Lithium Carbonate Market

Lithium carbonate is produced from several sources, such as ore and brines. Industrial-grade lithium carbonate undergoes carbonization, resulting in lithium bicarbonate. Lithium carbonate is used significantly in battery production for enhancing energy density, lifespan, and rechargeability. There are several ongoing research and development activities aimed at optimizing the use of lithium carbonate in energy storage systems. Lithium carbonate is used in the production of two major battery compounds, namely, lithium hexafluorophosphate and lithium cobalt oxide.

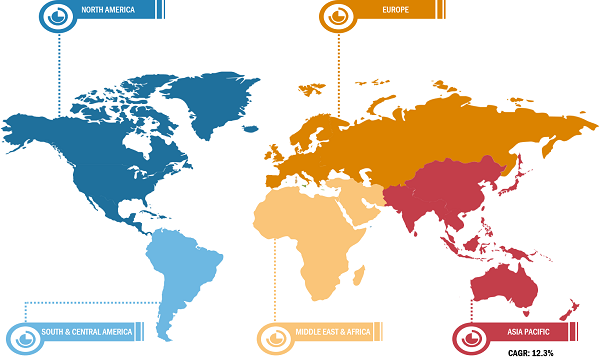

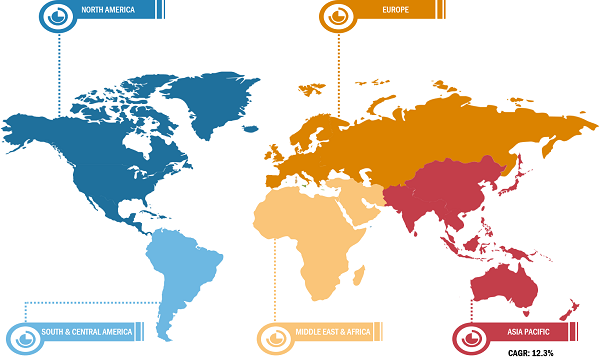

In 2022, Asia Pacific dominated the global lithium carbonate market. The strong presence of the automotive industry drives the market growth in Asia Pacific. Asia Pacific is a hub for automotive manufacturing as well as marks a major presence of lithium-ion battery producers. Lithium carbonate is used in the production of cathode materials and other battery materials. Lithium-ion batteries are used in many electric vehicles, as these batteries offer high energy per unit mass compared to other energy storage systems. According to a report published by the China Passenger Car Association, Tesla Inc delivered 83,135 made-in-China electric vehicles in 2022, indicating growth in sales of electric vehicles compared to 2021. According to the 2022 report by the International Energy Agency, China recorded electric vehicle sales of 3.3 million in 2021. Further, global expenditure on electric cars increased by 50% in 2022 compared to 2021. In 2022, China accounted for 2/3rd of the global stock of public chargers.

Rising Production of Lithium-Ion Batteries

Lithium-ion batteries are used in many consumer electronics, such as laptops and mobiles, as these batteries have high energy efficiency, high-temperature performance, and low self-discharge. Lithium-ion batteries are used in the majority of electric vehicles and plug-in hybrid vehicles. Battery-grade lithium carbonate is used for the production of Li-ion battery precursors and portable electronics. Lithium carbonate is also utilized in lithium-iron-phosphate batteries and the production of cathode materials, lithium metal, and electrolyte additives. As per the International Energy Agency, electric vehicle and battery producers declared investments of US$ 52 billion in the North America electric vehicle supply chain, of which battery production accounted for 50%, whereas battery components and electric vehicle production accounted for 20% each, in the US, during 2022–2023. Almost 2.7 million public charging points were installed globally by the end of 2022. There were ~540,000 total public chargers in Europe in 2022, a 50% rise from 2021. Thus, the rising production of lithium-ion batteries is expected to fuel the lithium carbonate market.

Lithium Carbonate Market: Segmental Overview

Based on grade, the lithium carbonate market is segmented into industrial grade, pharmaceutical grade, and battery grade. In 2022, the battery grade segment held the largest market share; it is expected to record the highest CAGR from 2022 to 2030. Battery-grade lithium carbonate is utilized for lithium-ion battery production and battery materials such as lithium cobalt oxide, lithium iron phosphate, and lithium manganate oxide. It has a purity of 99.5% and is used as a precursor in the production of critical battery materials.

Based on application, the lithium carbonate market is segmented into batteries, ceramic and glass production, lubricants, pharmaceuticals, metallurgy, and others. The batteries segment held the largest lithium carbonate market share in 2022. Lithium carbonate is a major component for the production of cathodes in lithium-ion batteries, such as lithium iron phosphate, lithium cobalt oxide, and lithium manganese oxide. Rising sales of electric vehicles are driving the demand for lithium-ion batteries, thereby fostering the lithium carbonate market. The high adoption rate of electric vehicles is further driving the demand for batteries.

Impact of COVID-19 Pandemic on Lithium Carbonate Market

Before the COVID-19 pandemic, many countries reported economic growth, whereas lithium carbonate manufacturers invested in research to develop advanced technology and enhance production efficiency. The chemical & materials industry announced a slowdown of manufacturing operations and shutdown, as well as projected a slump in lithium carbonate sales. Thus, major companies involved in lithium carbonate production were severely affected during the initial phase of the pandemic due to sudden government restrictions on the manufacturing of nonessential commodities. Battery manufacturers in the major electric vehicle markets, such as the US, Germany, and Australia, are highly impacted by the raw material production in China and other Asian countries.

Lockdowns imposed by governments of different countries in 2020 hampered the ability of industries to maintain inventory levels. Further, government restrictions and other COVID-19 precautions reduced the production capacities of stakeholders involved in the lithium carbonate ecosystem. In 2021, several electric vehicle manufacturers and ceramic producers began recovering from the losses incurred in 2020 with the revival of production operations. Manufacturers were permitted to operate at full capacities, which helped them cope with the demand-supply gap. With economies reviving their operations, the demand for lithium carbonate started rising globally as the automotive industry resumed its operations at full capacity.

Lithium Carbonate Market: Competitive Landscape and Key Developments

Albemarle Corporation, SQM SA, Targray, Noah Chemicals, Livent, Imerys, Tianqi Lithium, Alfa Aesar, Otto Chemie Pvt Ltd, and Celtic Chemicals Ltd are a few players operating in the global lithium carbonate market. Players operating in the global lithium carbonate market focus on providing high-quality products to fulfill customer demand.

Key Developments

- In August 2023, E3 Lithium produced the first lithium carbonate from its resources in the US. Further, testing was conducted to treat a concentrated sample produced by the direct lithium extraction technology.

- In February 2023, Livent Corporation reported the first 10,000 metric ton expansion of lithium carbonate in Argentina.

- In April 2022, SQM invested US$ 900 million for the expansion of lithium carbonate capacity to ~180 thousand metric ton per year.