Human Vaccine Adjuvants Market

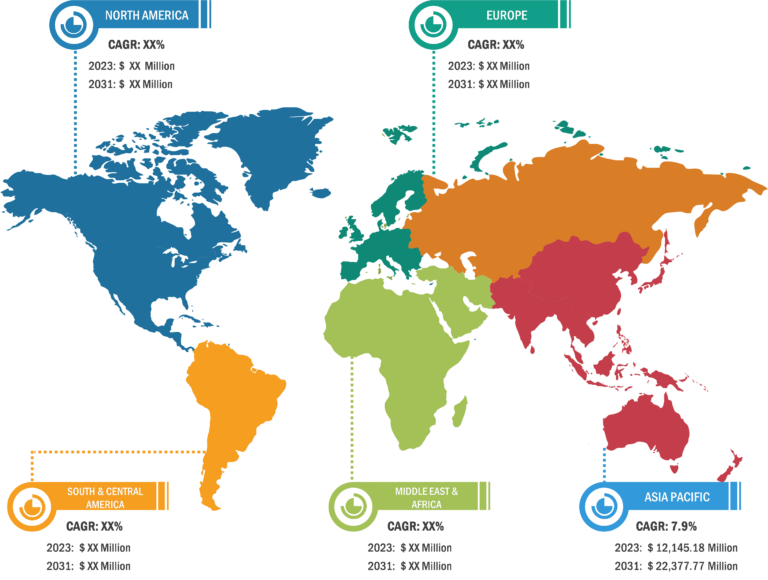

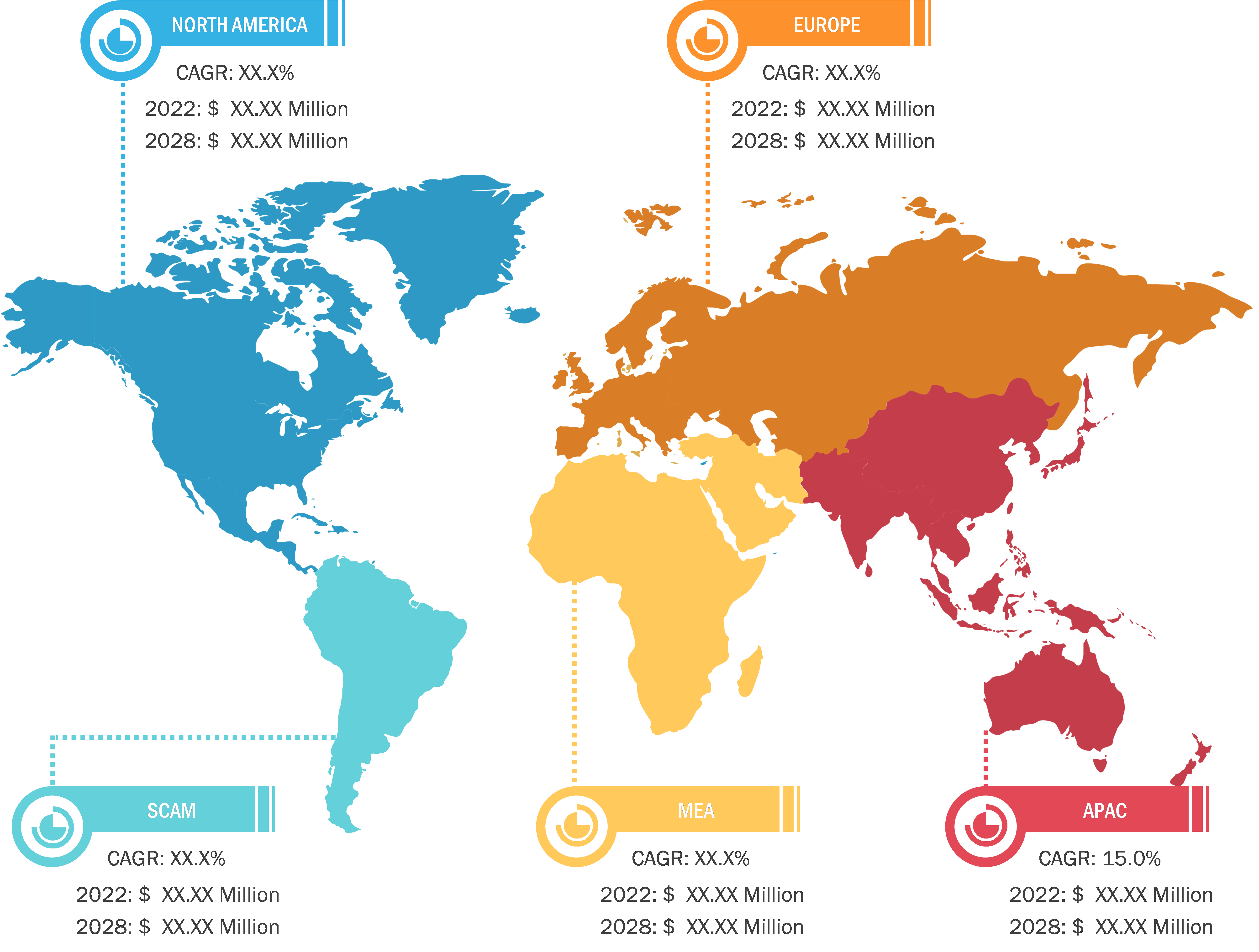

North America accounted for the largest share of the global human vaccine adjuvants market in 2022, and Asia Pacific is expected to record the highest CAGR during 2022–2030. The US held the largest share of the human vaccine adjuvants market in North America. The US holds a significant share of the human vaccine adjuvants market in North America. The market growth in this country is mainly ascribed to rising government spending on healthcare and a surging demand for novel vaccine formulations to treat infectious diseases more efficiently. According to the US Centers for Medicare & Medicaid Services, national healthcare expenditures in the US increased by 2.7% in 2021, reaching US$ 4.3 trillion or US$ 12,914 per person. Health spending accounted for 18.3% of the nation’s GDP. As per the US Department of Health & Human Services, national health spending is expected to grow at an annual rate of 5.4% from 2019–2028, reaching US$ 6.2 trillion by 2028. The rising health expenditure may lead to a rise in funds allocation for the research and development of vaccines, fueling the demand for human vaccine adjuvants.

According to new findings derived from the Global Burden of Disease study published in July 2020, there is a large and increasing burden of noncommunicable and infectious diseases in the US. According to Johns Hopkins University, the cases of diseases such as SARS, Lyme disease, dengue fever, West Nile virus, and Zika virus infection have increased rapidly in the last two decades in the US. Also, the same source affirmed an increase in the incidence of re-emerging diseases such as malaria, tuberculosis, cholera, pertussis, influenza, pneumococcal disease, and gonorrhea. Similarly, according to the Centers for Disease Control and Prevention (CDC), flu has resulted in 100,000 to 710,000 hospitalizations and 4,900 to 52,000 deaths annually between 2010 and 2022. According to a report by ICO/IARC Information Centre on HPV and Cancer in 2023, the US has a population of 140.5 million women aged 15 years and older who are at risk of developing HPV-related cervical cancer. Nearly 3.9% of women in the US in