Packaged Salad Market

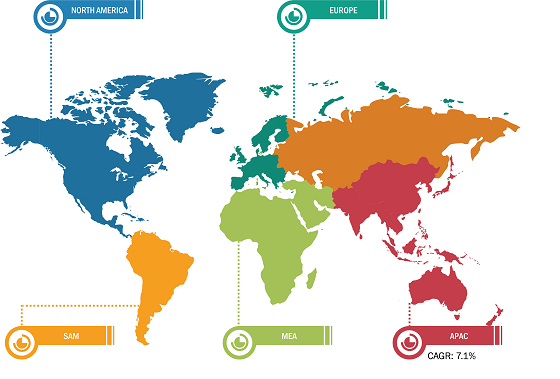

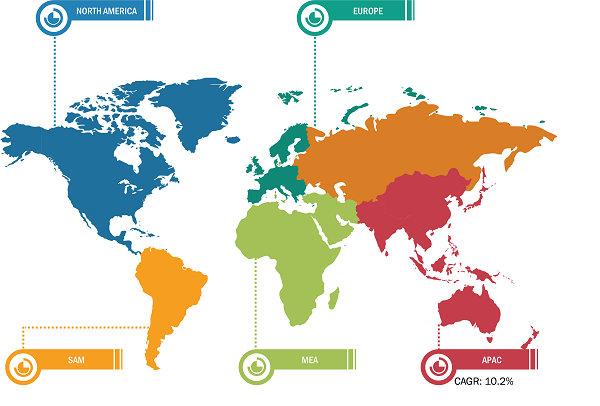

In 2023, North America held the largest global packaged salad market share. The surge in demand for packaged salad in North America can be attributed to several factors, reflecting evolving consumer preferences and lifestyle changes owing to a rising emphasis on health and wellness. Various campaigns are being conducted in the region to encourage people to follow a healthy lifestyle, which includes consuming a nutritional diet. Strategic initiatives such as mergers and acquisitions, expansion, partnerships, and product launches taken by various key players in the region also contribute to the packaged salads market growth. For instance, in 2023, Dole Food Co and Charlotte Hornets collaborated to host a power-up event for Charlotte School to promote healthy eating habits and active lifestyles among students. This created awareness of eating healthy among the students, ultimately increasing the sale of packaged salads.

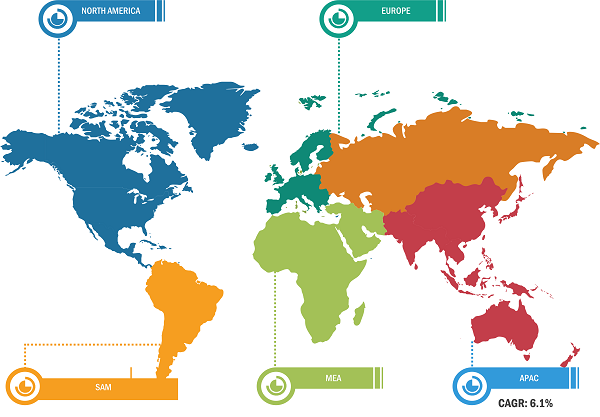

With an increasing awareness of the importance of nutrition and wellness, consumers actively seek convenient and nutritious food options, and packaged salads perfectly fit this demand. Packaged salads offer a convenient solution for individuals striving to maintain a healthy lifestyle amid busy schedules. Pre-cut vegetables, washed greens, and often included dressings provide a quick and hassle-free way to incorporate essential nutrients into one’s diet. The rise of urbanization has significantly contributed to the popularity of packaged salads. As more people migrate to urban areas, they often face limited time for meal preparation due to demanding work schedules and fast-paced lifestyles. Packaged salads offer a time-saving solution, allowing people living in urban areas to access fresh and nutritious meals without extensive cooking or meal planning. The convenience factor of packaged salads resonates strongly with urban consumers, driving the market expansion in densely populated areas. According to a survey, 91% of health-conscious consumers report that they actively pursue health and wellness.

