Paracetamol Market

In the paracetamol market report, North America accounted for the largest share of the global paracetamol market in 2022. Developments in medical infrastructure, the prevalence of infectious diseases, and increasing spending on healthcare services are the major factors benefiting the paracetamol market in the US. According to the US Department of Health & Human Services, 3–11% of the US population gets infected and develops flu symptoms annually. Findings derived from the Global Burden of Disease study published in July 2020 state that there is a large and increasing burden of noncommunicable and infectious diseases in the US. According to Johns Hopkins University, the cases of diseases such as SARS, Lyme disease, dengue fever, West Nile virus, and Zika virus infection have increased rapidly in the last two decades in the US. The same source affirmed an increase in the incidence of re-emerging diseases such as malaria, tuberculosis, cholera, pertussis, influenza, pneumococcal disease, and gonorrhea. Paracetamol and other drugs indicated to curb fever and similar symptoms are prescribed as a part of treatments for infectious diseases. Thus, a rising incidence of infectious diseases boosts the demand for paracetamol in the US, boosting the paracetamol market growth.

Rising Consumer Preference for Over-the-Counter Medications Drives Paracetamol Market Growth

Consumers prefer over-the-counter drugs such as paracetamol as they are easily accessible to them without a prescription. Paracetamol can be taken to get relief from mild to moderate pain and fever. Further, the burgeoning demand for online medicine delivery boosts the sales of OTC medicines. Various online delivery channels are providing OTC medicines through doorstep delivery. In June 2023, Uber Health launched OTC medicine delivery services as the company plans to extend its business into the healthcare segment. Previously, in March 2023, Uber’s healthcare business launched same-day prescription delivery on its centralized platform, which enabled pharmacies to quickly ship medications to patients’ homes. Over recent years, healthcare organizations have been actively using online platforms for various services, including patient appointments and online medication delivery. Thus, the preference for self-medication and easy access to paracetamol without a doctor’s visit or prescription contribute to the paracetamol market growth.

Effects of Paracetamol Overdose Limit Market Growth

On the basis of paracetamol market analysis, potential side effects have significant implications for the paracetamol market. Paracetamol, or acetaminophen, is used for pain and fever relief. Although paracetamol is widely used and considered to be generally safe when used as directed, several specific side effects and concerns are associated with its use. One of the most significant side effects associated with paracetamol is the risk of liver damage in case of overdosing or when used inappropriately. This is a major concern and can impact consumer confidence in the product, potentially leading to decreased usage. According to the study, “Potential deleterious effects of paracetamol dose regime used in Nigeria versus that of the United States of America,” published in 2022 in ScienceDirect Journal, paracetamol is one of the known causes of acute liver failure in the US and Europe. The same source reported that paracetamol poisoning is likely the cause of liver disorders in Nigeria. Thus, based on the paracetamol market analysis, the side effects of paracetamol hinder the paracetamol market growth.

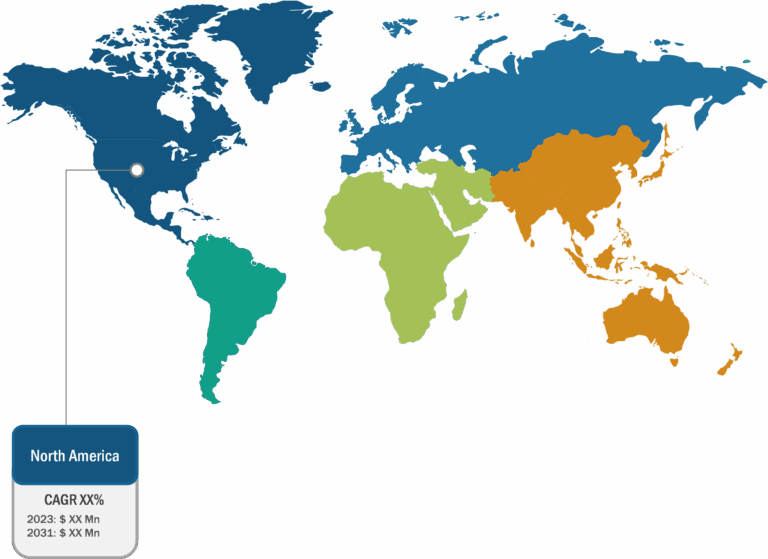

Paracetamol Market: Segmental Overview

Based on dosage form, the paracetamol market is differentiated into tablets, capsules, and others. The tablets segment held the largest market share in 2022. It is further anticipated to register the highest CAGR during 2022–2030. In terms of indication, the paracetamol market is segmented into fever, cold and cough, mild and moderate pain, and others. The fever segment held the largest market share in 2022. However, the mild and moderate segment is anticipated to register the highest CAGR from 2022 to 2030.

