Lab Automation Market

Asia Pacific is the fastest-growing market for lab automation. North America accounted for the largest share of the global lab automation market in 2022. The US held the largest lab automation market share in the region in 2022 and is estimated to continue its dominance from 2022 to 2030. The developments in medical infrastructure and the increased expenditure on healthcare services across the US are driving the laboratory automation market in the country. The use of laboratory automation in clinical trials, drug development, and biomedical research has substantially impacted market growth. These systems can also run for long periods of time with little supervision and direction, allowing researchers to focus on their primary work and spend less time on repetitive activities. Additionally, the Centers for Medicare & Medicaid Services (CMS) in the United States has adopted standards associated with human laboratory research under the Clinical Laboratory Improvement Amendments (CLIA), which has enhanced the market growth.

Growing Pharmaceutical Industry Drives Lab Automation Market Growth

The expanding pharmaceutical industry will influence the demand for extensive research and laboratory automation. The US is the major shareholder in pharmaceutical production globally. According to the European Federation of Pharmaceutical Industries and Associations (EFPIA), North America (the US and Canada) remained the world’s largest market with a 49.1% share, well ahead of Europe, China, and Japan. Additionally, as per EFPIA, North America accounted for 49.1% of global pharmaceutical sales in 2021, compared with 23.4% for Europe.

Similarly, according to the EFPIA, the Brazilian, Chinese, and Indian pharmaceutical industries grew by 11.7%, 6.7%, and 11.8% during 2016–2021, respectively, compared to the top five European Union markets and the US market, which recorded an average market growth of 5.8% and 5.6%, respectively. Furthermore, as per the India Brand Equity Foundation (IBEF), India is a major and rising global pharmaceutical industry player. The country is the world’s largest trader of generic medications, accounting for nearly 20% of the worldwide supply by volume. It supplies ~50% of the global vaccination demand. The domestic pharmaceutical industry includes a network of 3,000 drug companies and ~10,500 manufacturing units. Based on official figures from the Indian government, the pharmaceutical sector in India is valued at nearly US$ 50 billion, of which over US$ 25 billion is derived from exports. India accounts for ~20% of the world’s generic medicine exports.

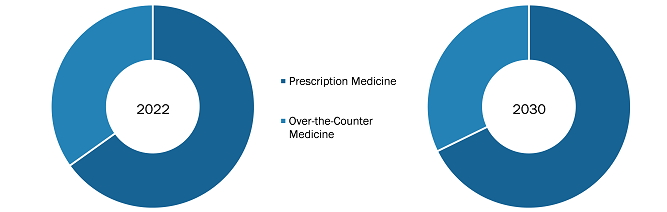

Japan is one of the largest pharmaceutical markets in the world. According to the Ministry of Health, Labor and Welfare’s (MHLW) Annual Pharmaceutical Production Statistics, the Japanese market for prescription and nonprescription pharmaceuticals in 2020 was US$ 107 billion. Therefore, as the industry continues to evolve and innovate, there is an increase in extensive research and development, which drives significant growth and investment in lab automation to reduce errors and improve efficiency. Thus, the growing pharmaceutical industry worldwide will provide lucrative growth for the global lab automation market in the coming years.

Limited Adoption of Lab Automation Due to High Capital Investment Hampers Lab Automation Market Growth

Various companies, notably in the biotechnology and pharmaceutical industries, experience significant problems adopting laboratory automation due to high capital expenditure. While laboratory automation provides various benefits, such as higher efficiency, accuracy, and throughput, the initial cost of deploying automation systems can be unaffordable for certain businesses. Various factors contribute to the high capital investment required for laboratory automation, such as equipment costs, infrastructure requirements, integration and customization, maintenance and support, high expertise requirements, and risk of technology obsolescence. For instance, according to Retisoft Inc., the price range for a small automated robot system is between US$ 100,000 and US$ 300,000. However, more complicated and large lab automation systems can often cost over US$ 1 million. Thus, the high capital investment required for laboratory automation can hinder the adoption of lab automation by many biotechnology and pharmaceutical companies, especially smaller or emerging organizations with limited financial resources. Thus, the abovementioned factors are likely to hamper the growth of the global lab automation market.

