E-invoicing Market

Integration of Blockchain in E-Invoicing to Fuel E-invoicing Market Growth During Forecast Period

Blockchain is a revolutionary technology that has the potential to transform business processes across industries, ranging from retail to logistics. Blockchain technology is growing at an unprecedented rate owing to various successful proof of concepts in industries such as BFSI, IT & telecom, and logistics & transportation. Common use cases of blockchain include applications that involve multiple parties, tracking of goods from origin to end user, and high-security applications. Presently, China and the US are two major contributors to the growth of the global blockchain technology market. In China, blockchain is being extensively used in real-world applications and is one of the important parts of the Digital China strategy. In 2019, China became the first country to use blockchain at a large-scale commercial level. The technology is used in the Shenzhen Metro System to enable e-invoicing for rail transit payments. This technology is anticipated to digitalize more than 170,000 invoices on a daily basis and thus reduce the cost and environmental impact of printing paper invoices substantially. The successful implementation of blockchain in e-invoicing by China showcases the future potential of this technology in driving growth and removing various barriers to the global e-invoicing market. Blockchain technology can be used to transform the global payment and invoicing industry by offering highly secure and easily accessible solutions to end customers without the need for any intermediaries. With the growing demand for digitalizing payment and invoice processes across businesses, the adoption of advanced technologies such as blockchain in the e-invoicing market is expected to increase in the near future.

E-invoicing Market: Industry Overview

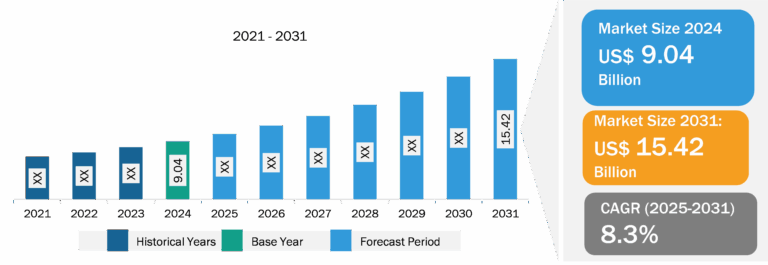

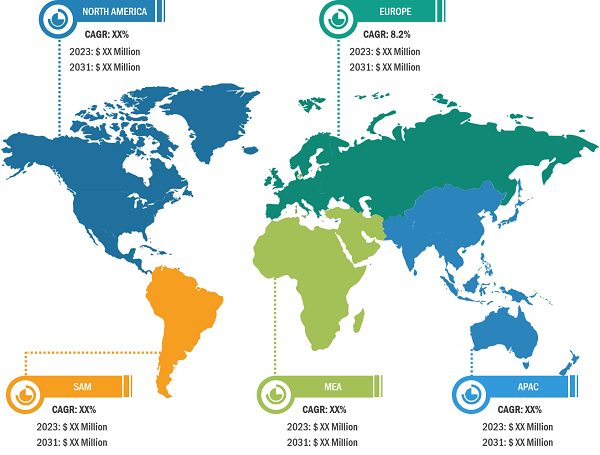

The e-invoicing market forecast is estimated on the basis of various secondary and primary research findings such as key company publications, association data, and databases. The market report emphasizes the key factors driving the market and showcases the developments of prominent players. The report includes growth prospects owing to the current e-invoicing market trends and their foreseeable impact during the forecast period. The market is segmented on the basis of deployment, end user, type, application, and geography. By deployment, the market is divided into on-premise and cloud-based. Based on end-user, the market is segmented into retail and e-commerce, government, IT and telecom, BFSI, and others. Based on type, the e-invoicing market is segmented into PO invoices and non-PO invoices. Based on application, the e-invoicing market is categorized into B2B, B2C, and B2G. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America.

