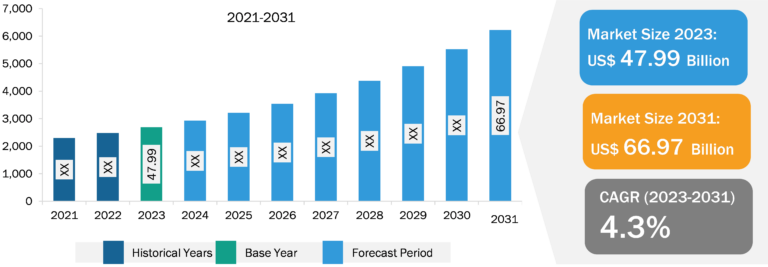

Wind Turbine Gearbox Market

Supportive Government Policies and Initiatives for Wind Energy is Steering the Wind Turbine Gearbox Market Growth

Wind power is one of the largest sources of renewable electricity globally, which is expected to further grow in the coming years. The rise in demand for renewable energy and its advantages in protecting the environment are expected to promote wind energy projects globally. Governments of various countries are supporting the construction of wind energy projects in terms of policies and investments. For instance, the government of India is providing financial incentives such as concessional custom duty exemption and accelerated depreciation benefits on the components, which is further promoting wind power projects in the country. Similarly, in Canada, the Offshore Renewable Energy Regulations (ORER) initiative supports the implementation of Offshore Renewable Energy Projects and Offshore Power Lines by developing modern safety and environmental protection regulations for the offshore renewable energy (ORE) projects and power lines in the offshore areas of Canada. In addition, in January 2022, the People’s Bank of China (PBOC) announced providing low-cost loans to fund decarbonization activities. Also, the current policy initiatives of Beijing are focusing on tax advantage and low-interest loans to companies developing low-carbon projects, power market reforms, and grid enhancement. Mounting a share of renewable resources in the complete power infrastructure and increasing focus on mitigating carbon emissions fuel the wind turbine gearbox market growth. The volatile geopolitical scenarios across the world and the COVID-19 pandemic have demonstrated the importance of renewable energy resources. In addition, the rising number of floating wind farms is also one of the major opportunities for the wind turbine gearbox market. In deep water, the offshore wind turbine is mounted on a floating structure, which allows the turbine to generate electricity in the water depths. The floating wind technology is highly efficient in harsh conditions and, thus, capable of producing high power. This technology is being adopted globally across various countries, such as Germany, China, Japan, the UK, Belgium, France, and Denmark. Further, the demand for floating wind technology is growing in the market due to the increase in technological advancements, advantages associated with floating wind technology, and turnkey solutions provided by service providers. Also, the growing awareness regarding clean energy in various countries is propelling the demand for floating offshore wind power, which will boost the growth of the wind turbine gearbox market.

