Howitzer Market

The changing modern warfare scenario has obligated governments of various countries to allocate significant funds and financial aid to respective defense and military forces. The defense budget allocation supports army and military forces in purchasing technologies and equipment from domestic or international developers. There is an augmented need to reinforce defense and military forces with advanced ground warfare systems; hence, land forces across the globe are focusing on investing significant amounts in procuring ground artillery systems such as howitzers, rocket artillery, and mortar systems. Defense forces’ constant inclination to acquire new technologies for noncombat and combat operations further boosts military expenditure worldwide.

The evolving modern warfare scenario has compelled governments of various countries across the globe to assign significant funds and financial aid toward respective defense and military forces. The defense budget allocation supports army and military forces to obtain enhanced technologies and equipment from domestic or international developers. On the other hand, military and army vehicle upgrades are on the rise owing to growing defense budget allocation. Furthermore, the increasing governmental expenditure showcases governments’ focus on strengthening national security forces. There is an increased need to reinforce military and border security forces with advanced surveillance, communication, navigation equipment, artilleries, armaments, and vehicles, among others; hence, military forces worldwide are focusing on investing significant amounts in procuring artillery systems and other advanced technologies. Defense forces’ constant inclination to acquire new technologies for noncombat and combat operations further boosts military expenditure worldwide.

As per the Stockholm International Peace Research Institute (SIPRI), global military expenditure increased to US$ 2,148 billion in 2022, representing a 3.5% increase from 2021. The US, China, India, Russia, and Saudi Arabia were the top five spenders in 2022, accounting for 63% of global expenditures. The figure given below depicts the yearly spending of these countries.

Military Expenditure of Top Five Countries (2020–2022)

| Country | 2020 (US$ Million) | 2021 (US$ Million) | 2022 (US$ Million) |

| US | 778,397.2 | 800,672.2 | 876,943.2 |

| China | 257,973.4 | 293,351.9 | 291,958.4 |

| Russia | 61,712.5 | 65,907.7 | 86,373.1 |

| India | 72,937.1 | 76,598.0 | 81,363.2 |

| Saudi Arabia | 64,558.4 | 55,564.3 | 75,013.3 |

Source: SIPRI

The increasing military expenditure encourages incorporating advanced warfare technologies such as high-range antennas, self-propelled artillery including howitzers, advanced communication devices, unmanned vehicles, radars, missile detection systems, surveillance and navigation systems, and modern warfare technologies. In addition, a high military budget supports the countries in assigning resources for advancing and upgrading their existing air, ground-based, and naval defense systems. All these factors boost the howitzer market growth across different regions.

Rising Contracts for Self-Propelled Howitzers to Provide Lucrative Opportunities for Howitzer Market

One of the major factors driving the growth of the howitzer market includes the rising number of contracts for howitzers, including towed and self-propelled products. A few of the howitzer procurement contracts are mentioned below:

• In December 2023, Poland’s State Armament Agency announced that it had purchased K9 Howitzers from South Korea as a part of the US$ 2.6 billion deal with Hanwha Defense.

• In November 2023, BAE Systems won a contract worth US$ 63 million from the US DoD to produce self-propelled Paladin howitzers and ammunition carrier vehicles.

• In September 2023, the Indian Army passed a proposal to purchase 400 units of howitzers worth US$ 48 million from Indian firms.

• In December 2022, the Indian Defence Ministry issued a Request for Proposal to L&T for producing 100 units of K9 Howitzers through Hanwha Defense Technology.

Such procurement and replacements (upgrades of older fleet of towed howitzers) of howitzers are expected to provide growth opportunities for howitzer market players across different regions.

