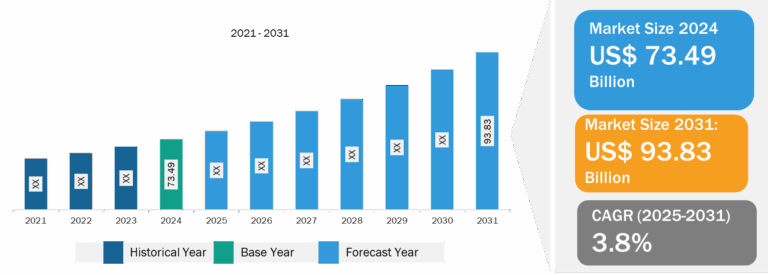

Breath Analyzer Market

The report highlights trends prevailing in the market and the factors driving and hindering the breath analyzer market growth. The growth of the market is attributed to growing alcohol consumption and alcohol-impaired accidents and government support and advanced technologies implementation for breath analyzers. However, false results by breath analyzers hinders the market growth.

Government Support and Advanced Technologies Implementation for Breath Analyzers

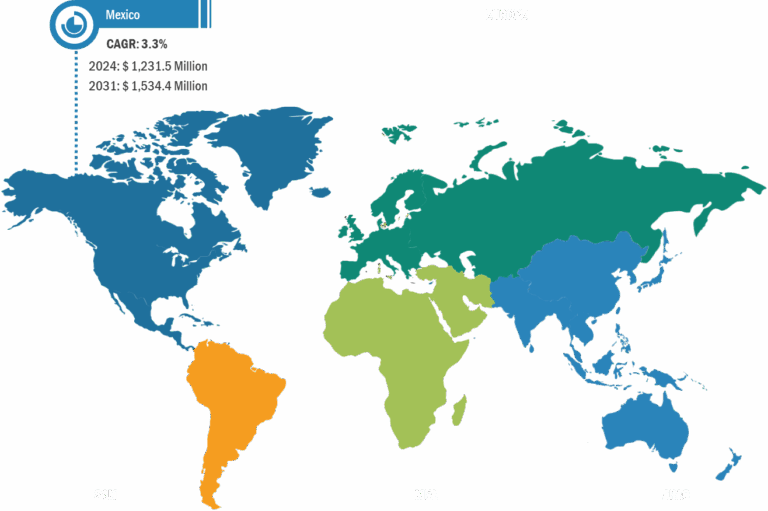

According to the WHO 2023 report, after the contentious debate, Brazil’s supreme court declared the country’s “Drink-Driving Law” completely constitutional in August 2022. This is due to crashes standing as one of the top three causes of death among Brazilian population aged between 5 and 39 years. Among these deaths, alcohol consumption-led accidents account for nearly 10% of all deaths due to road traffic crashes in the country. Also, Brazil’s supreme court implemented and announced that the police would carry the breath analyzer tests and administer drinkers to control alcohol-related road traffic crashes and deaths in the future. Such implementation makes the “Drink-Driving Law” completely workable and fully enforceable.

In November 2021, Congress mandated that all cars must have an in-built advanced drunk and impaired driving prevention technology capable of detecting drunk drivers by the police. The mandate was included in the US$ 1.5 trillion infrastructure bill that was signed in 2021. Also, in the US, some states already incorporated in-car breath analyzers for people called “ignition interlock devices.” These ignition interlock devices require drivers to blow an alcohol-free breath into a tube before the car will start. Despite this technology, Congress’s mandate for “advanced drunk and impaired driving prevention technology” is a more advanced technology than breath analyzers that involve sensors collecting data about the driver’s body and detecting whether the alcohol is consumed by the driver or not. Thus, government support and implementation of new advanced technologies to detect alcohol-impaired drivers resulting in controlling road traffic crashes boost the breath analyzers market growth.

Breath Analyzer Market: Segmental Overview

Based on application, the breath analyzer market is segmented as drug abuse detection, alcohol detection, and medical applications. The medical applications segment held a larger market share in 2022. In recent years, breath analysis has emerged as one of the most promising noninvasive diagnostic methods, attracting significant research interest. The method involves detecting gas analytes such as exhaled volatile organic compounds (VOCs) and inorganic gases, which are considered essential biomarkers for various diseases. Recent advancements in metabolomics have led to improved capabilities to explore human metabolic profiles in breath. Despite some challenges in sampling and analysis, exhaled breath is a desirable medium for metabolomics applications. It is convenient and practically limitless in availability. Currently, several breath-based tests are established and in practical and clinical use. In an article published by Biomedical Signal Processing and Control in September 2021, a study carried out using a breath analyzer for the assessment of patients’ breath print to diagnose chronic kidney disease resulted in 85.7% accuracy using Fast Fourier Transform (FFT) coefficient as feature sets.

In April 2022, the US FDA issued an emergency use authorization (EUA) for the first InspectIR COVID-19 Breathalyzer that detects chemical compounds in breath samples to diagnose SARS-CoV-2 infection.

Breath Analyzer Market: Competitive Landscape and Key Developments

Thermo Fisher Scientific Inc, Alcolizer Pty Ltd., Lifeloc Technologies Inc, Now Group UK Ltd, Dragerwerk AG & Co KGaA, Abbott Laboratories, Honeywell International Inc, KHN Solutions LLC, Bedfont Scientific Ltd, Intoximeters Inc are among the leading companies operating in the breath analyzer market. These players focus on expanding and diversifying their market presence and acquiring a novel customer base, tapping prevailing business opportunities in the breath analyzer market.

Market players are launching new products in the market. Below are a few instances:

- In May 2023, Cannabix Technologies Inc. a manufacturer of breath testing devices, announced the development of contactless alcohol breathalyzer (CAB) technology in the workplace and in-cabin vehicles..

- In Apr-2023, Drager launches the new Alcotest 6000, an improvement from the Alcotest 5820. The Alcotest 6000 identifies alcohol-impaired individuals, helping lawmakers and employers make effective decisions before the subject becomes a liability.

- In Apr-2022, Company’s InspectIR COVID-19 Breathalyzer gets FDA authorization for rapid detection of five Volatile Organic Compounds (VOCs) associated with SARS-CoV-2 infection.

- In May-2023, Pfizer and Thermo Fisher Scientific Inc announced a collaboration agreement to help increase local access to next-generation sequencing (NGS)-based testing for lung and breast cancer patients in more than 30 Latin American, African, Middle Eastern, and Asian countries where advanced genomic testing was previously limited or unavailable. Access to local NGS testing can help to give faster analysis of genes related with disease, allowing healthcare providers to choose the best medication for that specific patient.