Lateral Flow Assay Market

The increasing use of home-based assay kits and the rising popularity of point-of-care testing drive the market growth. However, inconsistent assay results due to procedural limitations hinder the lateral flow assay market growth.

Rising Popularity of Point-of-Care Testing Drive Lateral Flow Assay Market Growth

Lateral flow assay-based point-of-care (POC) diagnostic tools are rapid, easy-to-use, and low-cost paper-based procedures, which are specifically perceived to be beneficial in resource-limited settings and industrialized countries. These tests are increasingly replacing prolonged, conventional laboratory methods. No training and complex infrastructures are required to run POC diagnostic tests. Thus, these tests cost less than conventional laboratory diagnostic techniques. POC testing tools are expected to be a crucial revenue pocket in the lateral flow assay market because of their prominent role in combating the burgeoning disease burden. Many companies are engaged in developing innovative lateral flow assay-based POC devices for infectious disease diagnosis, drugs-of-abuse screening, pregnancy (using hCG levels) and ovulation confirmation, and blood protein marker measurement.

In July 2022, Hemex Health, a US-based medical diagnostic device company, and Mylab Discovery Solutions, an Indian startup, joined forces to create diagnostic solutions to transform frontline healthcare. In India, they launched the Gazelle PathoCatch COVID-19 FIA test as a collaborative diagnostic solution for point-of-care (POC) testing.

Thus, the rising popularity of POC testing and ongoing developments in lateral flow assay-based POC testing fuel the growth of the lateral flow assay market.