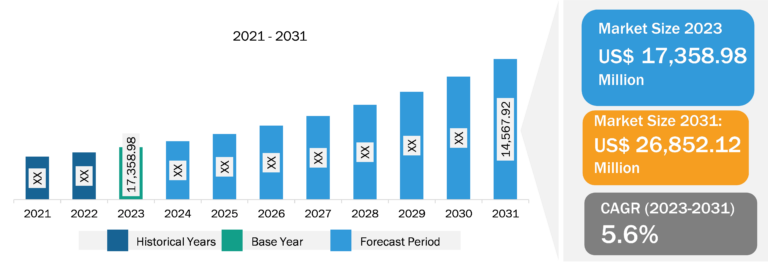

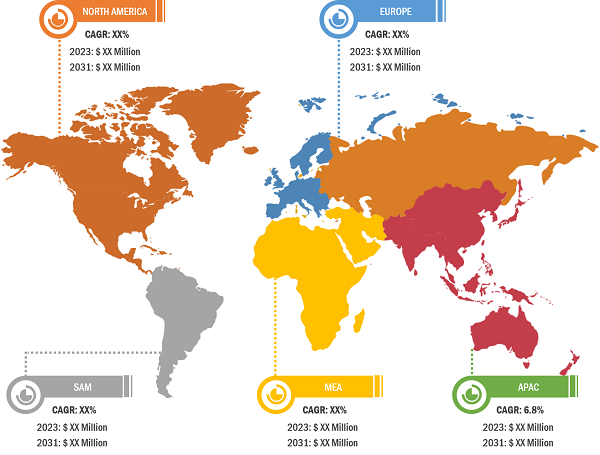

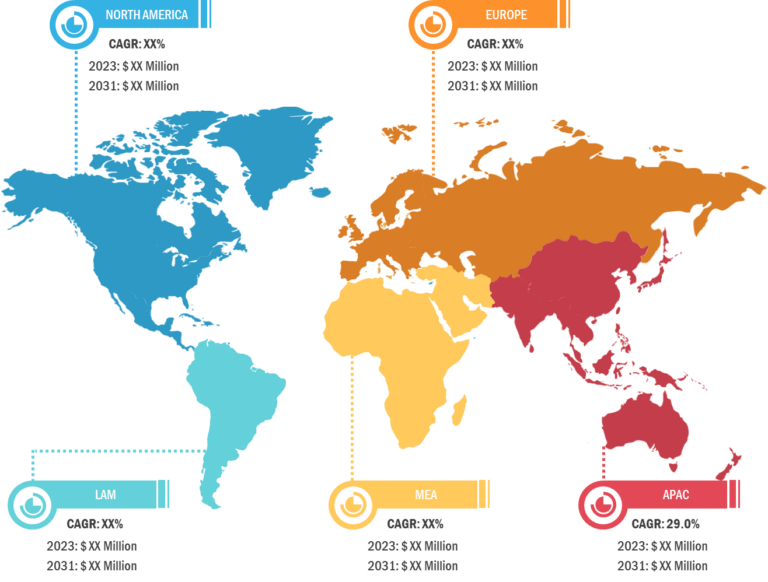

Howitzer Market: Segmental Overview

The howitzer market is segmented based on component, range, type, and geography. In terms of component, the howitzer market is categorized into gun turret, fire control system, ammunition handling system, auxiliary system, and others. In 2022, fire control system component accounted for the largest howitzer market share, and it is expected to retain its dominance during the forecast period. Based on range, the howitzer market has been segmented into short range, medium range, and long range. In 2022, the medium range segment accounted for a major share of the global howitzer market, and it is expected to retain its dominance during the forecast period as well. Based on type, the howitzer market has been segmented into towed howitzer and self-propelled howitzer. In 2022, the self-propelled howitzer segment accounted for a major share of the global howitzer market, and it is expected to retain its dominance during the forecast period. Based on geography, the howitzer market has been segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America. In addition, in 2022, North America accounted for a major share of the global howitzer market. Asia Pacific is likely to register the highest CAGR during the forecast period.

Howitzer Market Analysis: Competitive Landscape and Key Developments

BAE Systems Plc, Elbit Systems Ltd, Avibras, Hanwha Group, RUAG Group., IMI Systems, General Dynamics, ST Engineering, Denel SOC Ltd, and Saab AB are among the key companies operating in the howitzer market across different regions. The market leaders focus on new contracts, product launches, expansion and diversification, and acquisition strategies, which allow them to access prevailing business opportunities.

• In February 2023, BAE Systems secured a contract worth US$ 466 million to provide the U.S. Army with its M109A7 Paladin self-propelled howitzers. As per the U.S. Department of Defense announcement, the contract encompasses the supply of M992 Field Artillery Ammunition Support Vehicles. The quantity of howitzers and support carriers included in the order has not been disclosed.

• In January 2023, Colombian armed forces finalized an agreement with Israel’s Elbit Systems for the acquisition of 18 units of the 155mm howitzer Atmos, marking a significant deal valued at US$ 101.7 million.