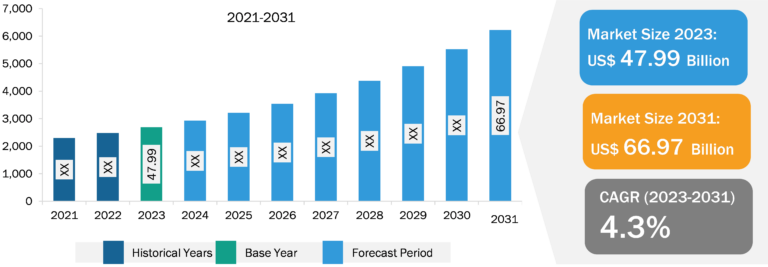

Offshore Oil and Gas Pipes, Fittings, and Flanges Market

Offshore oil and gas pipes, fittings, and flanges market analysis involves pipes, fittings, and flanges used in the fixed offshore rig platforms. Key driving factors for this market include high crude oil prices generating demand for efficient offshore rig operations and increasing focus on maximizing oil reserve recovery and extending field life. In addition, the increase in developments in the offshore oil & gas industry across regions such as South America, Asia Pacific, and the Middle East & Africa is expected to drive the market growth during the forecast period. However, the shift from fossil fuels to clean energy generation sources such as solar energy and wind energy to achieve sustainable power generation restrains the growth of the market.

Adoption of Efficient Oil Recovery Techniques

The crude oil extraction process involves three phases—primary, secondary, and tertiary [enhanced oil recovery (EOR)] recovery. As several oil fields have already been used up excessively for oil production, operators of these projects are focusing on tertiary or EOR stages that help extract 30–60% or more of a reservoir’s original oil output. Thermal EOR techniques have gained considerable traction in recent years. In April 2023, ONGC announced its investment of US$ 5 billion in developing the Cluster-II region of its flagship KG-DWN-98/2 asset in the Krishna Godavari basin offshore India’s Eastern Coast. Thus, the oil & gas industry is witnessing a trend of efficient oil extraction techniques, which is expected to support the growth of the offshore oil & gas pipes, fittings, and flanges market in the coming years.

Offshore Oil and Gas Pipes, Fittings, and Flanges Market Analysis: Material Type Overview

Based on material type, the global offshore oil and gas pipes, fittings, and flanges market is segmented into steel, steel alloy, nickel alloy, and copper alloy. Steel is the most widely used material in the oil & gas industry. In 2022, the steel segment dominated the global offshore oil & gas pipes fittings and flanges market, and it is expected to retain its dominance during the forecast period. This is because steel is the primary material used to enforce pipes for the oil & gas industry. Steel pipes also ensure the offshore supply channel to make a strong and efficient oil & gas rig infrastructure for efficient operations. Steel is mainly used for distribution pipes, allowing a better corrosion resistance capability for efficient transfer of oil & gas.

Alloy steel was the second most dominant segment in the global offshore oil & gas pipes, fittings, and flanges market in 2022, and it is expected to retain its dominance during the forecast period. The most popular alloy steel grades used in the oil & gas industry include 4130, 4145, 4330, 4340, and 8620. These different grades of alloy steel provide many properties required for various oil & gas rig operations. Moreover, steel-based pipes, fittings, and flanges manufacturers focus on developing new alloy steel-based products to understand market demands and cater to the growing market needs. Such factors drive the global offshore oil & gas pipes, fittings, and flanges market for the alloy steel segment.

Offshore Oil and Gas Pipes, Fittings, and Flanges Market: Competitive Landscape and Key Developments

US Metals Inc, Sumitomo Corporation, London Fittings and Flanges Ltd, American Piping Products Inc, Alliance Pipes & Fittings, AFG Holdings Inc, Flanschenwerk Bebitz GmbH, Kerkau Manufacturing Inc, SoluForce BV, and KME Germany GmbH are among the key offshore oil and gas pipes, fittings, and flanges market players profiled during this study. In addition, several other important offshore oil and gas pipes, fittings, and flanges market players have been studied and analyzed during the study to get a holistic view of the offshore oil and gas pipes, fittings, and flanges market and its ecosystem.

| Year | News | Country |

| 2023 | Vallourec won two major orders to supply line pipes for phases 6 and 8 of the Buzios oil field development operated by Petrobras. These orders, in addition to the contract previously won for phase 7, represent a total of 48,000 tons of line pipe. | Europe |

| 2023 | Corinth Pipeworks was awarded a contract by Snam to manufacture and supply ~13 km of longitudinally submerged arc-welded steel pipes (LSAW) for the development of an offshore and onshore natural gas pipeline for the Floating Storage and Regasification Unit (FSRU). The contract is valued at over USD 12 million. | Europe |