Growing Biopharmaceutical Industry Bioprocessing Market

In the biopharmaceutical industry, improved bioprocesses are always in demand to address new regulatory requirements, quality control requirements, and production issues in biological products, cell culture titration, and biosimilar production. In recent years, the biopharmaceutical industry has been growing at an unprecedented pace. Biopharmaceutical companies are spending huge sums in R&D to introduce new molecules with enhanced medical and commercial potency for various therapeutic applications. The acceptance of bioprocessing is gradually increasing due to its wide application in research, development, and manufacturing of biologics and biosimilars. Big pharmaceutical companies and contract research organizations are coming up with new medicines and therapy forms to treat a wide range of indications. Further, a strong demand for biologics and biosimilars to treat chronic diseases is, in turn, driving the growth of the biopharmaceutical industry. The biopharmaceutical industry is one of the most significant contributors to the economy. The US is the largest market for biopharmaceuticals and the leader in biopharmaceutical R&D. As per the Pharmaceutical Research and Manufacturers Association, the US firms conduct over half the world’s R&D in pharmaceuticals (US$ 75 billion) and hold the highest number of patents in new medicines. Besides growing economies, rapid growth is witnessed in the research environment in emerging economies such as Brazil, China, and India. Factors such as increasing biologics approval, growing biosimilar pipeline, rising investment in research activities, and increasing focus on developing affordable biologics are facilitating the growth of the biopharmaceutical industry.

Apart from these, increasing approvals in gene and cell therapies are favoring the bioprocessing market growth. The approved gene therapies are Glybera (to treat lipoprotein lipase deficiency) and Strimvelis (to treat ADA-severe combined immunodeficiency). Thus, the factors mentioned above are increasing the demand for the large-scale production of various therapeutics, thereby facilitating the growth of the bioprocessing market globally.

Bioprocessing Market: Scale of Operation Overview

The bioprocessing market, based on scale of operation, is segmented into commercial operations and clinical operations. The commercial operations segment held a larger bioprocessing market share in 2023 and is anticipated to register a higher CAGR during the forecast period.

Commercial operations involve the large-scale production of biopharmaceuticals and bioproducts by employing instruments with capacities in tens of thousands of liters and prioritizing efficiency, automation, and cost-effectiveness to meet the demands of a diverse patient pool. Commercial operation is crucial for the mass production of well-established biopharmaceuticals, such as vaccines and monoclonal antibodies. The growing demand for bioproducts in emerging markets, alongside increasing consumer expectations in established regions, drives the expansion of the commercial operation segment. It offers opportunities to tap into evolving market needs and preferences.

