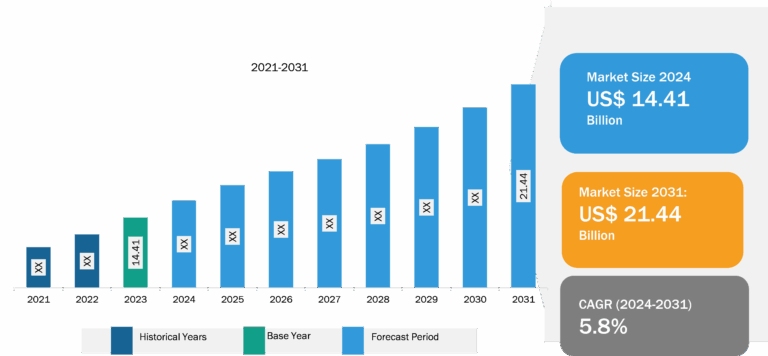

US Hearing Aids Market

Hearing loss profoundly impacts every dimension of the human experience, including physical, emotional, and mental health. The driving factors of hearing loss include increasing incidence of hearing loss among US population and surge in strategic initiatives by the market players. Furthermore, growing awareness pertaining to the newly launched technologically advanced hearing aids also contributes to the growing US hearing aids market size. However, high cost of customized and prescribed hearing aids is the major factor hindering the US hearing aids market growth.

Approval of Over-The-Counter Hearing Aids to Propel US Hearing Aids Market Growth During the Forecast Period.

Loss of hearing can have a profound impact on quality of life. According to US FDA, nearly 30 million adults living in the U.S. have some degree of hearing loss and despite that only about one-fifth of those who could benefit from a hearing aid seek intervention. The reason behind it is the high cost of hearing aids as people experiencing hearing loss must undergo audiology exams, get prescriptions for devices that are sized and fit appropriately in the ear, and receive counsel on proper use and follow-up tuning of devices. The US FDA established a regulatory category for over-the-counter (OTC) hearing aids for adults to improve access to hearing aid technology and reduce its costs for millions of Americans that came into effect on October 17, 2022. This new regulatory category will help people to have convenient access to an array of safe and cost-effective hearing aids from their neighborhood store or online. With the recent access to OTC hearing aids, people with mild to moderate hearing loss have a more affordable treatment option than in previous years. OTC hearing aids can now be marketed at significantly reduced prices, with some devices sold for only US$ 500 or less per ear. Experts also believe that existing manufacturers will develop low-cost OTC devices in addition to their existing offerings. Additionally, a surge is expected to be witnessed in the demand for OTC hearing aids by consumers suffering from mild to moderate hearing loss. For instance, In October 2022, Sony Electronics introduced its first over-the-counter hearing aids in the US market. The unique products were developed in partnership with W.S. Audiology. The first two products: Sony CRE-C10 and CRE-E10, will be available on the Sony website and at Amazon, Best Buy, and other retailers across the country. Introduction of over-the-counter promotes innovation and competition in the hearing aid technology market. Such factors will offer growth opportunities to the US hearing aids market.

