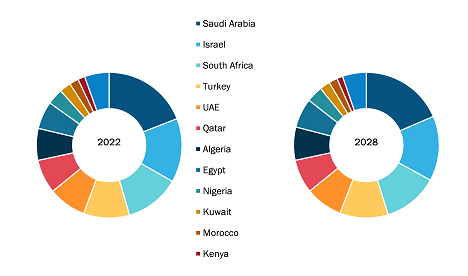

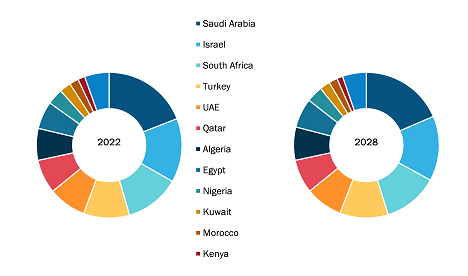

Middle East & Africa Blood Collection Devices Market

Blood collection tubes are sterile plastic or glass tubes that collect blood, urine, and serum samples from patients to diagnose blood-related diseases. Most blood collection devices comprise an additive that either accelerates the clotting of blood (clot activator) or prevents the blood from clotting (anticoagulant). The most commonly used blood collection devices comprise light-blue, red, green, lavender, gray, or gold mottled or “tiger” top. These tubes are generally used in clinical laboratories for coagulation, serology, immunology, and chemical tests. The market growth is attributable to growing government support for blood test services and prevalence of blood and genetic disorders.

Market Insights

Prevalence of Blood and Genetic Disorders

Hereditary blood disorders (HBD) are a heterogeneous group of disorders characterized by a bleeding tendency of variable severity. Blood tests are conducted to detect blood disorders. Also, Saudi Arabia has the highest autosomal recessive birth rate globally, with mutations accounting for 40% of the total mutation pool responsible for suffering from sickle cell anemia, cystic fibrosis, and Tay-Sachs disease. Further, sickle cell disease (SCD) is a common multisystem hereditary blood disorder reported in Saudi Arabia. Studies reveal that SCD accounts for 2–27% of sickle cell traits (inherited gene) as per the estimates published by the International Journal of Medicine in Developing Countries. The Saudi Premarital Screening Program also reveals that sickle cell traits account for 4.2% and 0.26% of SCD, with prevalence highest in the Eastern province, accounting for 17% for sickle cell trait and 1.2% for SCD.

The Centre for Arab Genomic Studies report also states that genetic disorders in the Kingdom of Saudi Arabia (KSA) follow the unexpected trend of predominantly recessive disease transmission among the Arab population. The two largest exome studies in the KSA revealed that 71–83% of recessive mutation cases are positive for genetic disorders. Also, ~67.3% of KSA-CTGA disease records involve disorders transmitted through recessive inheritance. Autosomal and X-linked disorders, as well as disorders classified with other relatively rarely reported forms of inheritance (sporadic, mosaic, Y-linked, mitochondrial, multifactorial, digenic inheritance, and different descriptions of transmission modes of the same disease), were reported between affected families. Thus, the prevalence of blood disorders and other genetic disorders among patients accelerate the demand for blood collection devices, thereby ultimately driving its overall market.

Middle East & Africa Blood Collection Devices Market: Segmental Overview

Based on product, the Middle East & Africa blood collection devices market is segmented into blood collection needles/holders, blood collection tubes, blood collection set, and others. The blood collection needles/holders segment held the largest market share in 2022. The blood collection tubes segment is likely to register the highest CAGR during the forecast period 2022–2028.

Based on method, the Middle East & Africa blood collection devices market is bifurcated into manual blood collection and automated blood collection. The manual blood collection segment held a larger market share in 2021. The automated blood collection segment is expected to register a higher CAGR during the forecast period.

In terms of end user, the Middle East & Africa blood collection devices market is categorized into hospitals & pathology laboratories, blood banks, and others. The hospitals & pathology laboratories segment held the largest share for the Middle East & Africa blood collection tubes market share in 2022 and is expected to register the highest CAGR during the forecast period.

Impact of COVID-19 Pandemic on Middle East & Africa Blood Collection Devices Market

In 2020, the COVID-19 pandemic significantly impacted the delivery and accessibility of social services, education, health and nutrition, healthcare spending, well-being, and development-related businesses. Owing to the dependence of Middle East & Africa countries on trade and tourism, as well as struggles with substantial youth unemployment, the global crisis led to serious long-term effects. Governments in the Middle East & Africa allocated funds to prevent the overburdening of their health systems and decelerate the spread of COVID-19; a few countries also emphasized on increasing the number of intensive care units and hospital beds.

Pre-emptive action by governments helped flatten the infection curve in their respective countries. With the gradual recovery of countries from the COVID-19 pandemic, authorities began working on improving their resilience and digitally efficient healthcare systems. Furthermore, the trend of consumerization in healthcare, which provides greater authority and decision-making power to patients, is driving the paradigm shift toward value-based care. Since the beginning of the COVID-19 pandemic, the World Bank Group committed more than US$ 157 billion to combat the effects of the crisis on health, economies, and social aspects. More than 100 countries are benefiting from the funding, which is being used to improve preparedness, protect the poor and jobs, and kick start a climate-friendly recovery.

As a result of the COVID-19 crisis, the World Bank forecasts that remittances to the Middle East & Africa region are projected to fall sharply by 19.6%, after total of US$ 42 billion in 2020, i.e., a 2.6% increase in 2019. The death pool of ill patients in low-cost regions is expected to rise because healthcare professionals have limited their patients checking as many hospitals have limited resources and staff.

The rising rate of SARS-CoV-2 has increased stress on the region’s healthcare system, raising the demand for diagnostic tests such as blood tests or antibody tests in its healthcare system, supporting the growth of the market in this region. In June 2020, two of the largest private hospital groups in the UAE rolled out FDA-authorized COVID-19 serology tests available to the public. Thus, the abovementioned factors had a positive impact on the market.

Middle East & Africa Blood Collection Devices Market: Competitive Landscape and Key Developments

Becton, Dickinson, and Company; SARSEDT AG & CO.KG; Thermo Fisher Scientific, Inc.; Cardinal Health; Greiner Bio-One International GmbH; Terumo Corporation, ICU Medical, Inc.; Grifols, S.A.; Fresenius Kabi AG; and F.L. Medical S.R.L are among the leading companies operating in the Middle East & Africa blood collection devices market. These players focus on expanding and diversifying their market presence by acquiring a novel customer base, thereby tapping prevailing business opportunities.