Dynamic Grid Support Technology Brings New Opportunities for Uninterrupted Power Supply Market Growth

The energy environment is rapidly changing, with renewables playing an increasingly important role. The intermittent nature of these energy sources presents both challenges and opportunities, necessitating the development of new and more efficient UPS and energy storage systems and services, as well as providing flexibility in grid frequency control and energy demand for the user’s site, allowing to tap into new revenue streams and save money. The grid occasionally demands additional capacity, which is often unavailable and costly. This is where energy storage system and dynamic grid support come in handy, particularly if there is a UPS system in place. Grid balancing services allow cash generation without impacting the IT load.

The data center sector is at the forefront of the world’s never-ending demand for energy. Industry players are seeking solutions to address the grid stability issues posed by rising demand and the temporary imbalances endemic to renewable energy sources, which can cause frequency changes and, if left uncontrolled, outages. What makes a UPS or other energy storage devices good candidates for grid balancing is that backup batteries in a UPS only come into action when there is an outage, so these batteries go unused for most of their life. The smart UPS technology makes use of the batteries’ storage systems to store energy and rapidly release it when needed—all while maintaining the UPS system’s ability to protect the load. Furthermore, a grid-interactive UPS with a sufficiently sized energy storage system is intended to respond quickly enough to meet frequency containment requirements while supporting income-generating services.

Uninterrupted Power Supply Market: Industry Overview

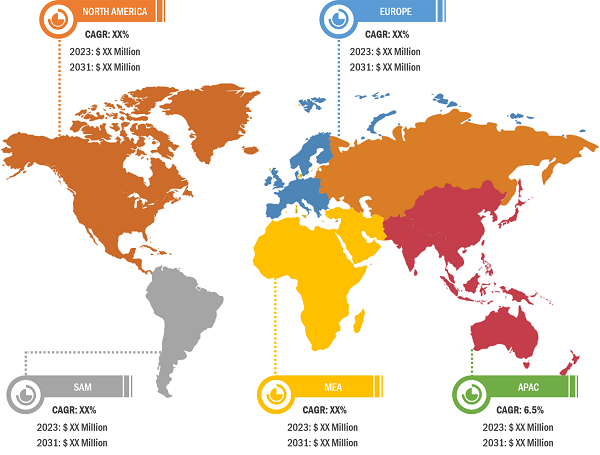

The uninterrupted power supply market analysis has been carried out by considering the following segments: type, rating, and end user. Based on type, the uninterrupted power supply market is segmented into standby, line-interactive, and online. In terms of rating, the market is divided into up to 50 kVA, between 50 and 100 kVA, and above 100 kVA. Based on end user, the uninterrupted power supply market is segmented into data centers, telecom, healthcare, industrial, and others. The data centers segment held the largest uninterrupted power supply market share in 2023. In terms of geography, the market is segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America.

The Europe uninterrupted power supply market is segmented into France, Germany, Italy, Russia, the UK, and the Rest of Europe. Factors driving the demand for uninterrupted power supply in Europe are increased investment in data center infrastructure, rapid urbanization, a rise in industrial infrastructure, and enhanced focus on energy efficiency regulations. The EU has formally approved a revamped Energy Efficiency Directive, which is another step toward finalizing the “Fit for 55” package; it aims to lower greenhouse gas emissions by 55% in the EU by 2030. Under the new directive, EU countries will be mandated to achieve an average annual energy savings rate of 1.5% between 2024 and 2030, nearly double the present target of 0.8%. In 2030, the annual savings requirement will reach 1.9%. This is predicted to result in energy reductions in buildings as well as industries. Moreover, in 2024, Microsoft announced its plan to invest over US$ 3.5 billion in Germany to increase its data center capabilities. Similarly, Mercury, a French construction business, has established its Digital Realty’s PAR9 data center in Paris Digital Park, leading to its overall development. Also, Virtus Data Centres aims to open a new campus in Saunderton, Buckinghamshire (UK). The campus will consist of four data centers capable of delivering 75 MW of IT capacity to suit the growing demand for cloud and AI applications. Thus, the rising establishment of data centers is boosting the demand for UPS in Europe.

Uninterrupted Power Supply Market: Competitive Landscape and Key Developments

Schneider Electric; Emerson Electric Co.; Toshiba Corporation; ABB Ltd; Eaton Corporation PLC; Mitsubishi Electric Corporation; Cyber Power Systems (USA), Inc.; Delta Electronics, Inc.; Legrand; Kehua Tech; Riello UPS; and S&C Electric Company are among the key players profiled in the uninterrupted power supply market report. Several other essential market players were analyzed for a holistic view of the market and its ecosystem.

The uninterrupted power supply market report provides detailed market insights, which help the key players strategize their market growth. A few recent developments by the key players, as per the company press releases, are mentioned below:

- In September 2024, ABB launched an industry-first MV UPS that provides a continuous and reliable power supply of up to 24 kV for data centers and other mission-critical facilities to protect servers and mechanical loads while reducing downtime. HiPerGuard supports sustainability with the highest levels of efficiency available on the market at 98%, translating to a potential carbon emission reduction of 1,245 tons over a typical 15-year lifespan.

- In January 2021, Toshiba International Corporation (TIC) announced the launch of the G9400 Series Uninterruptible Power System for global use. The G9400 Series features Gen 7 IGBTs, the latest generation of advanced Carrier Stored Trench Bi-Polar Transistor (CSTBT) IGBT technology, the “engine” of the UPS. The G9400 technology allows for high power density in a small footprint and 97% online efficiency at various loads, making it ideal for large colocation or hyper-scale data centers around the globe.