E-commerce Expansion

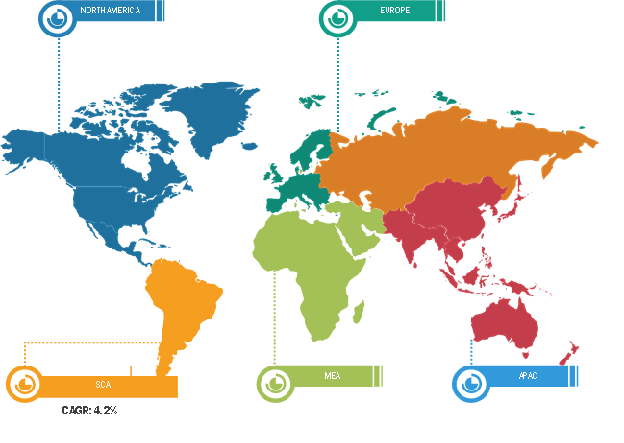

Online grocery shopping has experienced tremendous growth in recent years, fueled by technological advancements, changing consumer preferences, and the convenience of doorstep delivery. Packaged salad manufacturers can leverage this trend by partnering with online retailers or establishing e-commerce platforms to reach a broader audience beyond traditional brick-and-mortar stores. By tapping into the online market, companies can expand their customer base and cater to the growing segment of consumers who prefer the convenience of ordering groceries online.

One of the critical advantages of e-commerce for the packaged salad market is the ability to offer a varied range of products and customization options to meet individual preferences. Online platforms allow manufacturers to showcase their entire product portfolio, including different salad blends, sizes, and packaging options. They can provide personalized recommendations based on consumer preferences and dietary restrictions, enhancing the shopping experience and increasing customer satisfaction. By providing a seamless online shopping experience, packaged salad brands can differentiate themselves from competitors and capture a larger market share.

Packaged Salad Market: Segmental Overview

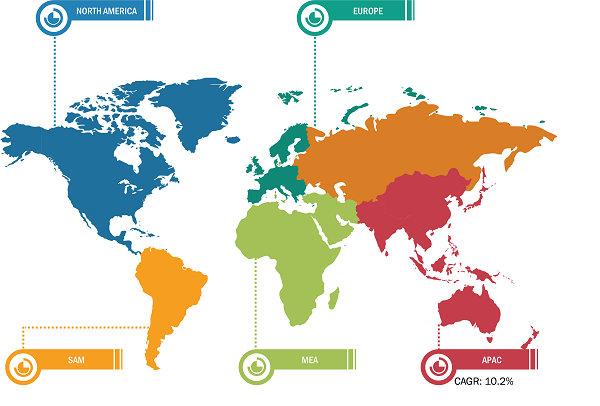

Based on product type, the packaged salad market is divided into vegetarian & vegan and meat-based. The vegetarian & vegan segment held a larger share of the market in 2023. Vegetarian and vegan salads include a variety of leafy vegetables, greens, fruits, and lentils. Lettuce, kale, iceberg, tomato, cucumber, spinach, arugula, and others are a few of the common vegetables used in packaged salad. The demand for vegetarian and vegan packaged salad has surged owing to the growing awareness of the health benefits of vegan diets. Further, the increasing number of vegan and vegetarian populations has contributed to the overall growth of the market. For instance, according to the Great Greens Walls, 23% of Americans are trying to eat less meat every year. This contributed to the adoption of packaged salad, boosting the market growth.

The packaged salad market, based on category, is segmented into organic and conventional. The conventional segment held the largest share of the market in 2023. Conventional packaged salads are often available at a lower price compared to organic alternatives, making them more accessible to a wide base of consumers, including budget-conscious individuals and families. In addition, conventional farming practices typically yield higher quantities of produce, leading to greater availability and variety of options in the market.

The packaged salad market, based on distribution channel, is segmented into supermarkets and hypermarkets, convenience stores, online retail, and others. The supermarkets and hypermarkets segment held the largest share of the packaged salad market in 2023. People often prefer to buy packaged salad from supermarkets and hypermarkets due to the convenience and variety of products offered by such outlets. Supermarkets and hypermarkets provide a one-stop, convenient shopping experience, allowing consumers to explore various types of packaged salads alongside other essential products. In addition, these large retail spaces often feature a broad selection of brands and varieties, allowing customers to compare products and make well-informed decisions. The ease of access, combined with the availability of a wide range of products and huge potential for bundled offers, makes supermarkets and hypermarkets attractive destinations for purchasing packaged salad.

Packaged Salad Market: Competitive Landscape and Key Developments

Dole Plc, Brightfarms Inc, Fresh Express Inc, Taylor Fresh Foods Inc, Eat Smart Inc, Troy Foods (Salads) Ltd, Bonduelle Sa, Avondale Foods (Craigavon) Ltd, Organicgirl Llc, and Misionero Inc are among the prominent players profiled in the packaged salad market report. These market players are focusing on providing high-quality products to fulfill customer demand. They are also adopting various strategies such as new product launches, capacity expansions, partnerships, and collaborations in order to stay competitive in the market.