Medical Ultrasound Flow Meter Market

Developments by Companies Create Opportunities for Medical Ultrasound Flow Meter Market

Companies operating in the medical ultrasound flow meter market constantly focus on new product launches and expansion to improve their sales. A few noteworthy developments in the medical ultrasound flow meter market are mentioned below:

• In February 2024, Sensirion Holding AG announced that its production facility in Debrecen, Hungary, would expand shortly. With the help of a build-to-suit partner, the facility added an area of 5,000 m2 to its production site. It is anticipated that the first phase of the production facility expansion will be completed by the fourth quarter of 2024 and the second phase by the first quarter of 2025. Improving the production facility will enable the business to provide its clients with high-quality sensor modules.

• In May 2023, ultrasonic specialist SONOTEC enhanced its SONOFLOW CO.55 non-contact flow meter to increase the efficiency throughout PAT-related upstream and downstream processes in biotechnology applications. The new SONOFLOW CO.55 V3.0 sensor combines better measurement performance and the highest clamp-to-clamp repeatability. The development of the new sensor generation is focused on major requirements in the biotech industry to introduce the right product features to the market.

• In April 2021, NovaSignal Corp. launched the NovaGuide 2 Platform that provides clinical teams with critical, real-time information about cerebral blood flow to guide diagnosis and advance patient results. The device is intended to integrate into current clinical practice; the platform contains the NovaGuide 2 Intelligent Ultrasound. The device autonomously captures blood flow data to identify brain illnesses and diseases. The NovaGuide View implements secure, cloud-based access to efficiently examine the data.

Thus, developments in ultrasound flow meters are anticipated to create opportunities for the market growth during the forecast period.