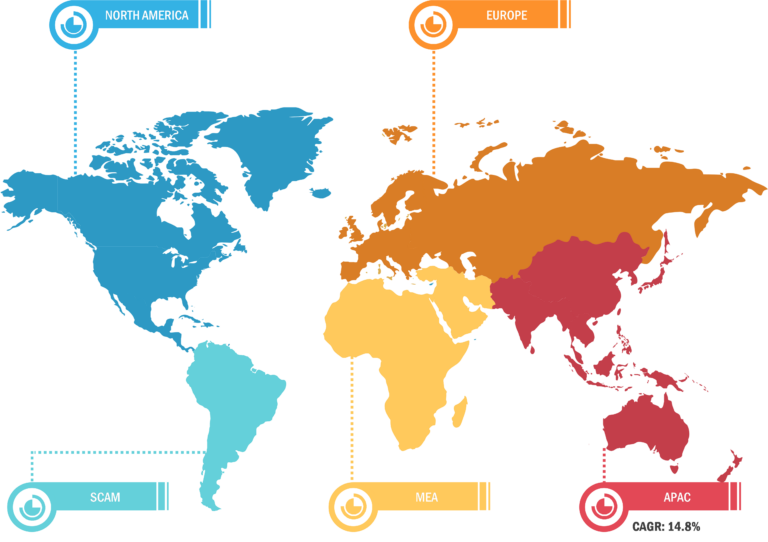

A gearbox in a wind turbine accelerates rotational speed from the low-speed main shaft to the high-speed shaft through an electrical generator. Across different parts of the world, different organic and inorganic strategies are occurring, which will increase the wind turbine gearbox market. The global wind turbine gearbox market is segmented into five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and South Africa. In 2022, Asia Pacific dominated the wind turbine gearbox market, followed by Europe and North America. Further, Asia Pacific is also expected to retain its dominance during the forecast period as well. In addition, the North America wind turbine gearbox market is estimated to indicate the highest CAGR during the forecast period. In the Asia Pacific region, China accounted for the largest share in terms of wind turbine gearbox deployment and manufacturing of different wind turbine components across the world. According to the Wood Makenzie projections, Asia Pacific is expected to add 122 GW of new wind capacity by 2030, surpassing Europe and the US’s estimated new capacity. As per the report, Taiwan, South Korea, Japan, Vietnam, and India will rank among the world’s top 20 largest offshore wind markets, with a combined net capacity of 27 GW from 2022 to 2030. Wind power currently accounts for 10% of Asia Pacific’s power capacity mix, coal accounts for 45%, and petrol contributes 12%. This is expected to change in 2050, as the shares of wind and solar will account for 50% of the region’s power capacity. Such factors are driving the growth of the wind turbine gearbox industry across different regions. Also, the different targets set by the government authorities of different countries for the deployment of renewable sources of power generation are expected to drive the demand for the wind turbine gearbox market during the forecast period.

Wind Turbine Gearbox Market Analysis: Type Overview

Based on type, the wind turbine gearbox market is bifurcated into planetary gearboxes, spur gearboxes, and others. In 2022, the planetary gearbox segment acquired a larger share of the global wind turbine gearbox market owing to their compact and small design with high-efficiency features. Many gearboxes at a 1.5 MW rated power range of wind turbines utilize a one- or two-stage planetary gearing system, which is also acknowledged as an epicyclic gearing system. Planetary gearboxes are highly efficient, and they persist with strong resistance to shock and a high torque to weight ratio. The planetary gearboxes have better stability as compared to other wind turbine gearboxes. This feature is contributing to the adoption of planetary gearboxes. However, planetary gearboxes use steel gear, which makes them prone to wear and noisy.

Raw material suppliers, component manufacturers, and end users are among the major stakeholders in the global wind turbine gearbox market ecosystem. Increased demand for wind turbine gearboxes has positively affected the total number of suppliers that are offering a wide range of raw materials. The raw material suppliers play a crucial role in the supply chain of the wind turbine gearbox market as it contributes to the revenue of the market growth. The raw materials that are used for the manufacturing of the wind turbine gearbox need to be of the highest quality, as the quality of these materials directly affects the performance of the wind turbines. Akzo Nobel N.V., Spahr Metric, Inc., Von Roll, Prysmian Group, Leeco Steel, NSK Ltd., NTN-SNR, and NUCOR are a few main raw material suppliers.

Wind Turbine Gearbox Market Analysis: Deployment Type Overview

Based on deployment type, the wind turbine gearbox market is segmented into onshore and offshore. In 2022, the onshore segment acquired a larger share of the wind turbine gearbox market owing to factors such as lower gaseous emissions and low maintenance costs compared to offshore farms. Further, onshore wind farms can be assembled in months, allowing wind farm owners to generate revenue at the earliest. Further, public and private investments in renewable energy, especially in onshore wind, have driven the onshore wind turbine gearbox market.

Wind Turbine Gearbox Market: Competitive Landscape and Key Developments

Siemens Gamesa Renewable Energy SA, General Electric, Mitsubishi Heavy Industries, Vestas Wind Systems, Elecon Engineering Company Limited, ME Production AS, ZF Friedrichshafen AG, Flender GmbH, Dana Motion Systems, Stork Gears & Services BVare are among the key wind turbine gearbox market players profiled during this study. In addition, several other important wind turbine gearbox market players have been studied and analyzed during the study to get a holistic view of the wind turbine gearbox market and its ecosystem.