer management system market share, followed by Europe and APAC. The US, Canada, and Mexico are among the major economies in North America. North America captures a noteworthy share of the global dealer management system market owing to high investment in automation and software coupled with the growing number of dealership stores in this region. A dealer management system helps enterprises manage ongoing orders, run a marketing campaign, understand customer buying trends, and manage day-to-day business operations. Many system providers are developing their existing dealer management systems to receive more contact certifications from automotive manufacturers. For instance, in July 2023, CDK Global Inc. received an official certification as a dealer management system provider from BMW Group Canada, including BMW and MINI retailers. CDK Global Inc. serves as a leading customer relationship management (CRM) provider for the BMW and MINI Canadian network. The partnership with auto manufacturers strengthens CDK Global Inc.’s position in both the US and Canadian dealer management system markets.

In the US, according to the National Automobile Dealer Association (NADA), there were 16,773 franchised light-vehicle dealers as of mid-2022. These dealers sold light-duty vehicles worth ~US$ 13.7 million to meet the growing demand for new light vehicles. Thus, the growing demand for light-duty vehicles among customers is a key driving factor of the market. Dealer management system help the auto dealers to manage and handle the entire buying and selling process light-duty vehicles.

Dealer Management System Market: Competitive Landscape and Key Developments

e-Emphasys Technologies Inc., ANNATA Ehf, DealerBox SAS, Hitachi Solutions Ltd, Irium Software SAS, CDK Global, Constellation Software, DealerTrack Inc, Tekion Corp, and XAPT Software Consulting LLC are among the key dealer management system market players profiled during the dealer management system market study. Various other companies are introducing new product offerings to contribute to the dealer management system market size proliferation. Several other important dealer management system market players were also analyzed during this market research to get a holistic view of the global dealer management system market and its ecosystem. The leading dealer management system market players focus on feature upgrades, expansion and diversification, collaboration, and acquisition strategies, which enable them to grab new business opportunities.

- In May 2023, e-Emphasys Technologies Inc. announced the merger with CDK Global Heavy Equipment to address the end-to-end business optimization needs of equipment dealers and rental companies. The mergers also facilitate the company to drive innovation in the industry.

- In January 2023, ANNATA Ehf partnered with Sitecore and Touchcast to create end-to-end approach-based solutions for automotive OEMs, dealer groups, and national sales & marketing companies. This solution offers virtual dealerships and enhances the vehicle purchasing experience of consumers.

- In October 2022, Salesforce Industries launched Automotive Cloud, a customer sales, service, marketing and commerce platform for car and heavy vehicle dealers, manufacturers, and finance companies. The new solution is effectively an automotive CRM, which also integrates with Driver 360, a custom instance of Salesforce’s Customer 360, and can create customer profiles, connect with them, and track them through commerce, service, and marketing activities.