Veterinary Diagnostics Market

The report highlights prevailing trends in the market and the factors driving and hindering the growth of veterinary diagnostics. The growth of the market is attributed to rising prevalence of zoonotic diseases and growing ownership of companion animals. However, the lack of skilled professionals in veterinary research hinders the market growth.

Growing Ownership of Companion Animals

According to the American Pet Products Association, pet ownership increased from 68% in 2016 to 70% in 2021. More than 67% of American households own almost 400 million pets, including dogs, cats, horses, birds, fish, and more. According to the American Society for the Prevention of Cruelty to Animals, ~6.5 million companion animals enter the countrywide animal shelters annually. As per the European Pet Food Industry Federation (FEDIAF), in 2022, ~340 million pets were raised in European households, with cats being the most popular pets, with a stable population of 127 million and dogs with 104 million. According to the Global Animal Health Association, China’s pet ownership increased 113% between 2014 and 2019, and by 2024, China will have the most number of pets in the world due to a relaxation of pet ownership regulations and a falling birth rate. Similarly, in South Korea, ~28% of all households raise pets. Dogs were raised by 6.02 million households and cats were raised by 2.58 million households in 2020, according to the Ministry of Agriculture, Food and Rural Affairs.

According to Euromonitor International, households will continue to exit poverty and reach the middle class, and thus, by 2040, 856 million households will have disposable incomes between US$ 15,000 and US$ 45,000, i.e., one in three households worldwide (35.5%). Due to increasing disposable income, companion animal adoption rates are growing in developing countries of Asia and Eastern Europe. The advancement in detecting animal diseases and increasing disposable income among pet owners drive the veterinary diagnostics market globally.

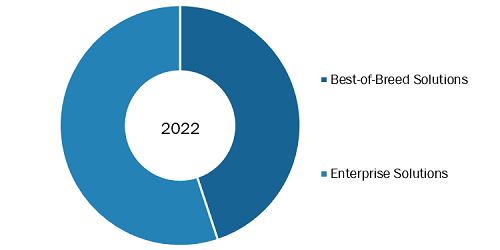

Veterinary Diagnostics Market: Segmental Overview

The “global veterinary diagnostics market” is segmented based on product, disease type, technology, animal type, end user, and geography. Based on product, the veterinary diagnostics market is bifurcated into instruments and consumables. The instruments segment held a larger market share in 2022. The consumables segment is anticipated to register a higher CAGR of 8.78% during 2022–2030. Veterinary consumables involve testing tubes, containers, petri dishes, deep well plates, and kits comprising syringes, needles, safety lancets, IV sets & tubes, and samplers. These consumables are intended to be used for companion animal diagnostics such as pet (canine, feline, and avian), bovine, goat, swine, equine, and poultry. The testing tubes involve citrate, ESR, glucose, and others. The cuvettes are used for biochemical tests of companion animals. Moreover, several manufacturers are involved in offering consumables for veterinary diagnostics animals. HWTAI is one such example. The consumables offered by HWTAI comprises specimen containers, petri dish, deep well plate, cuvette, swabs, VTM, and others. The rising diagnostics testing for veterinary and companion animals results in a high demand for consumables, thereby catalyzing the market for the consumables segment.

Based on technology, the veterinary diagnostics market is segmented as immunodiagnostics, clinical biochemistry, hematology, molecular diagnostics, and others. Immunodiagnostics is further segmented into lateral flow assays, ELISA tests, immunoassay analyzers, allergen-specific immunodiagnostic tests, and others. Additionally, clinical biochemistry is further segmented into clinical chemistry analysis, glucose monitoring, and blood gas & electrolyte. The immunodiagnostics segment held a larger market share in 2022 and is anticipated to register a higher CAGR of 8.90% during 2022–2030. The health of the animals is majorly associated with parasitic diseases. A parasite with a two host prey–predator lifecycle acts as an intermediate host, causing some of the most devastating and prevalent diseases in humans and animals. As per the World Health Organization (WHO) 2023 report, about 1 billion cases of illness and millions of deaths occur annually from zoonoses. Among these, about 60% of emerging infectious diseases reported globally account for zoonoses. To overcome such a high prevalence of zoonotic infections, the demand for immunodiagnostic techniques is high among veterinarians. Cystic echinococcosis (CE) and Alveolar echinococcosis (AE) are severe zoonotic diseases caused by the larval stage (metacestode) of the Helminth Echinococcus multilocularis. Immunodiagnostics employs antigen–antibody binding with a variety of detection methods for the immune complexes formed. Also, immunodiagnostics technology is easier to perform than other techniques, such as PCR chromatography for drug quantification. Further, immunodiagnostics is useful in studying infectious disease serology among veterinary animals. The “WITNESS” immunodiagnostics is one such example offered by Pfizer Animal Health. The WITNESS test offers accurate and rapid results, requiring no snapping, feature room temperature storability, and is easy to interpret. The WITNESS HW heartworm test is intended for dogs and cats with accuracy, affordability, and minimal time to snap. Also, the WITNESS feline leukemia virus (FeLV) test is highly accurate, sensitive, and specific for testing cats or kittens at any age. With the rising prevalence of zoonotic diseases, the demand for immunodiagnostics is high among veterinarians, thereby accelerating the market for the immunodiagnostics segment.

