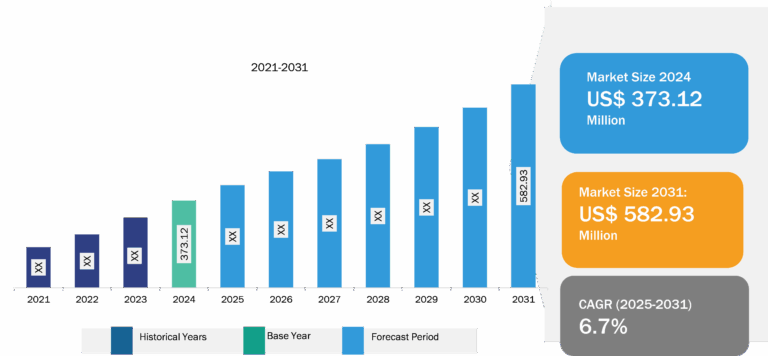

Parcel Sortation System Market

Government support for developing and deploying robotics and rapid expansion in the manufacturing industry is fueling the parcel sortation system market size. However, a relatively slow production rate is hindering the parcel sortation system market growth.

The European market is a tremendously varied market comprising 50 countries. Western European countries are more developed than NORDIC and other Eastern European countries. As a result, the countries are witnessing more breakthroughs and advancements in automation in Western Europe. The NORDIC countries are home to many small and medium enterprises (SMEs) that do not have a major requirement for automated storage warehouses. There is a significant need for fast, highly precise deliveries across Europe, driven by online purchasing habits and business recovery in the post-pandemic period. However, consumers increasingly expect next-day or even same-day deliveries; getting a box from A (the point of order) to B (the doorstep) in less than 24 hours requires a massively sophisticated and advanced supply chain. Automation is the key to encouraging the potential of parcel sortation technology in various sectors across Europe and fueling Europe parcel sortation system market size.

Germany, Italy, and the Netherlands are prospective growth areas for automated technology deployments in various applications. For accuracy and efficiency in operations, the automotive sector in Germany, the textile and manufacturing industries in Italy and Spain, and the electronics industry in the UK have used modern parcel sortation systems. Vanderlande Industries B.V., Invata Intralogistics, Interroll Holding GmbH, and Packrobat Automation Ltd. are a few firms engaged in the Europe parcel sortation systems market. These companies regularly indulge in various product developments and new launches related to parcel sorting systems. For instance, in June 2022, Interroll Group released Split Tray Sorter. The novel gadget ensured maximum availability, a very long service life, and rapid payback times for the automatic sortation of transported objects weighing up to 12 kg. Hence, the company provided suitable solutions for logistics service providers and express, courier, and package service providers to boost the productivity of customer-oriented distribution centers by successfully segregating small parts from other transport products.

Introduction of Cost-effective Advanced Parcel Sortation System to Provide Opportunities for Parcel Sortation System Market Players During Forecast Period

Many parcel sortation systems manufacturers are integrating their products with advanced technologies to gain customer attraction. However, the integration of advanced technologies and software is increasing the upfront cost of the systems. Thus, these manufacturers are focusing on developing advanced parcel sortation systems with reduced prices of the final products as well as the cost involved in their maintenance. This factor is expected to substantially increase the procurement of such technologies, which can help the warehouses, airports, dockyards, and delivery centers in developing countries to efficiently sort the parcels. Thus, the introduction of cost-effective advanced parcel sortation systems is expected to fuel the parcel sortation systems market growth during the forecast period.

Parcel Sortation System Market: Segmental Overview

Based on type, the parcel sortation system market is segmented into:

- Pop-Up Sorters

- Shoe Sorters

- Cross Belt Sorters

- Tilt Tray Sorters

- Pushtray

- Others

The cross belt sorters segment held the largest parcel sortation system market share in 2022, whereas the shoe sorters segment is anticipated to register the highest CAGR in the market during the forecast period.

Based on application, the parcel sortation system market is categorized into:

- Logistics Industry

- E-Commerce Industry

- Food & Beverages Industry

- Post and Parcel Services

- Airports

- Pharmaceutical Industry

- Others

The logistics segment held the largest parcel sortation system market share in 2022, whereas the others segment is anticipated to register the highest CAGR in the market during the forecast period.

Parcel Sortation System Market Analysis: Competitive Landscape and Key Developments

Bastian Solutions, LLC; Daifuku Co., Ltd.; Dematic; Honeywell International Inc.; Murata Machinery, Ltd; Interroll Group; BEUMER GROUP; Viastore Systems; Vanderlande Industries B.V.; and Siemens Logistics GmbH are a few of the key parcel sortation system market players. The market leaders in the international parcel sortation system market focus on new product launches, expansion and diversification, and acquisition strategies, which allow them to access prevailing business opportunities.

- In February 2022, Siemens Logistics was awarded a new contract by GLS Spain, one of the leading parcel companies in the country. The order included the design, integration, and commissioning of parcel sorting technology for GLS’ new logistics center in Madrid. Siemens Logistics will integrate several high-efficiency Visicon singulators, a 2-km conveyor belt, a linear sorter system, and state-of-the-art software.

- In May 2021, Deutsche Post contracted Siemens Logistics for the delivery, integration, and commissioning of parcel sorting technology for its international postal center (IPC) in Niederaula, Germany. The contract included a high-performance cross-belt sorter for small parcels with several high-speed inductions, conveyor technology, as well as intelligent control, reading, and coding software.

- In May 2021, Beumer Group introduced a new type of small- and medium-sized parcel sortation system. Installed for the first time in Germany during the peak Black Friday week and Christmas season, the system enabled more efficient sorting of the growing number of small and medium-sized e-commerce parcels handled by operators such as DHL.