Helicopter MRO Market

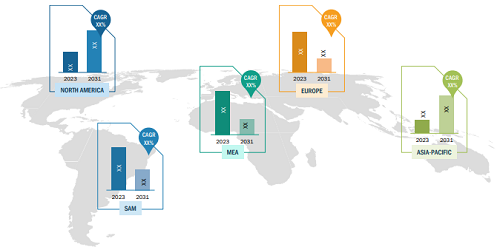

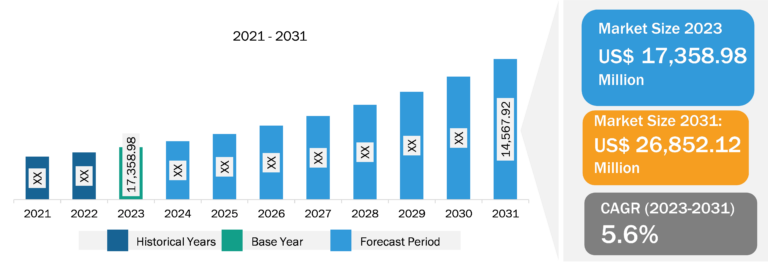

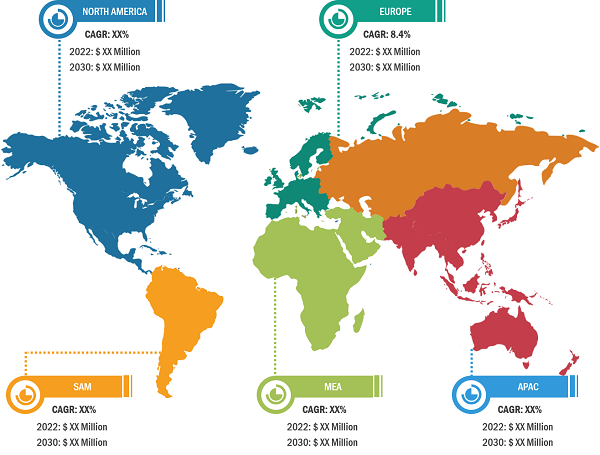

The global helicopter MRO market size is segmented on the basis of component, helicopter type, and end user. Based on component, the global helicopter MRO market is segmented into airframe maintenance, engine maintenance, component maintenance, and line maintenance. By helicopter type, the market is segmented into light helicopter, medium helicopter, and heavy helicopter. Based on end user, the helicopter MRO market size is bifurcated into commercial and defense. The global helicopter MRO market is also segmented into five major regions—North America, Europe, Asia Pacific, the Middle East and Africa, and South America.

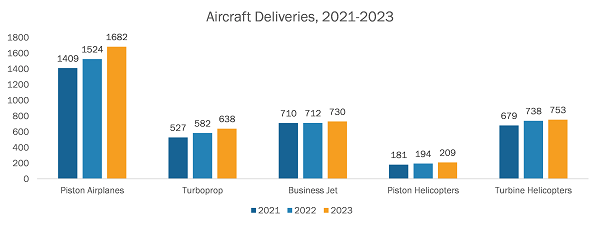

In 2022, India had more than 800 helicopters, with ~72% of the fleet from Non-Scheduled Operators (NSOP), while others belonged to government officials, public sector units (PSU), and private parties. According to the India Brand Equity Foundation Organization, Indian helicopter owners, including private and government, spend more than US$ 1.2 billion annually on their maintenance, repair, and overhaul (MRO) services, and the services are mostly outsourced from overseas companies. Helicopters are complex machines that require careful inspection before flying. It is mandatory to perform routine helicopter maintenance with the help of renowned MRO aviation companies that guarantee aircraft are safe while flying in the air. According to the Stockholm Peace International Research Institute, global military spending reached nearly US$ 2.2 trillion in 2022, an increase by 3.7% compared to 2021. An increase in military expenditure across the globe with rising helicopter production drives the helicopter MRO market growth. The US military army invested significant resources in the modernization of the helicopters and has increased its budget by 20% to reach US$ 1.1 billion for 2021 compared to 2020. The US government launched the Future Vertical Lift program for the modernization of helicopters and aircraft. Such rising military expenditure and increasing number of military helicopters drive the helicopter MRO services market growth.

Helicopter MRO Market Analysis: End User Overview

Based on end user, the global helicopter MRO market share is bifurcated into commercial and defense. Commercial applications such as air ambulance, helicopter tourism, and offshore wind turbines are growing continuously. In October 2023, Wales Air Ambulance Charity announced the addition of its new helicopter. In 2022, Wales Air Ambulance announced that Gama Aviation Plc had won a seven-year aviation contract covering the operation and maintenance of a primary fleet of four Airbus H145 helicopters. The service now operates three H145 helicopters and one smaller H135 helicopter. The H135 aircraft will be modified to an H145 as part of the new contract.

Helicopter fleet expansion activities by many developed nations propel the helicopter MRO demand in the defense industry. In December 2022, the Defense Acquisition and Program Administration (DAPA) of South Korea and Korea Aerospace Industries (KAI) signed a US$ 234 million contract for the first stages of mass production for their Light Armed Helicopter (LAH). Thus, factors mentioned above fuel the demand for helicopter MRO services in the commercial and defense sectors.

Helicopter MRO Market: Competitive Landscape and Key Developments

The market initiative is a strategy adopted by companies to expand their footprint across the world and to meet the growing customer demand. The market players present in the helicopter MRO market are mainly focusing on product and service enhancements by integrating advanced features and technologies into their offerings. Some of the key players adopting these strategies includes HELICONIA, Israel Aerospace Industries, Leonardo SpA, AAL Group Ltd., Abu Dhabi Aviation, and Airbus,

| Year | News | Region |

| October 2022 | Abu Dhabi Aviation received an offer from ADQ Aviation and Aerospace Services LLC (ADQ Aviation) to take a controlling stake in the company. The deal would see ADA’s operations merge with the ADQ Aviation-controlled Advanced Military Maintenance Repair and Overhaul Centre LLC (AMMROC), Etihad Airways Engineering LLC, and aviation services Global Aerospace Logistics businesses. | MEA |

| July 2021 | ITP Aero signed a contract with Gulf Helicopters Company (GHC) to provide comprehensive support for its fleet of General Electric CT7-2E1 and CT7-8A engines that are flown in its Leonardo AW189 and Sikorsky S-92. The contract spans five years, and work will be carried out at ITP Aero’s Albacete and Ajalvir (Madrid) facilities in Spain. | Europe |