2G & 3G Switch Off Market

Increasing Adoption of Industry 4.0 and Edge Computing Drives 2G & 3G Switch Off Market Growth

Edge computing and 5G are two linked technologies. They both enable huge amounts of data to be processed in real-time and used to improve the performance of applications substantially. Combined with 5G, Edge computing creates opportunities to enhance digital experiences, improve performance, support data security, and enable continuous operations in every industry. Edge computing brings computation and data storage closer to the data source. By leveraging the computational capacity of edge devices, networks, and gateways, users can continue to take advantage of the principles of dynamic allocation of resources and continuous delivery that are inherent to cloud computing. The potential of 5G in the manufacturing sector is transformative. Because of its high-speed, low-latency connectivity, which is explicitly designed to meet the needs of Industry 4.0, real-time data transmission and remote monitoring, control, and automation are made possible. Manufacturers may usher in a new era of efficiency and productivity by overcoming many obstacles that plagued previous industrial networks with 5G. Due to the huge application of Industry 4.0 and edge computing, several countries are adopting Industry 4.0 and edge computing. For instance, according to the research conducted by the National Association of Software and Services Companies (NASSCOM), Industry 4.0 has witnessed over a decade of evolution since 2011. It has also grown 9.6 times during the same period, from US$ 10.5 billion in 2011 to US$ 103 billion in 2021, driven by business growth, resilience, and sustainability needs. These solutions needed 4G and 5G technology to run smoothly.

Wi-Fi networks are a key part of any enterprise IT network, particularly for flexible workspaces that use laptops, tablets, and smartphones. However, several technical and scalability challenges limit the usefulness of Wi-Fi networks for wider manufacturing and supply chain operational applications, particularly when device numbers are scaled up. Therefore, manufacturing and supply chain companies are encouraged to introduce 5G mobile connectivity for their adaptable production environments. Mobile networks deliver the breadth of capabilities to support rapid reconfiguration of the production line, automated guided vehicles or autonomous mobile robots, reliable continuous tracking of components or supplies, or any other use cases analyzed earlier. As a result, the enterprise can achieve the complete benefits of Industry 4.0 investments. The substantial capabilities introduced with 5G, including network slicing, new authentication framework, key exchange and encryption, edge computing, massive bandwidth, and open networking initiatives—provide ultra-reliable low latency and deliver the greatest flexibility for Industry 4.0. In addition, 5G developments such as time-sensitive networking support can deliver additional capabilities to support the migration of wired networks to wireless.

Industry 4.0 heavily depends on big data to support advanced analytics, automated systems, and asset tracking. IoT sensors offer the physical medium to transmit and collect that data to edge devices for processing. IoT sensors collect massive data points, which are then analyzed and consumed by artificial intelligence and machine learning platforms. Thus, an increase in these technologies propels the growth of the 4G and 5G technology, driving the growth of the 2G & 3G switch off market.