Lab Automation Market: Segmental Overview

Based on product, the lab automation market is bifurcated into equipment and software. The equipment segment held a larger market share in 2022. However, the software segment is anticipated to register a higher CAGR during 2022–2030.

Based on equipment, the market is subsegmented into automated workstations, liquid handling systems, robotic systems, microplate readers, automated storage and retrieval systems (ASRS), and others.

Based on application, the lab automation market is differentiated into clinical diagnostics, drug discovery, proteomics solutions, genomics solutions, and others. The drug discovery segment held the largest market share in 2022, and the clinical diagnostics segment is anticipated to register the highest CAGR from 2022 to 2030.

Based on end user, the market is segmented into pharmaceutical companies, hospitals and diagnostic centers, educational and research institutions, and contract research organizations. In 2022, the pharmaceutical companies segment held the largest market share, and the hospitals and diagnostic centers segment is anticipated to register the highest CAGR during 2022–2030.

The lab automation market, based on geography, is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Lab Automation Market: Competitive Landscape and Key Developments

Siemens Healthineers, Thermo Fisher Scientific Inc, Analytik Jena GmbH+Co. KG, Labman Automation Ltd, BD, Brooks Automation Inc, bioMerieux SA, CrelioHealth Inc., Danaher Corporation, and F. Hoffmann-La Roche Ltd are a few key companies operating in the lab automation market. These companies adopt product innovation strategies to meet evolving customer demands, which allows them to maintain their brand name in the lab automation market.

A few of the recent developments in the global lab automation market are mentioned below:

- In May 2023, Opentrons announced the launch of the Opentrons Flex robot, an innovative class of reasonably priced, easily programmable liquid-handling lab robots that will level the playing field for labs of all sizes and make advanced lab automation accessible to more researchers than ever. The Flex robot combines cutting-edge robotics with a vast open-source software ecosystem. It can be used with AI tools and has a nearly limitless capability for selecting new protocols.

- In March 2023, Brooks Automation US, LLC announced the acquisition of Aim Lab Automation Technologies Pty Ltd. Brooks’s acquisition of Aim Lab aligns with the company’s expansion plan to offer more solutions in the lab automation market. With its PreciseFlex product solutions, Brooks leads the life sciences collaborative automation market. Brooks’ position in clinical diagnostics has increased beyond drug discovery with this acquisition. With PreciseFlex, Aim Lab will provide its clients with more capabilities, a global footprint, and opportunities to work together more closely.

- In February 2023, Automata launched LINQ, a new open, integrated laboratory automation platform. The LINQ platform includes an exclusive lab bench with built-in automation tools and strong, in-house lab orchestration software. As a result, labs may simply boost efficiency and accuracy while reducing the number of human touchpoints without adding more space for large, complicated equipment.

- In January 2023, BD (Becton, Dickinson and Company) launched a robotic track system for the BD Kiestra microbiology laboratory solution. This system automates lab specimen processing, potentially minimizing human labor and resulting in fewer wait times. With the new BD Kiestra 3rd Generation Total Lab Automation System, laboratories can link various BD Kiestra modules to build a unique and adaptable total lab automation configuration. It is also scalable to accommodate the changing needs of labs. By selecting from various track configurations and machines, labs can customize the automation system to match their unique workflow and physical lab space.

- In June 2022, Insilico Medicine launched an AI-run robotics lab. It is a real-world, interconnected expansion of Insilico’s end-to-end AI-driven drug discovery platform. It will be remotely controlled by its AI system, with autonomous guided vehicles running experiments instead of human scientists. These robots will make cell culture, high throughput screening, next-generation sequencing, cell imaging, and genomics analysis and prediction.