Eye Drops Market

High Incidence of Age-Related Eye Diseases is Boosting Eye Drops Market Growth

Weakening of eye vision is prominently caused by aging. According to data provided by the Centers for Disease Control and Prevention (CDC), ~12 million people in the US aged 40 and above suffered from vision impairment in 2022, of which 3 million suffered from vision impairment after correction and 8 million suffered from vision impairment due to uncorrected refractive index. According to the results of the Canadian Health Measures Survey conducted during 2016–2019, 50.4% of adults aged 40–64 and 71.6% of seniors aged 65–79 stated they had visited an eye care professional in the past. Thus, the high prevalence of dry eye among the older population is likely to encourage manufacturers to introduce new eye care products in the market, which, in turn, will contribute to the growth of the market. Also, the development in the healthcare industry has increased life expectancy. Various healthcare companies design products focusing on the geriatric population. Countries worldwide are adopting new techniques to treat older people safely and effectively. Thus, the growing aging population is driving the growth of the market. In addition, in 2019, the WHO launched the Universal Health Coverage and Eye Care: Promoting Country Action, an event to provide practical, step-by-step guidance to support Member States of WHO in planning and implementing the recommendations of the WHO’s World Report on vision. The WHO launched this event to provide integrated people-centered eye care services. Further, the India–US Collaborative Vision Research Program 2020 focuses on advancing science and technology crucial to understand, prevent, and treat blinding eye diseases, visual disorders, and associated complications. The Indian Department of Biotechnology and the US NEI fund this research program. Furthermore, the Karolinska Institutet, Sweden, offers grants to promote research on eye diseases. In 2020, the institute announced US$ 5,912.88–17,738.64 (SEK 50,000–150,000) per person funding for new research projects on eye diseases. In December 2022, Research to Prevent Blindness provided an annual grant of US$ 115,000 to the John A. Moran Eye Center at the University of Utah for eyecare research. These funds will provide maximum flexibility in developing and expanding eye research programs and fostering creative planning beyond the scope of restricted project grants. In December 2021, NIH-funded projects supported the partnership between Kellogg Eye Center and Aravind Eye Hospital (India) to develop a clinical research training program for eyecare specialists. Such training programs are meant to develop the eyecare field in India. Thus, increasing funds for eyecare research will likely offer growth opportunities to the eye drop market players.

Eye Drops Market: Segmental Overview

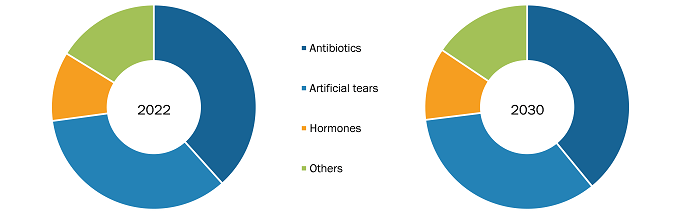

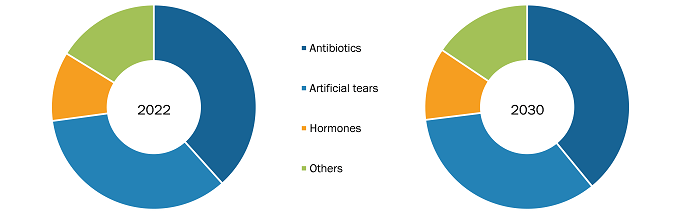

The “Global Eye Drops Market” is segmented based on type, application, purchase mode, and geography. Based on type, the eye drops market is segmented into antibiotics, artificial tears, hormones, and others.

