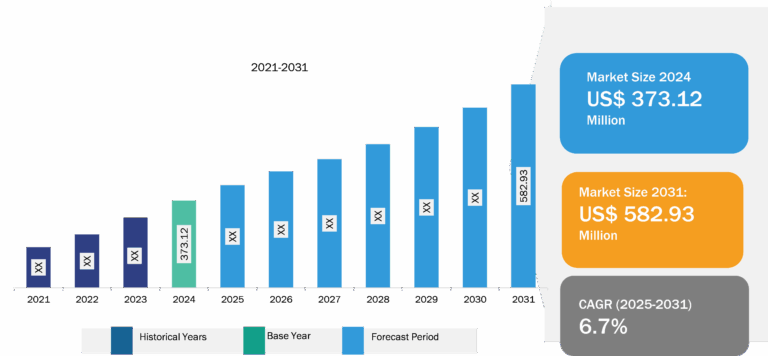

Synthetic Aperture Radar Market

Growing Demand for Earth Observation and Remote Sensing Capabilities to Fuel Synthetic Aperture Radar Market Growth During Forecast Period

SAR systems are widely used in sectors such as agriculture, mining, and environmental monitoring due to their ability to provide valuable insights and data. In the agriculture sector, SAR technology plays a crucial role in monitoring crops and other agricultural targets. SAR-based data can detect differences in surface roughness, which arises due to field plowing, soil tillage, and crop harvesting. This information helps farmers optimize farming practices, allocate resources efficiently, and improve crop yields. Such applications of synthetic aperture radar technology in the agriculture sector are anticipated to bring new synthetic aperture radar market trends in the coming years.

SAR systems are also valuable in environmental monitoring and natural resource management. SAR imagery provides detailed data about the Earth’s surface, enabling scientists and policymakers to understand the changing environment better. SAR can be used to assess and respond to climate change, ecosystem loss, natural disasters, and more. For example, SAR can help distinguish different types of floods, monitor urban growth, and assess the stability of civil infrastructure such as bridges. The increasing availability and advancements in SAR satellite systems have also contributed to the growing demand for SAR technology. For instance, the NASA-ISRO SAR Mission (NISAR) is a global SAR mission that provides data for studying hazards, changes in glaciers and ice sheets, and global environmental change. Private companies such as ICEYE are also playing a role in making SAR more widely available and accessible. According to industry reports, venture capital investment in space technology was recorded to be ~US$ 14.5 billion in 2021. Thus, the increasing demand for Earth observation and remote sensing capabilities contributes to the growing market.

Synthetic Aperture Radar Market: Industry Overview

The synthetic aperture radar market is segmented on the basis of component, application, frequency band, platform, and mode. Based on component, the market is segmented into receiver, transmitter, and antenna. Based on application, the market is bifurcated into commercial and defense. Based on frequency band, the market is segmented into X band, L band, C band, S band, and others. Based on platform, the market is bifurcated into ground and airborne. Based on mode, the market is bifurcated into single and multi. The market, based on geography, is categorized into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Europe held a significant synthetic aperture radar market share in 2022. In Europe, the UK held a promising synthetic aperture radar market share in 2022. The Europe is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. The Maritime Defense, Security, and Surveillance sectors in Europe are gaining significance and expanding with technological innovations and applications for military and civil use. France and the UK account for 40% of the total Defense R&D spending in Europe, followed by Germany, Italy, Spain, and Sweden. Thus, various players operating in the market are advancing SAR with AI and cutting-edge software. For instance, in August 2023, Polish company Satim secured US$ 2.2 million in their latest investor round. The firm plans to use these funds to advance its AI-based, cutting-edge software for automatic object detection, identification, and classification capabilities anytime, anywhere, using satellite synthetic aperture radar imagery. Thus, such initiatives are likely to have a significant impact on market in the next few years.

Several players across the region are adding synthetic aperture radar to unmanned aerial vehicles. For example, in April 2023, the European market leader in unmanned aerial systems (UAV) and intelligence-as-a-service solutions, TEKEVER, announced that it has effectively added GAMASAR to its AR5 UAS. GAMASAR is a synthetic aperture radar designed and developed by TEKEVER to support aerial and space-based Earth observation. It is now available on both AR5 and AR3 systems to support the most demanding land and maritime missions. The integration of synthetic aperture radar payloads typically imposes a significant tradeoff in operational capabilities, especially in smaller UAS platforms. Thus, such initiatives are anticipated to fuel the synthetic aperture radar market growth.

Competitive Landscape and Key Developments

The synthetic aperture radar market analysis is carried out by identifying and evaluating key players in the market across different regions. Northrop Grumman Corp, ASELSAN AS, BAE Systems Plc, Israel Aerospace Industries Ltd, Leonardo SpA, Lockheed Martin Corp, Raytheon Technologies Corp, Thales SA, General Atomics Aeronautical Systems Inc, and Saab AB are key players profiled in the market report. Several other essential synthetic aperture radar market players were also analyzed for a holistic view of the market and its ecosystem. The market report provides detailed insights, which help the key players strategize their market growth. A few of the key market developments are mentioned below:

- In December 2023, Saab was awarded a contract by the US Navy to provide a Double Eagle Semi-Autonomous Remotely Operated Vehicle (SAROV) to the Kuwait Naval Force. The SAROV is part of the well-established Double Eagle family of undersea vehicles. It is widely recognized for its safety and effectiveness in supporting mine countermeasure (MCM) operations for various naval forces worldwide. In its SAROV configuration, the vehicle offers dual functionality as both an Autonomous Underwater Vehicle (AUV) for detecting, classifying, and identifying underwater objects, as well as a Remotely Operated Vehicle (ROV) for safely disposing of detected mines.

- In September 2023, as part of its expansion plan in the UK, Saab established a new radar production facility. This new radar operation in Fareham will provide jobs to 100–150 employees as it expands. This expands Saab’s production capability for its Giraffe 1X Deployment Set, with the first units now in operation at the Fareham facility.

- In July 2023, Israel Aerospace Industries (IAI) launched Singapore’s DS-SAR radar satellite, showcasing the company’s expertise in the development of observation satellites. With a track record of 35 years in creating advanced-generation satellites such as OptSat and TecSAR, IAI has leveraged its experience to create the DS-SAR satellite. This satellite features a synthetic aperture radar sensor payload, which enables the collection of extensive and high-resolution data regardless of weather conditions, day or night. The launch of DS-SAR reinforces IAI’s position in the market and highlights its ability to deliver cutting-edge solutions in the field of satellite technology.