Industrial Control Panel Market

Supportive Government Standards and Regulations to Fuel Industrial Control Panel Market Growth During Forecast Period

Industrial control panels (ICPs) contain electrical and control devices. Because of the presence of different types of components, the companies have to follow several standards and regulations for ICP design, production, and installation. The ICPs must comply with the standards and regulations set by the government to ensure safety and performance. The NFPA 70, also known as the National Electrical Code (NEC), is issued by the National Fire Protection Association. This code regulates the safe installation of components and wiring for all residential, commercial, and industrial electrical systems. The NFPA70 standard is applied to electrical installations across the US, but it is adaptable to meet additional local regulations at the state level. Similarly, the UL60947-4-1 standard is for industrial control equipment. It is a result of the harmonization between IEC 60947-4-1 and UL 508 and is issued by Underwriters Laboratory. Previously, UL 508 was the key standard for control equipment in the US, but many industrial equipment categories have been superseded by UL 60947 in a multi-year phase-out program. Additionally, the NFPA 79 standard is also from the National Fire Protection Association. It helps delve deeper into wiring regulations for industrial machines, including control panels operating at 600 V or less. NFPA 79 also helps with the selection of wire sizes and provides guidelines for wiring installation, including the specifications for wire trays and conduits. This makes it a key standard for ICP design, considering that space is usually constrained due to the numerous devices installed inside. Such supportive standards and regulations by the government are driving the industrial control panel market.

Industrial Control Panel Market: Industry Overview

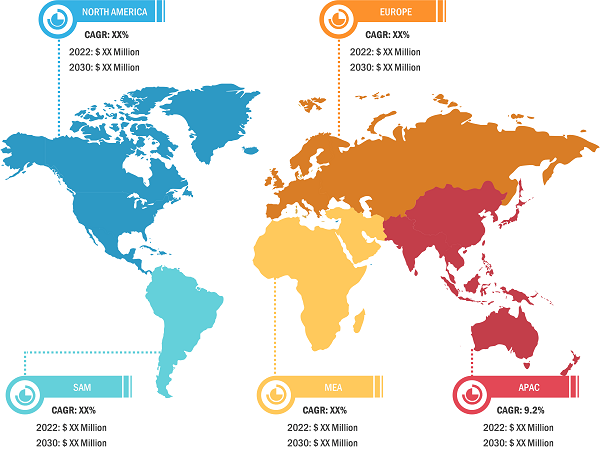

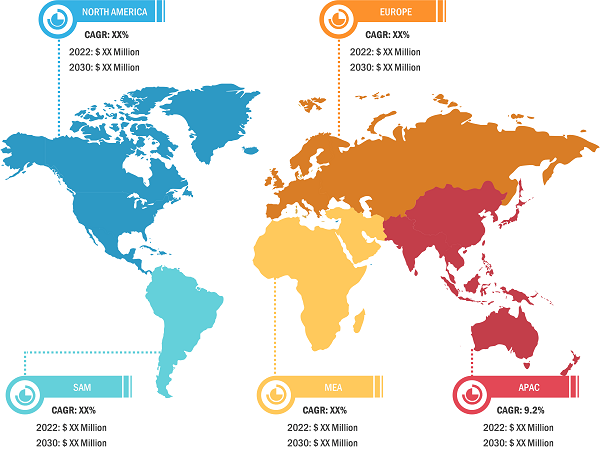

The industrial control panel market is categorized based on component, application, and geography. Based on component, the industrial control panel market is segmented into control devices, fused disconnect switches, motor controllers, circuit breakers, relays, and others. By application, the industrial control panel market is segmented into manufacturing, food and beverages, oil and gas, chemical industry, automotive, and others. The industrial control panel market, based on geography, is categorized into North America, Europe, Asia-Pacific, the Middle East & Africa, and South America.

In 2022, North America led the global industrial control panel market with a substantial revenue share, followed by Asia Pacific and Europe. The industrial control panel market in North America is segmented into the US, Canada, and Mexico. North America contributes a noteworthy share to the global industrial control panel market owing to growing investments by market players in the manufacturing sector. For instance, in August 2023, Eaton Corp Plc announced an investment of US$ 500 million in North America’s manufacturing sector to support energy transition, electrification, and digitalization across industries. These industries use industrial control panels to enhance their manufacturing processes’ precision, efficiency, and safety. These panels monitor pressure and temperature to maintain ideal electrical production and energy transition conditions.

For instance, in October 2022, Schneider Electric SE announced an investment of US$ 46 million in its Lexington, KY & Lincoln, and Nebraska manufacturing plants. The investment helped Schneider Electric SE modernize its operations by increasing circuit breakers and related electrical products output for its customers in the US and Canada. This investment also supports the company in strengthening its regional capability and increasing the manufacturing capacity of electrical products to attract a potential customer base in North America. The demand for electrical products among consumers increases the adoption of industrial control panels among electrical manufacturers for regulating and controlling machinery, equipment, and processes within the manufacturing plant, which is driving the market in the country. Moreover, the expansion of the electrical & electronics industry creates a demand for industrial control panels among manufacturers in North America. Industrial control panels are equipped with PLCs to automate the manufacturing processes, minimize the risk of errors, and reduce human intervention by improving production efficiency, which increases their demand in the manufacturing industry.

The automotive industry in the US, Canada, and Mexico is also rising rapidly due to the growing demand for passenger vehicles among consumers. The presence of key automotive manufacturers, including BMW, General Motors, Toyota, Audi, Ford, and Honda, increases the adoption of industrial control panels by these players to streamline their production processes. Automotive manufacturers are highly demanding industrial control panels for monitoring and inspecting the quality of products. However, a significant demand-supply gap still needs to be filled, which is expected to create growth opportunities for vendors operating in the market.

Industrial Control Panel Market: Competitive Landscape and Key Developments

ABB, Bectrol, Eaton, Siemens, Omron Corporation, Rockwell Automation, Rittal GmbH & Co. KG, Schneider Electric, Franzosi s.n.c., CETAL S.A.S. are among the leading market players profiled in the industrial control panel market report. Several other essential market players were analyzed for a holistic view of the market and its ecosystem. The report provides detailed market insights, which help the key players strategize their market growth. A few developments are mentioned below:

- In July 2023, ABB launched ABB Ability Symphony Plus distributed control system to support digital transformation in power generation and water industries. The latest version of Symphony Plus will further support customers’ digital journey through a simplified and secure OPC UA1 connection to the Edge and Cloud without interfering with core control and automation functionalities.

- In January 2023, SWTCH Energy, an electric vehicle (EV) charging solutions provider for multi-tenant properties across North America, announced its partnership with Bectrol, a Québec-based integrator of EV chargers and provider of industrial automation, distribution, and manufacturing of control panels.