The antibiotics segment held the largest market share in 2022. The hormones segment is anticipated to register the highest CAGR of 5.8% during the forecast period. Eye vision in females is largely affected by changing hormone levels. Changing levels of estrogen and progesterone impact oil glands in the eye, leading to dryness. Estrogen fluctuations are primarily responsible for causing dryness in the eyes. Women who are at the stage of menopause are at high risk of suffering from dry eye conditions. The condition can be treated using prescribed eye drops. Several research activities are being conducted to develop eye drops that treat eye diseases caused due to hormonal changes. Thyroid-related autoimmune diseases may lead to thyroid level changes, which can consequently cause dry eye. Thus, the aforementioned factors are anticipated to boost the eye drops market for the hormone drops segment.

Based on application, the eye drops market is divided into eye diseases, eye care, and others. Eye disease is further categorized into dry eye, glaucoma, cataract, and others. The eye diseases segment held the largest market share in 2022. The eye care segment is anticipated to register the highest CAGR of 5.8% during the forecast period. A dry eye is a condition that occurs when tears are not able to lubricate the eyes. Tears are essential to maintain good eye health and provide good vision. The condition is commonly seen among older people and people who spend excessive time on computers, laptops, and smartphones. Dry eyes disrupt the healthy tear film and the reasons for tear film dysfunction includes hormone changes, autoimmune disease, inflamed eyelid glands or allergic eye disease. Although the conditions cannot be cured completely, it can be managed using medical products.

Based on purchase mode, the eye drops market is bifurcated into OTC and prescription. The prescription segment held a larger share of the market in 2022 and is anticipated to register a higher CAGR of 5.5% in the market during the forecast period. Patients visit an ophthalmologist when they do not get results with prolonged use of available over-the-counter (OTC) drugs. Prescribed eye drops treat disorders such as dry eye disease and lowering intraocular pressure in glaucoma patients. Antibiotic eye drops prescribed by a doctor treat bacterial eye infections. Restasis (cyclosporine ophthalmic) eye drops are approved to treat dry eye disease (called keratoconjunctivitis sicca). Further, many medicines are available for lowering the IOP in glaucoma patients. Frequently used eye drops available for these purposes are prostaglandin analogs such as Latanoprost, Travoprost, Bimatoprost, and Tafluprost; beta-blockers such as Timolol and Betaxolol; and alpha-2 adrenergic agonists such as Brimonidine.

The development of prescription drugs will continue to boost the market in the coming years. Vuity, the first eyedrop approved by the Food and Drug Administration (FDA) to treat presbyopia, was launched in December 2021. Presbyopia more commonly affects people aged 40 and older. Vuity replaced the reading glasses of millions of Americans suffering from age-related blurry vision. The prescription drug uses the eye’s natural ability to reduce pupil size. Thus, such developments are anticipated to accelerate the eye drops market growth for the prescription segment.

Eye Drops Market: Competitive Landscape and Key Developments

Akorn Operating Company LLC, Alcon AG, Pfizer Inc, Prestige Consumer Healthcare Inc. , Rohto Pharmaceutical Co Ltd, Sager Pharma Kft, Similasan Corp, AbbVie Inc, Bausch & Lomb Inc, and Biomedica Pvt Ltd are among the leading companies operating in the eye drops market. These players focus on expanding and diversifying their market presence and acquiring a novel customer base, tapping prevailing business opportunities in the eye drops market.

Market players are launching new products to the market. Below are few instance:

- Iin January 2021, Kala Pharmaceuticals Inc. launched EYSUVIS (loteprednol etabonate ophthalmic suspension) 0.25% for the short-term (up to two weeks) treatment of the signs and symptoms of dry eye disease. EYSUVIS is now available in national and regional US pharmaceutical distribution centers.

- In December 2020, Alcon launched a professional line of the preservative-free version of SystaneTM Ultra HYDRATION Lubricant Eye Drops in Canada, which is the newest addition to its revolutionary portfolio of dry eye solutions.

- In February 2019, Rayner introduced the AEON family of pre- and post-surgery eye drops to help patients with dry eye manage their condition and improve their visual outcomes. AEON PROTECT PLUS has a unique cross-linked sodium hyaluronate (HA) formulation to provide an artificial tear for the relief of moderate to severe dry eye condition.