Hydrogen Compressors Market

Energy consumption has risen significantly with rapid urbanization and industrial growth. To meet the growing demand for power, the development of sub-transmission and intrastate transmission networks is expanding. With the rise in new power transmission projects, the deployment of hydrogen compressors is also increasing. Renewable energy plays a significant role in generating electricity to cater to the increasing demand for energy. As per the International Energy Agency (IEA), the demand for electricity is projected to expand at 2.1% per year by 2040 worldwide. The rising requirement for electricity in Southeast Asia is among the fastest in the globe; it shows great potential for the growth of the renewable energy sector. Moreover, in APAC, India is the third largest producer of electricity, and the generating capacity is exponentially expanding owing to favorable government support and the initiation of numerous power generation projects. For instance, the Khargone Transmission Project was initiated to connect NTPC’s 1,320 MW thermal power project at Khandwa in Madhya Pradesh with a transmission system to serve Maharashtra and southern states in India. Therefore, the rising investments in the energy & power industry are expected to create huge opportunities for the hydrogen compressors market growth during the forecast period.

The growth in electricity demand is higher in Asia Pacific countries such as China, Japan, and India. In APAC, India is the third largest producer of electricity, generating higher capacity with favorable government support and the initiation of numerous power generation projects. For instance, the Khargone Transmission Project was initiated to connect NTPC’s 1,320 MW thermal power project at Khandwa in Madhya Pradesh with a transmission system to serve Maharashtra and southern states. Along with the new power transmission projects, the deployment of hydrogen compressors is also increasing. Therefore, development in the renewable energy & power sector is surging the demand for power generation projects worldwide, thereby boosting the demand for hydrogen compressors.

Many hydrogen production projects are being launched due to government support and funding. According to the International Energy Agency Organization and McKinsey Report, worldwide, more than 680 large-scale investment projects were announced with investments of US$ 240 billion in 2022. The report estimates that investment is expected to reach US$ 700 billion by 2030 to achieve the net-zero target. Also, investment in building hydrogen fuel stations across the globe is rising, owing to a surge in investments in fuel cell technology by private equity firms and venture capital. For instance, in March 2022, H2 Mobility Germany’s fueling station network planned an investment of US$ 121 million for the next five years for building the hydrogen infrastructure for fuel cell vehicles in the country.

Thus, rising investments in renewable energy and hydrogen generation projects owing to government support and funding are anticipated to create ample opportunity for the market growth in the coming years.

Hydrogen Compressors Market Share: End-User Overview

On the basis of End-User, the global hydrogen compressors market is segmented into power plants, oil and gas, food and beverages, automotive and refueling stations, petrochemicals and chemicals, hydrogen storage, and others. The petrochemical and chemical segment held the largest hydrogen compressors market share in 2023. The automotive and refueling stations segment is projected to record the highest CAGR during the forecast period, owing to continuous research and development activities for the development and adoption of fuel cells in the industry. Europe, the US, and China are a few of the largest markets for hydrogen refueling stations. As per the data published by the H2 Station in 2023, Europe had a total of 254 refueling stations in 2022, of which 105 were in Germany, 44 in France, and 17 in the UK and the Netherlands. Further, increasing investments in hydrogen refueling stations are anticipated to boost the demand for hydrogen compressors during the forecast period. The oil & gas segment accounted for the largest share of the market in 2022. Increasing investments in the oil and gas industry with the surge in the adoption of advanced technologies-based equipment such as hydrogen compressors and mining detection devices for exploration are driving the market. The upstream oil and gas industry’s spending reaches US$ 900 billion annually, according to the International Energy Agency Report in 2022. Also, rising demand for low-carbon emission-based devices across other industries, including chemical, automotive, and transportation, is contributing to the growing hydrogen compressors market size. Further, an increase in investment in the renewable energy sector with government funding is the major driving factor for the hydrogen compressors market growth. According to the International Energy Agency Report in 2023, global investment in renewable energy reached US$ 1.7 trillion in 2022 and is expected to grow at a rapid pace in the coming years.

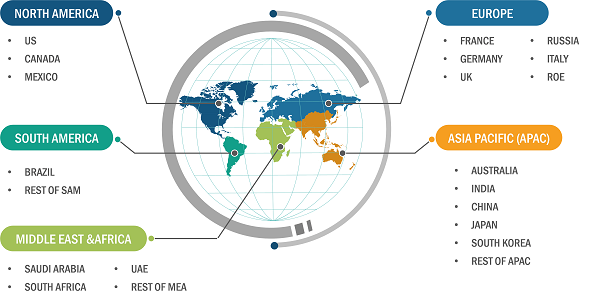

The scope of the hydrogen compressors market report focuses on North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and Rest of Europe), Asia Pacific (Australia, South Korea, India, China, Japan, Indonesia, Singapore, Taiwan, New Zealand, Southeast Asia, and Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America). APAC held the largest hydrogen compressors market share in 2023 and is projected to maintain its dominance during the forecast period. Europe is the second-largest contributor to the global hydrogen compressors market, followed by North America.

APAC consists of various growing economies such as India, China, Thailand, Vietnam, Singapore, Taiwan, and New Zealand. The availability of low labor costs, low taxes and tariffs, and a gradual increase in the adoption of advanced technologies indicate a robust business ecosystem in these countries, attracting global manufacturing players to expand their production facilities in this region.

Asia Pacific is witnessing intense competition among companies aiming to establish green hydrogen production bases, recognizing its potential as a next-generation power source. The domestic players are teaming up with companies from Western countries for massive projects. Orsted, a Danish offshore wind power company exploring entry into the green hydrogen sector, partnered with POSCO, a South Korean steelmaker, for an offshore wind power project in May 2021. It is also studying the feasibility of green hydrogen production. Moreover, Western oil companies are making significant investments in Asia Pacific. In June 2022, BP became the largest shareholder in the Asian Renewable Energy Hub (AREH) project in Australia, aiming to produce up to 1.6 metric tons of green hydrogen annually and secure a 10% share of the global market. Such investments by companies are expected to fuel the hydrogen compressors market growth in Asia Pacific during the forecast period.

A report from the Hydrogen Council, which includes over 150 multinational companies, predicts that the combined hydrogen demand from China, India, Japan, and South Korea is expected to reach ~285 metric ton by 2050, accounting for 43% of the global total. China, being the world’s largest hydrogen consumer, is actively striving to gain the lead in green hydrogen production. As the demand for green hydrogen surges, companies are engaging in strategic partnerships and investing heavily to position themselves in the emerging green hydrogen industry in Asia Pacific, which propels the growth of the hydrogen compressors market.

Hydrogen Compressors Market: Competitive Landscape and Key Developments

Atlas Copco AB; Fluitron, Inc.; Gardner Denver Nash, LLC; Burckhardt Compression AG; HAUG Sauer Kompressoren AG; Howden Group; NEUMAN & ESSER GROUP; Hydro-Pac, Inc.; Lenhardt & Wagner GmbH; PDC Machines Inc.; Sundyne; and Ariel Corporation are among the key players covered in the hydrogen compressors market report. Companies in the market mainly focus on product and service enhancements by integrating advanced features and technologies into their offerings.