Private 5G Networks Market

Rising Digitalization Across Enterprises to Fuel Private 5G Networks Market Growth During Forecast Period

Enterprise digitalization is the process of transforming businesses using digital technologies. Enterprise digitalization has surged the demand for solutions in the private 5G networks market. As businesses become more digitalized, they need faster, more reliable, and more secure connectivity to support their operations. Private 5G networks can meet these needs by providing dedicated bandwidth, low latency, and high QoS. Moreover, enterprise digitalization is also leading to new business models for private 5G networks. For example, several vendors are offering managed private 5G services, which allows businesses to deploy and manage private 5G networks without having to invest in their infrastructure. For instance, AT&T provides a 5G enterprise solution that promises to deliver broadband speeds over wireless and cellular networks to unlock new opportunities previously constrained by wired, bandwidth, and transmission limitations.

Several market players are also taking initiatives to stay competitive in the market. For instance, in 2023, Nokia partnered with DXC technology to launch DXC signal private LTE and 5G solutions. Nokia and DXC Technology, one of the leading Fortune 500 global technology services companies, announced the availability of DXC Signal Private LTE and 5G, a managed secure private wireless network and digitalization platform solution that helps industrial enterprises digitally transform their operations. Additionally, Nokia announced that it has entered into a partnership with NTT Ltd. to make private wireless networking solutions available to more than 3.2 million enterprises across Thailand, accelerating a digital transformation that will drive measurable increases in productivity, operational efficiency, and worker safety. Deployed at multiple enterprise business parks across Thailand, Nokia 5G private wireless solutions is projected to revolutionize business-critical applications and use cases across sectors vital to the nation’s economy including manufacturing, mining, healthcare, and education. Therefore, the increasing requirement for IoT is creating a strong demand for private 5G networks. Private 5G networks can offer the bandwidth, latency, reliability, and security that IoT applications require. As a result, the private 5G network market is growing significantly.

Private 5G Networks Market: Industry Overview

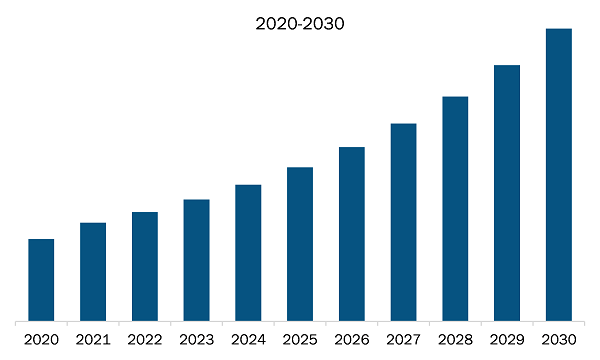

The Private 5G Networks market is categorized on the basis of component, frequency, end user, and geography. Based on component, the Private 5G Networks market is segmented into hardware, software, and services. By frequency, the private 5G networks market is segmented into Sub-6 Ghz and mmWave. Based on end user, the private 5G networks market is categorized into manufacturing, energy and utilities, automotive, military and defense, government and public safety, and others. The Private 5G Networks market, based on geography, is categorized into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

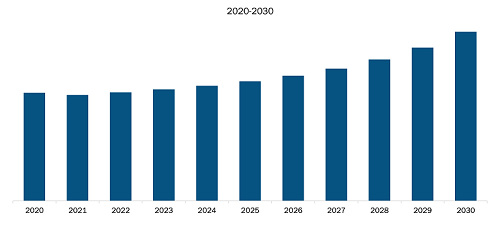

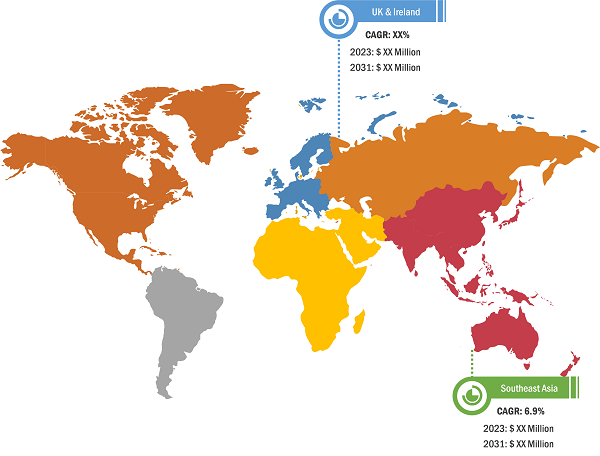

In 2022, Europe led the global Private 5G Networks market with a substantial revenue share, followed by North America and Asia Pacific. The Private 5G Networks market in Europe is segmented into Germany, France, Italy, the UK, Spain, and the Rest of Europe. In Europe, businesses in a variety of industries—such as manufacturing, logistics, and healthcare—are increasingly demanding high-speed, low-latency connectivity to support their operations. Private 5G networks can provide these capabilities, making them an attractive option for businesses. Additionally, the European government is investing in the private 5G network. For instance, in March 2023, the Spanish Ministry launched several tenders with a total value of US$ 53.3 million.

On the contrary, according to local media, the Spanish Ministry of Defense is looking to build private 5G networks for the military. The largest tender is for a project to create a testing and training hub to provide military cyber protection training. The second tender is for the establishment of two private 5G standalone networks for two military installations in Madrid.

A total of US$ 21.3 million will be granted to initiatives in healthcare, emergency services, logistics, and defense. In March 2023, Orange was announced as the winner of the Belgian government’s 5G pilot project tender. It was chosen to carry out a total of 12 of these projects. In addition, Citymesh, a private networking provider, was awarded five projects. The government said that the country suffered from a slower 5G rollout than most other EU countries and that the projects would accelerate 5G innovation in Belgium. The project call was first launched in July 2022. Therefore, the private 5G network market in Europe is expected to experience significant growth in the coming years, driven by the increasing demand for high-speed, low-latency connectivity, the growing need for security and privacy, and the increasing availability of spectrum.

Private 5G Networks Market: Competitive Landscape and Key Developments

AT&T Inc; Broadcom Inc; Cisco Systems Inc; Huawei Technologies Co., Ltd.; Nokia Corporation; Qualcomm Technologies Inc.; Telefonaktiebolaget LM Ericsson; T-Systems International GmbH; Verizon Communications; and Vodafone Ltd are among the leading market players profiled in the Private 5G Networks market report. Several other essential market players were analyzed for a holistic view of the market and its ecosystem. The report provides detailed market insights, which help the key players strategize their market growth. A few developments are mentioned below:

- In September 2023, 5G Open Innovation Lab (5G OI Lab) announced that international telecommunication leaders AT&T and Comcast have joined its innovation ecosystem. The Lab also announced that its Batch 8 cohort–its largest to date with over US$ 313 million in venture capital raised and 17 multi-stage start-ups embarking on 5G OI Lab’s Fall program. The Lab has established itself as an ecosystem leader since its inaugural Batch #1 launch in May 2020, becoming a destination for innovative global start-ups, technology platforms, integration, and enterprises.

- In April 2023, AT&T Mexico added new allies to their 5G Innovation Lab to develop use cases for Private Networks. In Alliance with Qualcomm, Celona, Axity, and Veea, the company has started technological testing private networks within the 5G Innovation Lab that AT&T has located in Mexico City.