Based on the route of administration, the paracetamol market is bifurcated into enteral and parenteral. In 2022, the enteral segment held a larger market share, and the same segment is anticipated to register a higher CAGR during 2022–2030. The paracetamol market, based on distribution channel, is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The retail pharmacies segment held the largest market share in 2022, and the same segment is anticipated to register the highest CAGR during 2022–2030.

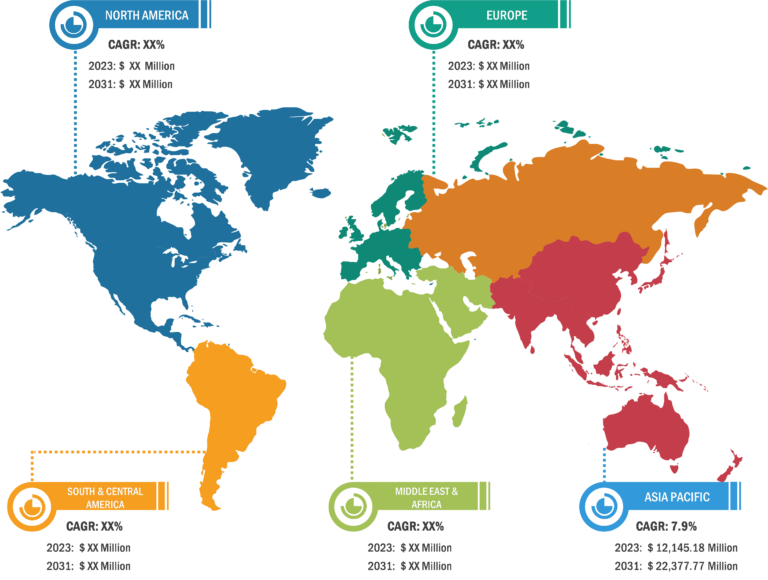

In terms of geography, the paracetamol market report is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Paracetamol Market: Competitive Landscape and Key Developments

Mallinckrodt Pharmaceuticals; GSK plc; Teva Pharmaceutical Industries Ltd.; Sun Pharmaceuticals; Sanofi; Micro Labs Limited; Cipla Inc.; B. Braun Medical Inc.; Dr. Reddy’s Laboratories Ltd; and Fresenius Kabi are a few key companies operating in the paracetamol market. These companies adopt product innovation strategies to meet evolving customer demands, which allows them to maintain their brand name in the paracetamol market.

A few of the recent developments in the global paracetamol market are mentioned below:

- In October 2023, the Minister for Mental Health and Older People in Ireland launched a new campaign to promote safe paracetamol sales in pharmacy and non-pharmacy retail settings. The campaign has been launched to make new sets of information available for employees from these settings. The program also intends to raise awareness of paracetamol-related intentional drug overdose among pharmacy and non-pharmacy retail staff in Ireland.

- In April 2022, IOL Chemicals & Pharmaceuticals Ltd commenced the commercial production of “Paracetamol” with an installed capacity of 1800 MTPA and backward integration of Para Amino Phenol (PAP). The company manufactures Paracetamol in its existing Unit No. 4, which has been converted as a multiproduct facility, costing ~US$ 1.2 million (nearly INR 100 lakh). On the other hand, PAP is being manufactured in a part of Unit No 9. The company shall continue to use Unit 4 and Unit 9 to manufacture other products as per market conditions.

- In March 2022, Paraveganio became the world’s first medicinal product registered under the Vegan Trademark approved by the Vegan Society. Paracetamol tablets generally have magnesium stearate, which acts as a flow regulator. It is a stearic acid and magnesium salt that may be derived from animals. Axunio’s Paraveganio contains magnesium stearate derived entirely from vegetables.

- In July 2021, Hyloris Pharmaceuticals SA announced the launch of Maxigesic IV in Germany and Austria. Maxigesic IV is a novel, patented, non-opioid treatment for postoperative pain and is a unique combination of 1,000 mg paracetamol and 300 mg ibuprofen solution for infusion. Hyloris and AFT Pharmaceuticals (a partner of Hyloris) have various distribution partners with strong local presence, which help them commercialize the product worldwide.