The veterinary diagnostics market, by animal type, is bifurcated into livestock animals and companion animals. The livestock animals segment is further segmented into cattle, pigs, poultry, and others. The companion animals segment is further divided into dogs, cats, horses, and others. The companion animals segment held the largest share of the market in 2022 and is anticipated to register the highest CAGR of 8.10% in the market during 2022–2030. Companion animals include dogs, cats, horses, and others. Companion animals are a potential source of infectious disease for humans and food-producing animals. Newcastle disease epidemiology of neosporosis is a popular example of companion animals suffering from infectious diseases. Additionally, West Nile Virus (WNV) results in inflammation of the brain (encephalitis) and spinal cord lining (meningitis). Among horses bitten by a carrier mosquito, one-third will typically develop severe disease, resulting in the death of animals. Feline infectious peritonitis (FIP) is a viral disease of cats responsible for feline coronavirus. The incidence of the disease is 1 per 5,000 families of cats, as published in Thermo Fisher Scientific report. With such a high prevalence, the demand for companion animal diagnostic methods is high among veterinarians, ultimately driving the market for the companion animal segment.

Various initiatives have also been taken to enhance veterinarians’ knowledge about the utility of antimicrobial drugs to companion animals. Veterinarians’ awareness of antimicrobial drugs to treat diseases among companion animals reported in an AVMA survey revealed that 60.5% of the US veterinarian participants were aware of guidelines related to the utility of antimicrobial drugs. Such guidelines associated with rising awareness of antimicrobial drugs to treat infectious diseases among companion animals further promote the market for the segment.

The veterinary diagnostics market, by disease type, is categorized into infectious diseases, non-infectious diseases, and other diseases. The infectious diseases segment held the largest share of the market in 2022 and is anticipated to register the highest CAGR of 8.07% in the market during 2022–2030. Veterinary infectious diseases impact the overall health of livestock, domestic animals, and wildlife. Therefore, animal farming can contribute to the spread of pathogens from wild animals due to deforestation and biodiversity loss associated with agriculture. Almost two-thirds of the pathogens cause human diseases as per the Creative Diagnostics 2023 report. These diseases include SARS-CoV-2/COVID-19, avian influenza, rabies, and Ebola.

Additionally, other animal infectious diseases such as African Swine Fever, Classical Swine Fever (CSF), Foot and mouth Disease (FMD), Newcastle Disease (ND), Lumpy Skin Disease (LSD), African Horse Sickness (AHS) have proven to be extremely fatal. Therefore, the demand for veterinary diagnostics is high with the rising prevalence of animal infectious diseases. Creative Diagnostics offers a range of high-quality antigens and antibodies for an extensive range of viral, bacterial, and protozoal veterinary diseases. These reagents are intended for livestock and companion animals suffering from clinically relevant pathogens such as Newcastle Disease and Brucella Abortus. Also, the reagents can be used in a wide range of research applications and the development of immunoassays for diagnostic and vaccine R&D. The aforementioned factors are responsible for the influential growth of the segment.

The veterinary diagnostics market, by end user, is segregated into veterinary hospitals & clinics, animal diagnostic laboratories, and veterinary research institutes & universities. The veterinary hospitals & clinics segment held the largest share of the market in 2022, and the hospital segment is anticipated to register the highest CAGR of 8.14% in the market during 2022–2030. Veterinary-associated infections are majorly treated in veterinary hospitals & clinics. Similar to human care, the “Accreditation Standards” framework is developed to achieve desired goals. These standards allow healthcare providers to overlook systems, policies, procedures, and processes to provide better services. Therefore, veterinary hospitals & clinics are developed to prove effective in understanding and providing benefits to animals to reduce mortality, infection rates, and adverse effects. Such accreditations bring transparency in overall veterinary hospitals & clinics’ functionality and achieve better clinical outcomes for animals’ health. Additionally, the PVS Pathway for the sustainable improvement of national veterinary services and aquatic animal health services, one health capacity building in partnership with the World Health Organization (WHO), the Food and Agriculture Organization of the United Nations (FAO), and Veterinary Legislation Support are among such accreditations to the veterinary hospitals & clinics.

Veterinary Diagnostics Market: Competitive Landscape and Key Developments

Thermo Fisher Scientific Inc, Idexx Laboratories Inc, Zoetis Inc, Heska Corp, Neogen Corp, Randox Laboratories Ltd, Virbac SA, INDICAL BIOSCIENCE GmbH, FUJIFILM Holdings Corp, and Merck Animal Health are among the leading companies operating in the veterinary diagnostics market. These players focus on expanding and diversifying their market presence and acquiring a novel customer base, tapping prevailing business opportunities in the veterinary diagnostics market.

Market players are launching new products in the market. Below are a few instances:

- In Jan 2023, IDEXX announced novel diagnostic test for kidney injury, expanding its veterinary renal testing portfolio. It is used for detecting kidney injury in cats and dogs.

- In August 2023, Zoetis launched first on-farm mastitis diagnostics. Zoetis has launched Vetscan Mastigram+, a rapid on-farm mastitis diagnostic, in several markets across Europe. It uses a simple flow dipstick test to detect Gram-positive mastitis in 8 hours, enabling results before the next milking. Because often only Gram-positive cases will benefit from treatment with antimicrobials, a farmer or vet can use this information to deliver more targeted therapy and ensure antimicrobial usage is focused only on cows that need it.

- In April 2023, Mars completed the acquisition of Heska, a global provider of advanced veterinary diagnostic and specialty solutions. Heska is now part of Mars Petcare’s Science & Diagnostics division, enabling broader coverage across diagnostics and technology while accelerating R&D and expanding access globally to pet healthcare solutions.

- In September 2021, Neogen acquired CAPInnoVet, Inc, a companion animal health company that provides pet medications to the veterinary market. CAPInnoVet will integrate into Neogen’s Animal Safety business segment, which includes veterinary instruments, pharmaceuticals, vaccines, and diagnostic products.