the general population are projected to harbor cervical HPV16/18 infection at a given time, and 71.2% of invasive cervical cancers are attributed to HPVs 16 or 18. Thus, a rise in the incidences of various infections and re-emerging diseases boosts companies’ efforts in vaccine development, fueling the human vaccine adjuvants market growth in the US.

The US government strives to create a conducive environment for developing and commercializing pharmaceutical and healthcare products in the country. The country has several potential pharmaceutical and medical device market players, including Pfizer, Novartis, Boston Scientific, Integra LifeSciences, Amgen, and Abbott, with various patents for their pharmaceutical and medical device industry innovations. Thus, an increase in drug development activities by various pharmaceutical giants bolsters the human vaccine adjuvants market in the US.

Growing Focus on Immunization Programs Drives Human Vaccine Adjuvants Market Growth

Governments of several nations recognize the importance of vaccination as a cost-effective strategy to prevent and control chronic diseases. According to the WHO, immunization currently prevents 3.5–5 million deaths yearly from diseases such as diphtheria, tetanus, pertussis, influenza, and measles. As a result, governments in various nations are implementing immunization programs to reduce the incidence of diseases such as cancer, diabetes, cardiovascular diseases, and respiratory diseases. These programs often target specific populations, such as children, older people, and high-risk individuals, to ensure they are adequately protected against these chronic conditions. The US, India, and Australia are among the key prominent nations that have effective immunization programs. For example, the US has the Vaccines for Children (VFC) program, which became operational in 1994 and is funded by the federal government. Similarly, India has the Universal Immunization Programme (UIP), which targets immunization of 26.7 million newborns and 29 million pregnant women annually. The United Nations International Children’s Emergency Fund (UNICEF) also offers an immunization program that provides vaccines to protect children from life-threatening diseases globally.