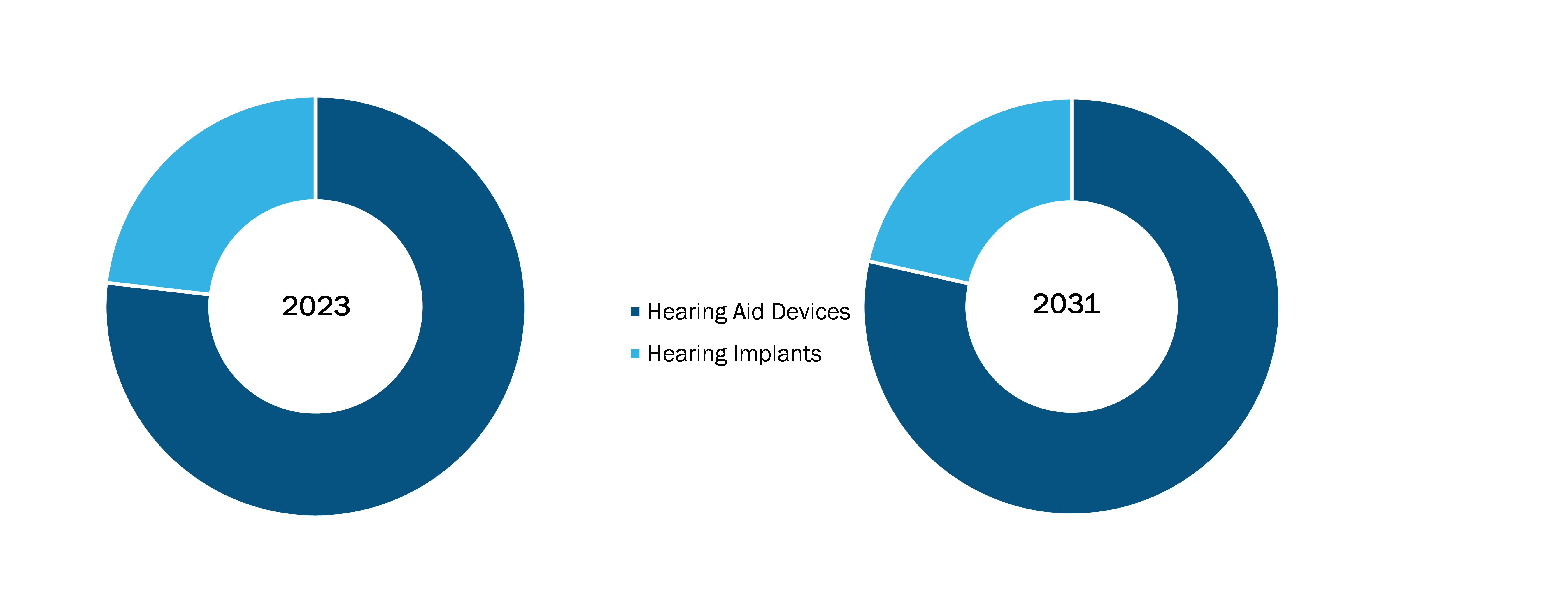

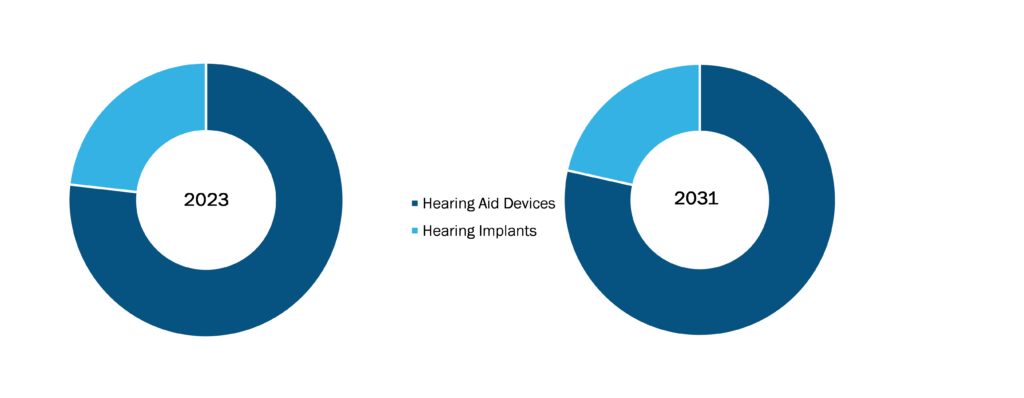

US Hearing Aids Market: Segmental Overview

The “US Hearing Aids Market” is segmented by Type, Product Type, Technology, Type of Hearing Loss, Patient Type, and Distribution channel. Based on type, the US hearing aids market has been bifurcated into OTC Hearing Aids and Prescription Hearing Aids. The prescription hearing aids segment held a larger market share in 2022, while OTC hearing aids segment is anticipated to register a higher CAGR of 43.7% during the forecast period.

Based on product type, the US hearing aids market has been bifurcated into Hearing Aid Devices, Hearing Implants. Based on technology the market is differentiated as digital hearing aids and conventional hearing aids. The US hearing aids market is bifurcated into sensorineural hearing loss, conductive hearing loss based on the type of hearing loss. On the basis of patient type the us hearing aids market is divided into adults and pediatrics and the market is broken down into pharmacies, retail stores, online, by type of distribution channels.

US Hearing Aids Market: Competitive Landscape and Key Developments

Starkey Laboratories Inc., Audina Hearing Instruments Inc, Sebotek Hearing Systems LLC, Earlens Corp, GN Store Nord As, Cochlear Ltd, WS Audiology AS, Sonova Holding AG, Sonic Innovations Inc, Amplifon Hearing Health Care Corp. are a few of the key companies operating in the US hearing aids market. The market leaders focus on new product launches, expansion and diversification, and acquisition strategies, which allow them to access prevailing business opportunities. Some inorganic strategies adopted by the market players of US hearing aids market are given below:

- In March 2021, Earlens Corporation partnered with ENT Partners. This partnership will result in the expansion of Earlens hearing aids nationwide.

- In September 2022, WSA entered into a partnership agreement with Sony Corporation. The partnership aims to develop and supply new products and services in the over-the-counter hearing aid market, beginning with the United States.

A few of the recent developments in the US hearing aids market are mentioned below:

- In May 2022, WS Audiology’s brand Signia launched its new Styletto AX Hearing aid that comes in an award-winning design and is preferred by 8 out of 10 people, including on-the-go charging.

- In January 2021, GN Hearing, introduced ReSound Key to its ReSound hearing aids portfolio. Its new features include the latest technology, such as rechargeability up to 30 hours, direct streaming using iOS and Android devices, and state-of-the-art Bluetooth Low Energy.

- In October 2022, Lexie Hearing launched the Lexie B2 hearing aids, powered by Bose, adjoining a third hearing aid model to its audiologist-quality hearing aid products. The second-generation device has been developed in partnership with Bose.