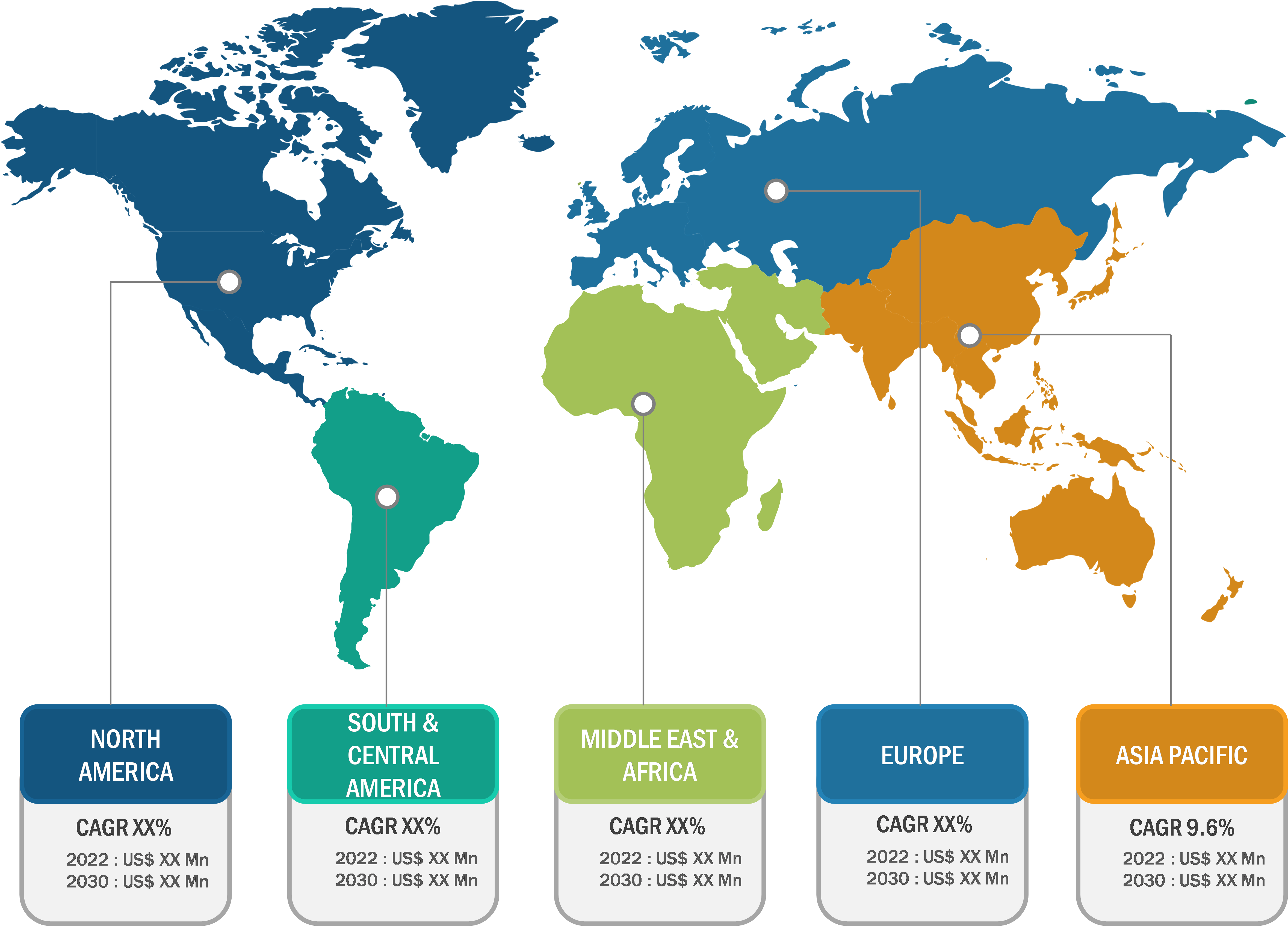

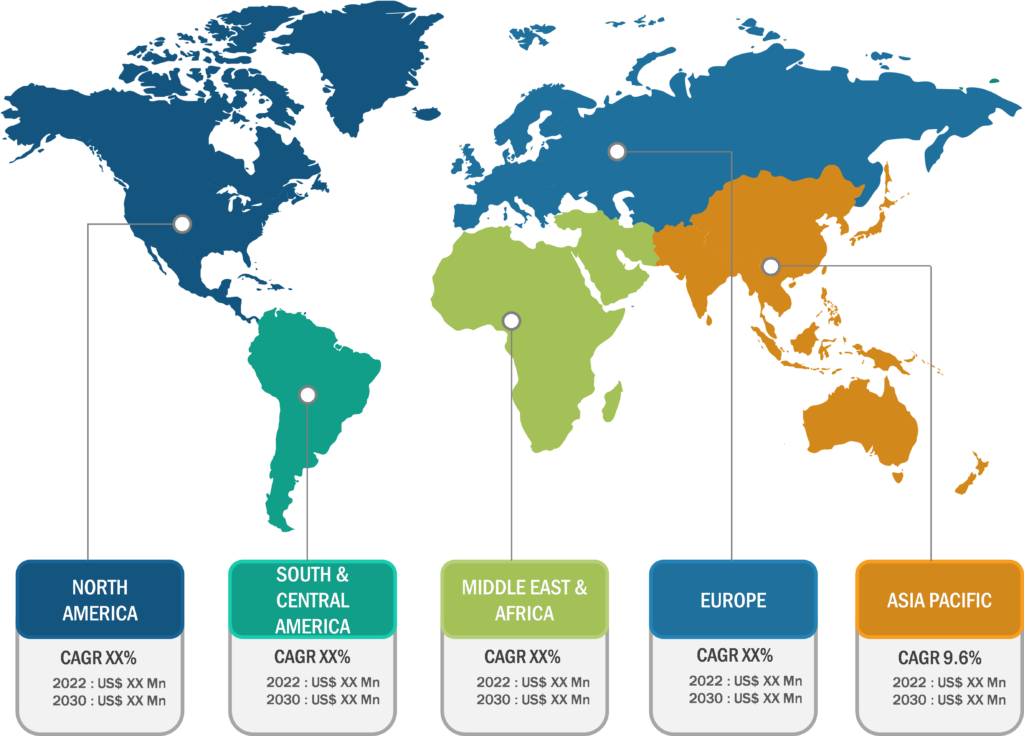

Medical Ultrasound Flow Meter Market: Regional Overview

Geographically, the medical ultrasound flow meter market is segmented into North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In 2022, North America held the largest market share. The market growth in this region is driven by rising prevalence of cardiovascular diseases and respiratory diseases and growing strategic developments by market players.

The medical ultrasound flow meter market growth in the US is further fueled by increasing chronic kidney diseases and growing aging population. According to the National Chronic Kidney Disease fact sheet, in 2020, approximately 30 million people suffered from chronic kidney diseases in the US. Moreover, as per the National Institute of Diabetes and Digestive and Kidney Diseases, in 2019, ~661,000 Americans suffered from kidney failure, of which 468,000 patients underwent dialysis, and 193,000 have undergone kidney transplantation.

According to the American Heart Association, in January 2019, it was reported that by 2035, over 130 million, or 45.1% of people, are likely to suffer from some form of cardiovascular disease. Therefore, the growing incidence of chronic and cardiovascular diseases is upsurging the demand for extracorporeal membrane oxygenation (ECMO) and organ transportation systems.

The medical ultrasound flow meter market in Asia Pacific is expected to register the highest CAGR during the forecast period. Market growth in the region is attributed to strategic initiatives by the key players and increasing availability of advanced products, growing awareness, increasing number of organ donations, and rising incidence of chronic diseases leading to a higher risk of organ failure. Furthermore, favorable government initiatives are anticipated to strengthen the market. For instance, in June 2021, the Chinese government announced the amendment of organ transplantation regulations in the 2021 legislation plan, which boosted organ transplantation development. The National Health Commission carried out a two-year special campaign from October 2020 to October 2022 to renovate and improve organ donation and transplantation work in China. Thus, owing to the factors mentioned above, the medical ultrasound flow meter market is likely to witness remarkable growth in China during the forecast period.

Medical Ultrasound Flow Meter Market: Competitive Landscape and Key Developments

Apart from factors driving the market, the medical ultrasound flow meter marketreport emphasizes prominent players operating in the market; these include Arjo AB, PSG Dover, Moor Instruments Ltd, Transonic Systems Inc, Compumedics Ltd, Cook Medical, Holdings LLC, GF Health Products Inc, Sonotec Gmbh, Deltex Medical Ltd, Strain Measurement Devices Inc, Siemens AG, Perimed AB, and Sensirion Holding AG. Market players focus on expanding and diversifying their businesses and acquiring novel customer bases, which allows them to explore attractive business opportunities prevailing in the medical ultrasound flow meter market. As per company press releases, a few recent developments are as follows:

• In April 2023, Sonotec GmbH presented SONOTEC with new sensor sizes to cover a wider range of biopharmaceutical applications. The new flow meter series sets a new standard in non-contact flow measurement.

• In June 2022, Sonotec GmbH enhanced its SONOFLOW CO.55 non-contact flow meter to increase the efficiency across PAT-related upstream and downstream processes in biotechnology applications. The new SONOFLOW CO.55 V3.0 sensor combines outstanding measurement accuracy and the highest clamp-to-clamp repeatability.