Temperature Sensor Market

Rising Concerns Over Vehicle and Road Safety to Drive Temperature Sensor Market

Temperature sensors are highly deployed in cars, homes, defense systems, and smartwatches to monitor health, change settings for comfort, and alert users regarding potential threats. Various government bodies across the globe are taking significant initiatives and supporting manufacturers in the development of high-quality sensors. For instance, in May 2023, the Defense Advanced Research Projects Agency (DARPA) organized a new high operational temperature sensors (HOTS) program for the development of microelectronic sensor technologies used in extreme missions. These technologies include high-performance temperature sensors with high-dynamic-range sensing capable of working in extreme temperatures such as corrosive chemicals, high temperatures, and mechanical stress. Moreover, the temperature sensor market is governed by different bodies according to their use in different industries.

- Food and Drug Administration (FDA) and European Medicines Agency (EMA) mandate stringent calibration, reliability, and accuracy requirements for the use of temperature sensors in the healthcare industry. These authorities are constantly taking the initiative and providing support to healthcare facilities regarding the use of temperature sensors to ensure patient safety.

- FDA, the US Department of Agriculture (USDA), and the European Food Safety Authority (EFSA) impose stringent regulations to prevent foodborne illnesses by preserving food quality. The temperature sensor is used to monitor the temperature range in the various stages of the food supply chain.

- The International Organization for Standardization (ISO) and the Occupational Safety and Health Administration (OSHA) are taking significant initiatives to create awareness related to the use of temperature sensors in manufacturing and industrial applications. This government authority is creating awareness related to the use of temperature sensors and the capability of temperature sensors to mitigate risks associated with thermal hazards to ensure workers’ safety.

Significant initiatives taken by the government to create awareness related to the benefits provided by temperature sensors and support manufacturers in the development of high-quality sensors are driving the overall temperature sensor market growth.

Temperature Sensor Market: Industry Overview

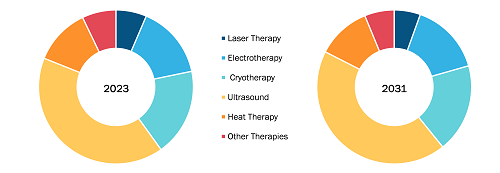

The temperature sensor market is segmented on the basis of type, connectivity, end user, and geography. Based on type, the temperature sensor market is segmented into thermocouples, thermistors, resistance temperature detectors, infrared, and others. Based on connectivity, the market is bifurcated into wired and wireless. Based on end user, the temperature sensor market is segmented into semiconductor manufacturing, aerospace, healthcare & pharma, food & beverages, energy & utility, data centers, and others. The scope of the temperature sensor market report is primarily segmented into North America (the US, Canada, and Mexico), Europe (Russia, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Australia, Japan, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

The report includes growth prospects owing to the current temperature sensor market trends and their foreseeable impact during the forecast period. In terms of revenue, Asia Pacific dominated the temperature sensor market share, followed by North America and Europe. The market in North America is segmented into the US, Canada, and Mexico. The data center industry in North America has witnessed continued demand and growth in recent years. This growth in the data center industry in North America is majorly attributed to the substantial rise in demand from cloud providers. In the US, Texas, North California, and certain areas of San Antonio registered relatively higher cloud activity. The overall absorption and demand for data centers in the US and other prominent countries is growing. Various companies are launching new data centers in the region. For instance, in April 2023, Equinix announced plans to construct a new data center in Montreal, Canada. Also, in November 2023, Vertiv introduced Vertiv SmartMod Max CW, a prefabricated modular data center designed to address the growing demand for rapid deployment of computing. Temperature sensors continuously monitor the ambient temperature in different areas of the data center. Thus, with the increasing data centers, the demand for temperature sensors is also growing in the region, further fostering the North America temperature sensor market share.

Temperature Sensor Market: Competitive Landscape and Key Developments

Texas Instruments Inc, Siemens AG, TE Connectivity Ltd, Amphenol Corp, Analog Devices Inc, Emerson Electric Co, Microchip Technology Inc, Panasonic Holdings Corp, Honeywell International Inc, and NXP Semiconductors NV are among the key players profiled in the temperature sensor market report. Several other major market players were also studied and analyzed during this market research study to get a holistic view of the market and its ecosystem. The temperature sensor market forecast provides detailed market insights, which help the key players strategize their growth. Below mentioned are a few of the strategic initiatives taken by the key market players:

- In January 2023, TDK Corp introduced the TDK i3 Micro Module—the first module with edge AI and wireless mesh connectivity. It is developed in collaboration with Texas Instruments. It integrates TI SimpleLink, Arm Cortex-M4F MCU, SmartIndustrial MEMS accelerometer, and mesh network functionality. This module simplifies deployment and sensor data gathering.

- In December 2022, Newark signed a global distribution agreement with Analog Devices Inc, enhancing its semiconductor portfolio. Under this agreement, Newark will deliver the Analog Devices portfolio, including new-to-market products. This will benefit the design engineers in various markets. The expanded range includes mixed signal and power management products suitable for 5G, IoT, cyber security, radar systems, RF solutions, sensor interfaces, and precision technology applications. The partnership aims to meet market requirements and drive customer success.