Canned Tuna Market

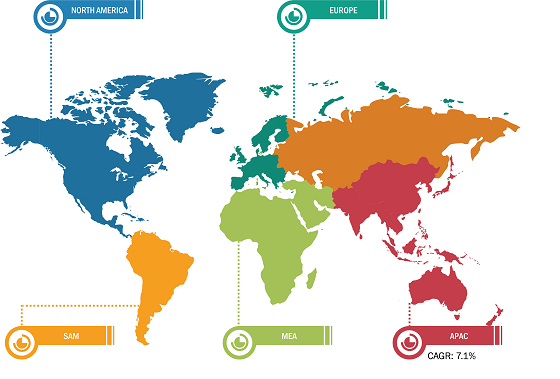

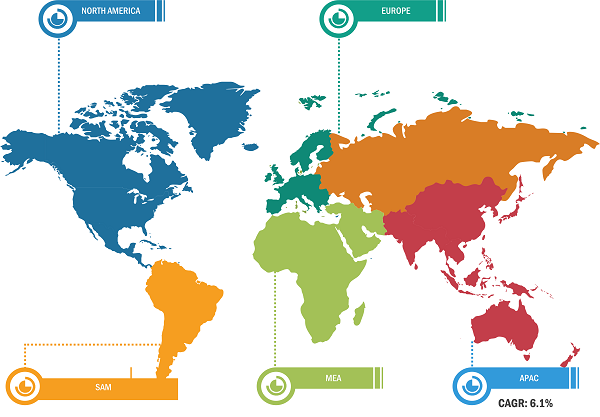

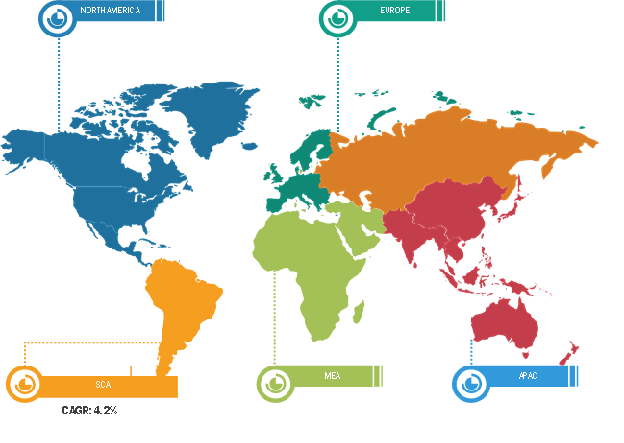

In 2023, Europe dominated the global canned tuna market share. The increasing focus on health and wellness drives the demand for canned tuna in Europe. As consumers become health-conscious and seek nutritious food options, canned tuna is an attractive choice as it contains a high protein content, omega-3 fatty acids, and various vitamins and minerals. With rising prevalence of obesity and health issues, European consumers are gravitating toward healthier and more sustainable food options, including seafood such as canned tuna, which offers a convenient and affordable way to incorporate essential nutrients into their diets. According to European Commission, in 2019, around 16.5% of adults were obese, and 36.2% were pre-obese in the EU.

The growing popularity of Mediterranean cuisine in Europe fuels the demand for canned tuna. Tuna is a staple ingredient in many traditional Mediterranean dishes such as salads, pastas, and tapas. The Mediterranean diet, known for its emphasis on fresh vegetables, fruits, olive oil, and seafood, has gained recognition for its various health benefits, including reducing the risk of heart disease and promoting longevity. Canned tuna is a convenient and versatile ingredient that aligns with the principles of the Mediterranean diet, making it a favored choice among consumers looking to adopt healthier eating habits and incorporate more seafood into their meals. According to CBI, Ministry of Foreign Affairs, tuna is the most consumed marine species across Europe. Tuna is a vital part of the diet of Europeans. In 2019, Europe sourced 85% of its fresh tuna imports from within Europe (24,149 tons). The remaining 15% came from non-European countries (4,390 tons). The robust import–export activities contribute to the canned tuna market growth in Europe.

According to Eurostat, the European Union (EU) Member States caught live tuna (including bonitos and billfishes) of weight almost 435,000 tons in 2017 in the seven fishing regions covered by EU statistics. This represented about 10 % of all marine fish caught by EU Member States that year. France and Spain accounted for almost all of the tuna catch in 2017. Spain caught almost 277,000 tons of bonitos, tuna, and billfishes in live weight terms (64% of the EU total) and France caught about 122,000 tons (28% of the EU total). Thus, the large quantity of domestic production of tuna in Europe propels the canned tuna market growth in the region.