Governments are also investing in public awareness campaigns to promote the benefits of vaccination and encourage individuals to get vaccinated. For instance, the US Department of Health & Human Services started National Immunization Awareness Month (NIAM) in August every year to highlight the importance of routine vaccination for people of all ages. Similarly, in collaboration with member nations, Gavi (a vaccine alliance), UNICEF, and other global immunization partners, WHO launched “The Big Catch-up” in 2023, a global vaccination drive to support efforts to catch up, restore, and improve routine immunization globally. These campaigns aim to increase vaccination coverage rates and reduce the spread of infectious diseases that can exacerbate chronic conditions. As a result, there is a growing demand for vaccines and adjuvants that can enhance the immune response and provide long-lasting protection against these diseases. Thus, all these factors boost the growth of the human vaccine adjuvants market.

Human Vaccine Adjuvants Market: Segmental Overview

The global human vaccine adjuvants market is segmented on the basis of type, application, and end user.

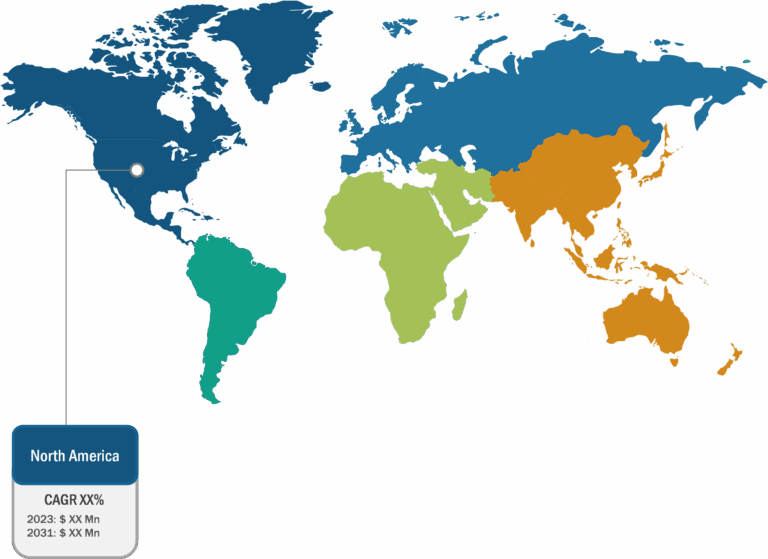

Based on type, the human vaccine adjuvants market is segmented into particulate adjuvants, emulsion adjuvants, combination adjuvants, and others. The particulate adjuvant segment held a larger share of the market in 2022. However, the emulsion adjuvants segment is expected to register a higher CAGR in the market from 2022 to 2030.

By application, the human vaccine adjuvants market is segmented into influenza, hepatitis, human papillomavirus (HPV), and others. The influenza segment held the largest share of the market in 2022 and is expected to register the highest CAGR in the market from 2022 to 2030.

In terms of end user, the human vaccine adjuvants market is segmented into pharmaceutical and biotechnology companies, CMOs and CROs, and others. The pharmaceutical and biotechnology companies segment held the largest share of the market in 2022 and is expected to register the highest CAGR in the market from 2022 to 2030.

Human Vaccine Adjuvants Market: Competitive Landscape and Key Developments

Novartis AG, Dynavax Technologies Corp, CSL Ltd, Seppic SA, SPI Pharma Inc, Hawaii Biotech Inc, Croda International Plc, Novavax Inc, Phibro Animal Health Corp, and Creative Biolabs Inc are a few key companies operating in the human vaccine adjuvants market. These companies adopt product innovation strategies to meet evolving customer demands, which allows them to maintain their brand name in the human vaccine adjuvants market.

A few of the recent developments in the global human vaccine adjuvants market are mentioned below:

- In December 2023, Health Canada approved a supplement to a New Drug Submission for Novavax Inc’s Nuvaxovid as a primary series of two doses for adolescents aged 12 to 17 years.

- In November 2023, Seppic launched MONTANIDE GEL P PR, an aqueous adjuvant based on a polymeric technology exclusively dedicated to avian injectable vaccines, meeting the need for innocuity in the avian market. In addition, MONTANIDE GEL P PR is particularly stable and can resist destabilizing antigenic media frequently used in avian vaccines.

- In October 2023, SPI Pharma Inc. and Q-Vant Biosciences Inc. announced a partnership that combines Q-Vant’s leadership in sustainable saponin extraction technology with SPI’s global reach and servicing expertise in the pharmaceutical industry. The arrangement includes investment in the expansion of Q-Vant’s proprietary 100% sustainable Q-SAP technology and an exclusive commercial agreement to accelerate the global adoption of their saponin adjuvants for veterinary and human vaccine formulations.

- In January 2023, Novavax Inc. partner SK Bioscience received expanded manufacturing and marketing approval from the Korean Ministry of Food and Drug Safety (“KMFDS”) for Nuvaxovid for use as a booster in adults aged 18 and older.