The increase in consumers’ disposable incomes and changes in their lifestyles and purchasing patterns are a few factors contributing to the increased purchasing of goods and products from online platforms. Consumers prefer to shop online as it offers a selection from a wide range of products and saves time and money compared to brick-and-mortar stores. In addition, the increasing penetration of the internet and smartphones is boosting customers’ preference for online shopping, fueling the growth of the e-commerce industry. According to the India Brand Equity Foundation, the online shopper base in India was 150 million in 2021 and is expected to reach 350 million by 2026. In addition, per the International Trade Administration (ITA), the global B2C e-commerce revenue is expected to reach US$ 5.5 trillion by 2027 at a steady 14.4% compound annual growth rate between 2017 and 2027.

With the growth of the e-commerce industry, the volume of transactions, e-commerce operators, and the introduction of new market players is also growing, generating the demand for e-invoicing solutions for efficient and error-free operations across the supply chain. In addition, the government mandates over e-invoicing in the e-commerce industry play a significant role in the growth of the e-voicing market. For instance, if the annual turnover of the e-commerce organization is above US$ 1.22 million (INR 10 crores), then it is mandatory that the organization register the e-invoice under GST on the Invoice Registration Portal and generate an IRN. E-invoicing market players such as Basware and IRIS Business Services Ltd. provide e-invoicing solutions for the e-commerce industry. E-invoice solutions provide faster and more efficient processing of input tax credits and faster online invoice issuance; they are less prone to errors than manual records; analytics and automated reports allow a bird’s eye view of the invoices; and they save time using the streamlined billing method. All these benefits provided by e-invoice solutions for e-commerce platforms fuel the market growth in the e-commerce industry.

Germany held a significant e-invoicing market share in Europe. Germany is the largest economy in Europe, and e-invoicing is allowed but not mandatory yet. The government is taking initiatives to mandate e-invoicing, starting with B2G transactions in 2020. The e-invoicing regulations in Germany are imposed through EU directives and are currently limited to government organizations. Being a federal republic, the e-invoicing policies vary state-wise. Since April 2020, German federal states have been mandated to accept B2G e-invoices in compliance with European Directive 2014/55/EU. Germany moves closer to implementing obligatory B2B e-invoicing in 2025. The “Bundesrat,” the representative body of the federal states of Germany, has approved the draft law that includes B2B electronic invoicing, postponing the start of the mandatory issuance of invoices to January 2027 for companies with more than US$ 868,840 (EUR 800,000) of turnover and to 2028 for companies with less than EUR 800,000 of turnover. Upcoming implementation deadlines and the government’s willingness to promote e-invoicing at various levels are expected to drive the e-invoicing market growth in Germany in the coming years.

India accounted for the significant e-invoicing market share in 2022. India is among the fastest-growing economies in APAC. The country is focused on adopting e-invoicing. India’s new e-invoicing system is the latest in a series of similar programs across Asia to manage the tax evasion situation. Businesses have said that they lack time to make their internal systems release e-invoices under the goods and services tax (GST) rule from January 2020; however, the advisors debate that implementation should not be delayed. Therefore, from April 2020, registration of e-invoice systems became mandatory in the country. From August 2023, e-invoicing is mandatory for businesses above US$ 602,365 (INR 5 crore) turnover. Among the many objectives pursued by the Ministry of Finance, the simplification of tax declaration, the reduction of tax fraud, and standardized communications between companies are addressed by the e-invoice.

E-invoicing Market: Competitive Landscape and Key Developments

The e-invoicing market analysis is carried out by identifying and evaluating key players in the market across different regions. Cegedim SA, Sage Group Plc, Comarch SA, Nipendo Ltd, Tradeshift, Transcepta LLC, Basware Corporation, Coupa Software Inc, International Business Machines Corp, and SAP SE are among the prominent players profiled in the e-invoicing market report. Several other players have also been studied and analyzed during the study to get a holistic view of the market and its ecosystem. Below are a few key developments in the market:

- In 2021, the business commerce platform Tradeshift connected its standalone Chinese service to its global network to enable China’s first-ever cross-border electronic invoicing solution.

- From July 1, 2024, the obligation to receive invoices in electronic format will be mandatory for all companies in France when their supplier is required to issue an invoice in electronic format. Considering these changes, Comarch took a step further to ensure it was in line with French requirements by joining the Forum National de la Facture Electronique (FNFE).