Growing Demand for Consumer Electronics Drive Growth of Spend Analytics for Electronics and Semiconductor Market Size

The spend analytics for electronics and semiconductor market forecast is based on analysis of various factors, including the surge in demand for various consumer electronics. The electronics and semiconductor market experienced a significant surge in demand for smartphones, tablets, wearable devices, and other consumer electronics. This increase in demand highlighted the necessity for spending analytics within the industry. For instance, according to the JEITA, electronic components and devices production in Japan increased by US$ 5,337 million in 2022 compared to 2019. As the consumer electronics market expanded, companies in this sector faced the challenge of efficiently managing their expenditures to maintain competitiveness and meet their customers’ changing preferences. The adoption of spend analytics solutions became crucial as it provided valuable insights into spending patterns, identified opportunities for cost optimization, and facilitated informed decision-making to ensure companies remained adaptable and responsive in this fast-paced market. Also, spend analytics help companies streamline their procurement processes, identify potential areas for cost reduction, and strategically allocate resources to meet the growing demand for consumer electronics, which boosts the spend analytics for electronics and semiconductor market growth.

Spend Analytics for Electronics and Semiconductor Market Analysis: Segment Overview

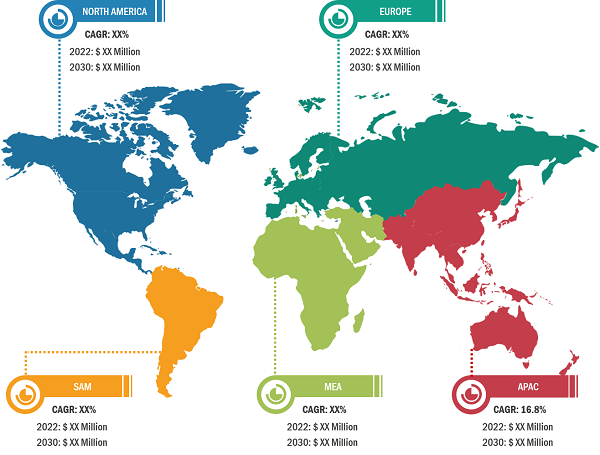

The global spend analytics for electronics and semiconductor market report is segmented on the basis of component, type, deployment, and application. Based on component, the market is bifurcated into software and services. Based on type, the market is segmented into predictive analytics, prescriptive analytics, and descriptive analytics. Based on deployment, the market is bifurcated into on-premise and cloud. Based on application, the market is segmented into financial management, risk management, supplier sourcing and performance management, governance and compliance management, demand and supply forecasting, and others. By geography, the spend analytics for electronics and semiconductor market report is segmented into North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and South America (SAM).

In 2022, North America held the second largest global spend analytics for electronics and semiconductor market share, after APAC. The market in North America is segmented into the US, Canada, and Mexico. North America is a key global spend analytics for electronics and semiconductor market player, with a strong presence of leading technology companies and research institutions and a robust semiconductor and electronics manufacturing ecosystem. The spend analytics for electronics and semiconductor market in North America is a well-established and mature one, exhibiting a high level of adoption and a strong focus on leveraging analytics to optimize procurement processes as well as drive cost savings. Particularly, the US has a significant presence in the global and North American spend analytics for electronics and semiconductor market. IBM Corporation, Lytica Inc, SAP, and Zycus are among the established players operating in the US that offer sophisticated analytics solutions tailored to the needs of their client organizations. These players have a deep understanding of the market dynamics and provide comprehensive analytics tools that allow businesses to gain valuable perceptions of their spending patterns and make informed decisions, further contributing to the growth of spend analytics for electronics and semiconductor market. In June 2023, Kearney, a global management consulting firm, led the investment round for Simfoni, raising the investment amount of ~US$ 8 million. Simfoni (based in San Francisco) provides solutions for spend analytics, e-sourcing, and tail spend management. Such trends are anticipated to propel the growth of North America’s spend analytics for electronics and semiconductor market share.

The adoption of spend analytics in the electronics & semiconductor industry provides numerous benefits, including cost optimization, supplier performance evaluation, demand forecasting, identifying savings opportunities, risk management, compliance monitoring, and strategic decision-making. By leveraging spend analytics, companies can gain valuable insights into their spending patterns, optimize procurement processes, and make knowledgeable decisions to boost efficiency and competitiveness. In August 2023, Nokia announced its plan to establish manufacturing operations in the US to produce crucial electronic components utilized in fiber-optic broadband networks. As per Nokia, the manufacturing of fiber-optic broadband electronics products will start by 2024, which is expected to generate approximately 200 employment opportunities in Wisconsin. Such collaborations boost the adoption of spend analytics in various industries, including electronics & semiconductors, further contributing to the spend analytics for electronics and semiconductor market growth in the region.

Spend Analytics for Electronics and Semiconductor Market Analysis: Competitive Landscape and Key Developments

Coupa Software Inc, IBM Corporation, Ivalua Inc, Lytica Inc, NB Ventures Inc (GEP), SAP SE, Scanmarket AS, Synertrade Inc, Vortal Connecting Business SA, and Zycus Inc are among the key players profiled in the spend analytics for electronics and semiconductor market report. Several other companies are introducing new product offerings to contribute to the spend analytics for electronics and semiconductor market size proliferation. Various other important players were also analyzed during this market research to get a holistic view of the global market and its ecosystem. The leading players focus on feature upgrades, expansion and diversification, collaboration, and acquisition strategies, which enable them to grab new business opportunities.

- In August 2023, Ivalua’s launched a new platform, which accelerated AI-powered contract digitization and overall purchasing optimization. This release indicates Ivalua’s growing investment in R&D, including innovations that improve contract digitization and analytics in order to improve visibility to optimize disparate purchasing activities, extend global e-invoicing compliance, enable new virtual card payment scenarios, and provide a built-in digital adoption layer.

- In January 2021, Scanmarket announced the acquisition of MIA Data, an analytics technology company specializing in artificial intelligence and machine learning applied to digitalizing business procurement processes. The new AI capabilities have been applied to Scanmarket’s Spend Analytics software.