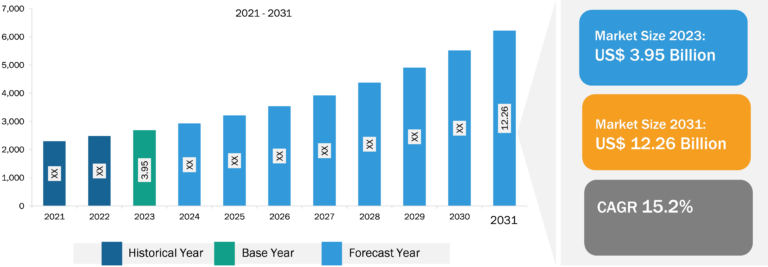

Public Key Infrastructure Market

Increasing Number of Connected Devices Drives Public Key Infrastructure Market Growth

Public key infrastructure is also known as asymmetric cryptography, and it uses two pairs of keys—one is public and the other private. A key is generally a long binary number, while a root key is the topmost key in the public key infrastructure hierarchy. It is used to authenticate and sign digital certificates and are asymmetric key pairs with lengths ranging from 256 to 4,096 bits, depending on the digital signature algorithm used. The public key is distributed worldwide, while the private key is held private. Application design has changed radically since the introduction of public key infrastructure. With cloud and mobility, employees are allowed to operate remotely. In addition, cloud computing has enabled information processing at a vendor’s premises, out of the enterprise data center. Cloud computing has also been promoting the rise in the number of connected devices. According to the report by Telefonaktiebolaget LM Ericsson, the number of devices connected through Massive IoT technologies reached approximately 500 million at the end of 2022. This growth of Massive IoT technologies is due to the added capabilities in the networks, which enables Massive IoT to coexist with 4G and 5G in frequency division duplex (FDD) bands via spectrum sharing.

Also, in 2022, broadband IoT reached 1.3 billion connections and helped connect the largest share of all cellular IoT devices. In addition, the rising adoption of 5G worldwide is boosting the number of IoT devices. According to the Groupe Speciale Mobile Association (GSMA), in 2022, 5G penetration accounted for 17% across the world, which is expected to reach 54% by 2030. North America has the highest 5G penetration; it was recorded to be 39% in 2022 and is expected to reach 91% by 2030. Similarly, in 2022, Asia Pacific (except China) and Europe recorded 4% and 11% of 5G penetration, which is expected to reach 41% and 87% by 2030, respectively. This rise in 5G penetration further increases the number of connected devices globally, which boosts the need to secure the data, fueling the demand for public key infrastructure. With the use of PKI, IoT devices can enable direct authentication across systems in decentralized handling of authentication, thereby driving the public key infrastructure market.

Public Key Infrastructure Market: Segment Overview

The public key infrastructure market is categorized on the basis of deployment mode, component, enterprise size, and end user. Based on component, the public key infrastructure market is bifurcated into solutions and services. The services segment is further bifurcated into professional services and managed services. Based on deployment mode, the market is bifurcated into on-premise and cloud. Based on enterprise size, the market is divided into small and medium enterprises (SMEs) and large enterprises. In terms of end user, the market is categorized into BFSI, retail & e-commerce, government & defense, IT & telecom, manufacturing & automotive, and others. By geography, the public key infrastructure market is segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM).

In 2022, Europe held the second-largest global public key infrastructure market share, followed by North APAC. The Europe public key infrastructure market is segmented into Germany, France, Spain, the UK, Italy, and the Rest of Europe. The rising demand for information security solutions is broadly acknowledged in Europe. According to the AAG IT Services, in 2022, 39% of UK businesses experienced a cyberattack. This cybercrime cost UK businesses an average of US$ 5,064.44 (GBP 4,200) in 2021. The most common cyber threat faced by these businesses is phishing (83% of identified attacks). Similarly, in 2022, 72.6% of German organizations suffered at least one cyberattack. To address these cyber-attack challenges, the region is adopting security solutions and focusing on the implementation of advanced technology, such as public key infrastructure. Also, the rising use of technology is creating new opportunities, including new solutions and services, which are becoming integral parts of daily lives. The risk of cyber-attacks is growing in the region; hence, governments of various countries in the region is focusing on accelerating the efforts to strengthen cybersecurity.

Public Key Infrastructure Market: Competitive Landscape and Key Developments

DigiCert Inc, eMudhra Limited, Enigma Systemy Ochrony, Entrust Corporation, Fortinet Inc, FutureX, GlobalSign, Sectigo Ltd, Securemetric Bhd, and Thales SA are among the key players profiled during the public key infrastructure market study. Various other companies are introducing new product offerings to contribute to the public key infrastructure market size proliferation. Several other important players were also analyzed during this market research to get a holistic view of the global market and its ecosystem. The leading public key infrastructure market players focus on feature upgrades, expansion and diversification, collaboration, and acquisition strategies, which enable them to grab new business opportunities.

- In June 2023, India’s Controller of Certifying Authorities under the Ministry of Electronics and Information Technology (MeitY) released the draft public key infrastructure mutual recognition framework to boost cross-border adoption of digital public infrastructure.

- In January 2023, DigiCert Inc, a leading provider of digital trust, announced the release of DigiCert Trust Lifecycle Manager, a comprehensive digital trust solution unifying Certificate Authority (CA) agnostic certificate management and public key infrastructure services. Trust Lifecycle Manager securely integrates with DigiCert’s public trust issuance for a full-stack solution governing the unified management of corporate digital trust infrastructure.