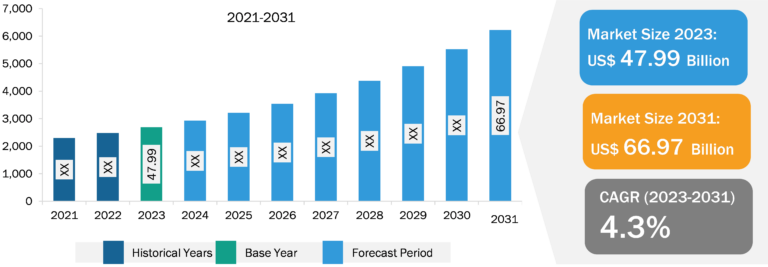

Spiral Membrane Market

Spiral membranes are highly used in water treatment applications such as purification of industrial water, drainage purification, sewage treatment, and wastewater treatment. Spiral membrane provides a higher packing density, making it a more efficient membrane material and leading to improved filtration capacity and separation performance. The spiral membrane consists of a spiral-wound configuration, which enables a high surface area within a smaller filtration area. Thus, owing to its enhanced efficiency, the spiral membrane is crucial in applications such as the treatment of municipal waste and industrial waste, where optimal separation is paramount. Governments of many countries worldwide are encouraging water and wastewater treatment practices. Various countries in Europe are working toward achieving wastewater treatment targets, protecting sensitive water systems, and utilizing wastewater sludge. According to the European Environment Agency (EEA) published data in 2021, the collection and treatment of wastewater are improving across the region. Further, ~90% of urban wastewater across the EU is collected and treated in accordance with the EU Waste Water Treatment Directive. A country-level analysis was conducted based on the implementation of EU rules on wastewater treatment, which shows that the EU member states are mandating the rules; this led to a rise in the compliance rate of EU member states between 2016 and 2018. As per the EEA, Austria, Luxembourg, Germany, and the Netherlands treat urban wastewater in compliance with the Directive’s requirements, while 10 other countries have reached more than 90% compliance rate. As per the data recently published by the Water Information System for Europe (WISE), Austria has invested US$ 36.82 (36 euros) per citizen each year for new collection and treatment infrastructure as well as the renewal of aging infrastructure. Further, EPA stated that wastewater treatment facilities across the US process approximately 34 billion gallons of wastewater every day. The increasing demand for clean water, growing cases of water contamination, stringent government regulations on water treatment, and increasing industrial waste discharge into water bodies have necessitated initiatives to expand wastewater treatment facilities in Southeast Asia. In Singapore, the government has developed an advanced system for treating sewage involving a network of tunnels and high-tech plants. According to Southeast Asia Infrastructure, as of 2022, recycled wastewater meets 40% of Singapore’s water demand, and it is expected to reach 55% by 2060. The government is planning to invest ~US$ 7.4 billion in upgrading its water treatment infrastructure. Thus, the rise in water and wastewater treatment activities fuels the spiral membrane market growth.

Spiral Membrane Market: Segmental Overview

Based on membrane type, the spiral membrane market is segmented into polyethersulfone, polyamide, fluoropolymers, and others. In 2023, the polyamide segment held the largest market share and is expected to register the highest CAGR from 2023 to 2031. Polyamide membranes are composed of polyamide, a type of polymer known for its high mechanical strength, chemical resistance, and excellent filtration properties. The spiral configuration involves winding the membrane sheets around a central tube, creating a compact and efficient design that maximizes surface area while minimizing footprint. This structure allows for high permeability and selectivity, enabling the removal of various contaminants, including salts, microorganisms, and organic compounds. Polyamide spiral membranes operate under high pressure, forcing water through the semipermeable membrane while retaining impurities. These membranes are favored in applications requiring high-purity water, such as desalination and wastewater treatment, as well as a few applications in the food & beverages industry.

Based on technology, the market is categorized into microfiltration, ultrafiltration, nanofiltration, and reverse osmosis. In 2023, the reverse osmosis segment held the largest share of the market. Reverse osmosis (RO) technology is a widely used method for purifying water by removing dissolved salts, contaminants, and other impurities. This technology employs a semipermeable membrane configured in a spiral-wound design, which optimizes the surface area for filtration while maintaining a compact and efficient form. The RO process involves applying high pressure to the feed water, forcing it through the membrane, and filtering out the contaminants. The membrane’s pores, which are on the order of 0.1 nm to 1 nm, allow only water molecules and some significantly small, uncharged species to pass through it, effectively rejecting ions, larger molecules, and microorganisms. This high level of selectivity makes RO suitable for a range of applications, including the desalination of seawater and wastewater treatment, as well as the production of ultrapure water for industrial and pharmaceutical uses. The spiral-wound configuration enhances the system’s efficiency by enabling a high surface area-to-volume ratio, facilitating large-scale processing with relatively low energy requirements.

Based on end user, the market is segmented into food and beverages, biotech and biochemical, pharma and healthcare, water treatment (municipal), wastewater (industrial), chemicals, oil and gas, textile/pulp and paper industry, and others. In 2023, the water treatment (municipal) segment held the largest spiral membrane market share. Spiral membrane technology is extensively used in municipal water treatment processes such as reverse osmosis (RO) and nanofiltration (NF) due to its high efficiency in removing contaminants. These membranes effectively filter out a wide range of impurities, including dissolved salts, organic molecules, and pathogens, providing high-quality potable water. The spiral configuration allows for high flux rates and low energy consumption, optimizing operational costs. Moreover, the modular nature of spiral membranes facilitates easy scaling and maintenance, allowing municipal plants to adapt to varying water quality and demand. Uninterrupted cleaning and maintenance routines are essential to maintain the membrane’s performance and longevity, ensuring consistent delivery of safe, clean water to communities.

Spiral Membrane Market: Competitive Landscape

Alfa Laval AB; Toray Industries Inc; GEA Group; MANN+HUMMEL International GmbH & Co. KG; DuPont de Nemours Inc; Pentair Plc; PCI Membranes; Solecta, Inc.; Atech Innovations GmbH; Kovalus Separation Solutions Inc; TAMI Industries S.A.S; Synder Filtration Inc; UNISOL Membrane Technology; Membranium; AXEON Water Technologies; Inopor; Nitto Denko Corporation; Veolia Environnement SA; and Membracon (UK) Ltd are among the key players operating in the global spiral membrane market. Players operating in the market focus on providing high-quality products to fulfill customer demand.