2G & 3G Switch Off Market: Segment Overview

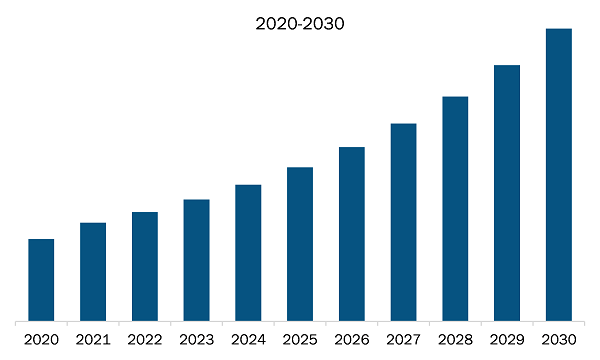

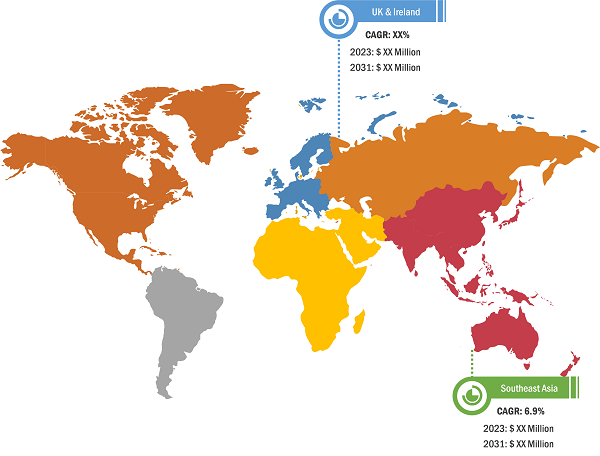

The 2G & 3G switch off market is categorized based on Type and application. Based on Type, the 2G & 3G switch off market is bifurcated into 2G and 3G. The 3G segment had a larger market share in 2020, and the 2G segment is declining faster. In terms of application, the market is segmented into message, voice, data, and IoT. The IoT segment is decelerating at the fastest pace as industries are shifting to 5G-enabled devices. By geography, the 2G & 3G switch off market is segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM). APAC is adopting 5G at the fastest pace and has a faster-declining rate of 2G & 3G switch off market.

In 2020, Europe held the second-largest global 2G & 3G switch off market share, followed by APAC. The Europe 2G & 3G switch off market is segmented into Germany, France, Spain, the UK, Italy, and the Rest of Europe. The trend in Europe differs from that of North America or APAC since the region is switching off 3G before 2G. 2G and 3G technologies are expensive to maintain and inefficient from an energy perspective. Thus, several regional operators are switching off the 2G and 3G technology. For instance, as of September 2023, various UK mobile network operators confirmed to the government that they do not plan to offer 2G and 3G mobile networks after 2033. This will support the rollout of the 4G and 5G networks, offering faster and more reliable customer service. The operators are making their own decisions on the timing and process of the switch off, and they all plan to switch off their 3G networks first.

According to SIM GmbH’s data, mobile operators in Germany, including Deutsche Telekom, Vodafone, and O2, have announced the 3G switch off, with Deutsche Telekom and Vodafone switching off their 3G radio cells in June 2021. In rural areas of Europe, the widespread 2G network is significant despite its slower connectivity. Hence, MNOs are not keen to stop it abruptly. Only Vodafone, among mobile operators across Europe, has announced a date for switching off 2G and plans to pull the plug on the 2G network in December 2025. Thus, the decision of operators to switch off the 2G and 3G networks will propel the 2G & 3G switch off market.

2G & 3G Switch Off Market: Competitive Landscape and Key Developments

AT&T Inc, BCE Inc, China Mobile Ltd, Deutsche Telekom AG, KDDI Corp, NTT Data Corp, Orange SA, Telefonica SA, Telenor ASA, and Vodafone Group Plc are among the key players profiled during this market study. In addition, several other essential market players were also studied and analyzed to get a holistic view of the global 2G & 3G switch off market and its ecosystem. Several recent developments are as follows:

- In October 2023, Yettel Hungary announced it would switch off its 3G network in November and join its rivals in sunsetting the legacy technology in Hungary. Currently, the operator is phasing out its remaining 2100 MHz 3G network and, by doing so, discontinuing its UMTS-2100 services around Lake Balaton and Lake Velence in May 2023 and across Western Hungary in September. The company’s 3G network will be switched off in November as Yettel refocuses on its 4G and 5G services.

- In September 2023, BT Group plans to switch off EE’s 3G network completely by March 2024. According to the UK telecom regulator Ofcom’s Mobile Matters 2023 report, EE customers only spend 2.7% of their time connected to 3G networks. As per EE, 3G technology represented around 35% of EE’s total power consumption. Hence, the decision was made to switch off 3G and repurpose the spectrum for 4G and 5G.