Bioprocessing Market: Geographic Overview

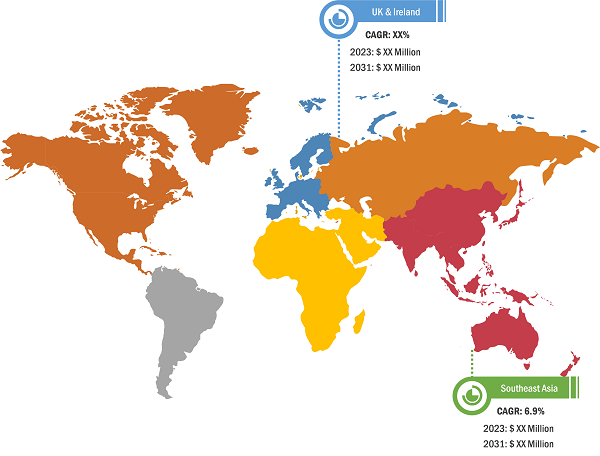

In terms of geography, the bioprocessing market is segmented into North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In 2023, North America accounted for the largest global bioprocessing market share. Market growth in the region is determined by the increasing incidence of rare diseases and the rising trend of cell and gene therapy (CGT) in the region. Asia Pacific is expected to register the highest CAGR during 2023–2031. The Asia Pacific bioprocessing market is segmented into China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific. China is predicted to hold the largest market share in 2023, and India is expected to show a significant growth rate in the market. The bioprocessing market in China is witnessing growth owing to the constant technological advancements, developments of innovative products by market players, and favorable regulatory policies. In January 2022, Shanghai ZhenGe Biotech Co., Ltd., a CDMO service provider, completed a successful financing round C, raising a total of US$ 100 million. Goldman Sachs Asset Management and Sofina led the funding round, with additional investments from Novo Holdings A/S, Qiming Venture Capital, IDG Capital, LYFE Capital, Junxin Capital, and Cowin Capital. In October 2023, WuXi Biologics launched a new bioprocessing platform—WuXiUITM—for cost-effective commercial manufacturing and desirable product quality. WuXiUITM intensifies fed-batch solutions, enhancing the productivity and quality of various mammalian cells and product modalities. Further, the growing number of market players focusing on countries in Asia Pacific for their geographic expansion and other growth strategies, the rising count of research centers, and a notable increase in government funding fuel the bioprocessing market growth in Asia Pacific.

Industry Developments and Future Opportunities:

As per company press relases, a few initiatives taken by leading players operating in the bioprocessing market are listed below:

- In February 2024, the Eppendorf Group announced the expansion of the company in a new site in South Africa. A sophisticated pipette calibration laboratory with a service workshop and a customer experience center featuring Eppendorf equipment are among the amenities offered by the branch office, which is situated in Johannesburg’s Waterfall City economic center. This location provides top-notch laboratory services, such as instrument maintenance and customer training.

- In November 2023, 3M Co revealed the newest model in its line of chromatographic clarifiers. For the purpose of separating monoclonal antibodies, recombinant proteins, and biologics, Harvest RC Chromatographic Clarifier, BT500 is a 500 mL chromatographic clarifier designed for single use. Based on 5–8% packed cell volume (PCV) culture, the business claims that the BT500 can generate predictive yield samples in 10 minutes. Customers seeking to optimize productivity in the laboratory can now better meet the rapidly increasing demands of the industry with the addition of 3M Harvest RC Chromatographic Clarifier, BT500, to their product line.

- In October 2023, Getinge AB acquired High Purity New England, Inc for US$ 120 million. By the end of 2024, the company will fully integrate High Purity New England, Inc. The acquisition has helped Getinge AB acquire a comprehensive range of proprietary and distributed products from drug discovery, upstream and downstream processing, and fill-and-finish.

- In September 2023, Entegris, Inc. announced the introduction of its interactive customer tool, the F/T Optimizer, at the BioProcess International Conference in Boston, MA. The tool uses proprietary algorithms to test virtually as many as eight equipment and process combinations to determine the most efficient and cost-effective cold chain solutions.

- In September 2023, Agilent Technologies Inc. signed a Research Collaboration Agreement (RCA) with the National Cancer Centre Singapore (NCCS) outlining their collaboration to accelerate translational cancer research on the genomic landscape of Asian-prevalent cancers over the next two years. The scope of the agreement included the supply of an Agilent Magnis Next-Generation Sequencing (NGS) Preparation System to help investigate details specific to Asian cancer cohorts, where tissue samples derived from routine clinical care remain limited locally and regionally.

- In August 2023, Sartorius AG and Repligen launched an integrated bioreactor system to combine Repligen XCell ATF upstream intensification technology into Sartorius’ Biostat STR bioreactor. According to both firms, the objective is to make the deployment of N perfusion and intensified seed train easier for biopharmaceutical makers.

- In May 2023, Merck KGaA and the Ministry of Trade, Industry and Energy (MOTIE) in Daejeon City signed a non-binding Memorandum of Understanding (MoU) for the establishment of a new Asia-Pacific BioProcessing Center in order to promote the healthcare ecosystem in the area. The proposed bioprocessing plant would enable commercial production for Asia Pacific biotech and pharmaceutical clients. Through this partnership, the pharmaceutical and biotechnology sector in South Korea will have the chance to advance as the country’s leading industry for research and technology.

Bioprocessing Market: Competitive Landscape and Key Developments

Cytiva (Danaher Corporation), Sartorius AG, Thermo Fisher Scientific Inc., Repligen Corporation, Merck KgaA, 3M Company, Getinge AB, Eppendorf SE, Corning Incorporated, Entegris, Agilent Technologies, and Bio-Rad Laboratories are among the leading companies operating in the bioprocessing market. These players focus on expanding and diversifying their market presence and acquiring a novel customer base, thereby exploiting attractive business opportunities prevailing in the bioprocessing market.