Health Benefits Associated with Canned Tuna Drive Canned Tuna Market Growth

Canned tuna is an excellent source of high protein for building and repairing tissues, muscles, and organs. Protein content helps maintain a feeling of fullness, making canned tuna a satisfying and filling option for consumers seeking to manage their weight or build muscle mass. Canned tuna contains omega-3 fatty acids, particularly eicosatetraenoic acid (EPA) and docosahexaenoic acid (DHA). The fatty acids are known for their various health benefits, including reducing the risk of heart disease, improving brain function, and supporting overall cognitive health. Incorporating omega-3 fatty acids into the diet through canned tuna consumption can help consumers maintain a healthy heart and brain function. Furthermore, canned tuna is a good source of various vitamins and minerals, including vitamin D, vitamin B12, selenium, and potassium. Vitamin D is essential for smooth immune function and bone health, whereas vitamin B12 supports nerve function and red blood cell production. Selenium is an antioxidant, protecting cells from damage, and potassium helps regulate blood pressure and muscle function. By consuming canned tuna, consumers can obtain these essential nutrients, contributing to good health and well-being. Canned tuna is low in saturated fats and cholesterol; thus, it is a heart-healthy choice for individuals willing to reduce their risk of cardiovascular disease. The American Heart Association recommends consuming fish such as tuna at least twice weekly as part of a heart-healthy diet. As canned tuna contains protein, omega-3 fatty acids, vitamins, and minerals, it offers consumers a convenient and nutritious option to support their health goals, which drives the popularity of canned tuna.

Canned Tuna Market: Segmental Overview

The canned tuna market is segmented on the basis of type, category, distribution channel, and geography. Based on type, the market is segmented into albacore, yellowfin, skipjack, and others. The albacore segment holds a larger canned tuna market share. Albacore tuna/longfin tuna is found in tropical waters across the world. The canned albacore tuna is mostly labeled as “white meat tuna” due to its mild flavor and white flesh. Consumers, especially in France, US, and Spain prefer albacore canned tuna due to its low-fat and high protein content with a mild flavor. Albacore meat is a versatile ingredient used in various dishes such as pasta and salads; it is also used as a substitute for chicken. Albacore tuna species is rich in omega-3 acids, proteins, minerals, and essential vitamins. This species is low in fat and mercury. Thus, the preference for canned albacore tuna is high among price-sensitive and health-conscious consumers. These factors drive the albacore segment’s growth in the canned tuna market.

Based on category, the canned tuna market is segmented into tuna in water, tuna in oil, and others. Canned tuna in oil is typically packed in extra-virgin olive oil, vegetable oil, and olive oil. The fish may take a slight flavor from the oil in canned tuna. Tuna in oil is better for those with an increased need for essential fatty acids (EFAs), including linoleic acid. This includes those suffering from conditions such as cystic fibrosis. The nutrition content of tuna in oil varies depending on variety, and they are higher in calories, fats, and sodium. Consumers focusing on moisture, flavor, and vitamin D levels prefer tuna in oil. Manufacturers are innovating canned tuna in oil with different added ingredients such as carrot, sweetcorn, alpine, and cumin.

Based on distribution channel, the canned tuna market is segmented into supermarkets and hypermarkets, convenience stores, online retail, and others. Supermarkets and hypermarkets are large retail establishments that offer a wide range of products such as groceries, seafood, and other household goods. Products from various brands are available in these stores at reasonable prices. Moreover, these stores offer attractive discounts, multiple payment options, and a pleasant customer experience. Supermarkets and hypermarkets focus on maximizing product sales to increase their profit. Due to their heavy customer base, canned tuna manufacturers usually prefer to sell their products through supermarkets and hypermarkets. Increasing urbanization, rising working-class population, and competitive pricing boost the popularity of supermarkets and hypermarkets in developed and developing regions. Moreover, supermarkets and hypermarkets have modern storage facilities, ensuring ideal storage conditions for broth and other nonperishable products. In March 2021, Waitrose (UK’s supermarket chain) launched the UK’s first MSC-certified yellowfin and albacore tuna products. These products are available at their supermarket chain in the UK.

Canned Tuna Market: Competitive Landscape

StarKist Co; Bumble Bee Foods, LLC.; Chicken of the Sea; Wild Planet Foods; Genova; Conservas Ortiz S.A.; Century Pacific Food Inc; American Tuna Inc; and Sustainable Seas are among the prominent players profiled in the canned tuna market report. In addition, several other players have been studied and analyzed during the study to get a holistic view of the market and its ecosystem. The canned tuna market report also includes company positioning and concentration to evaluate the performance of competitors/players in the market.