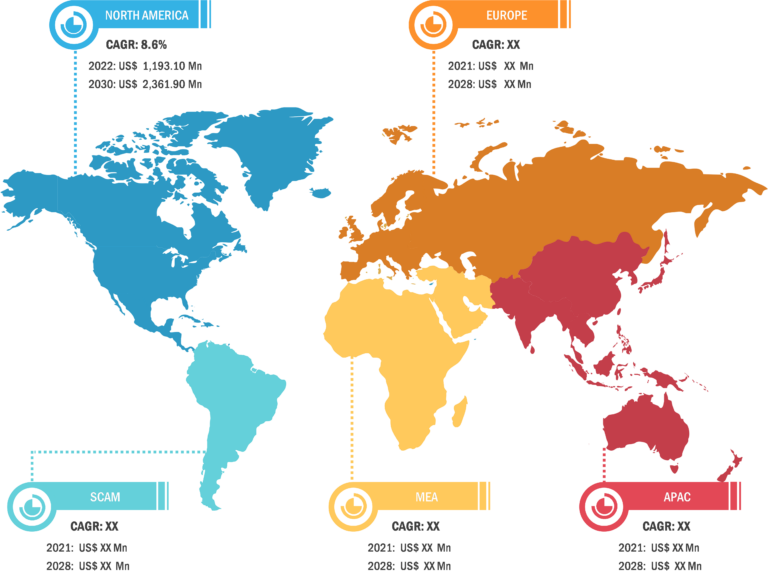

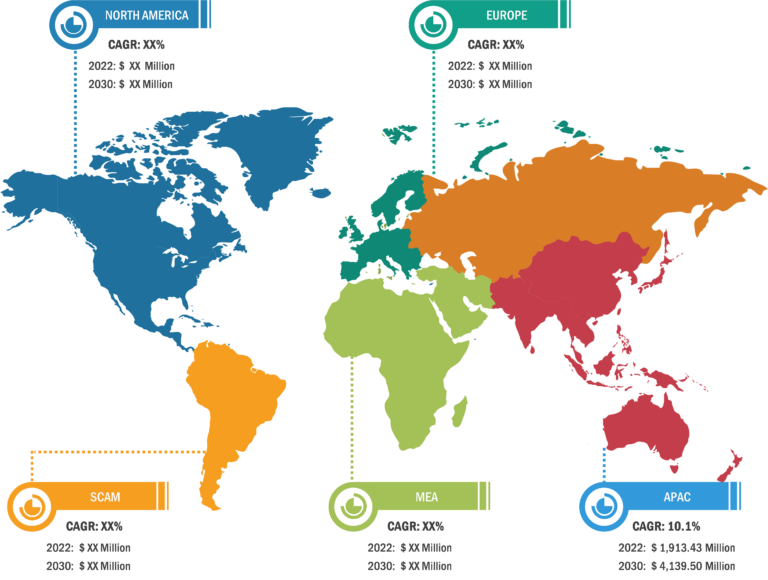

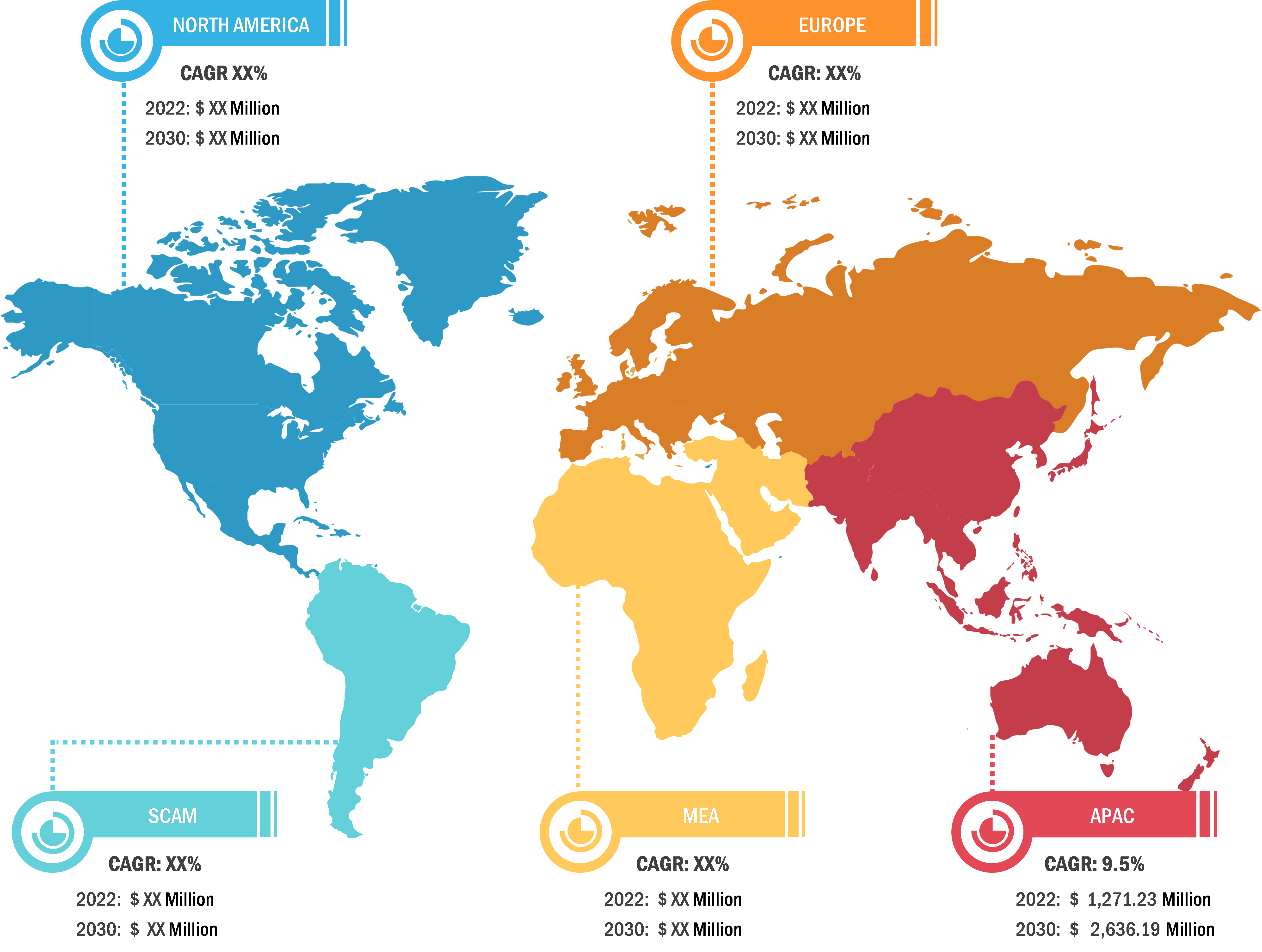

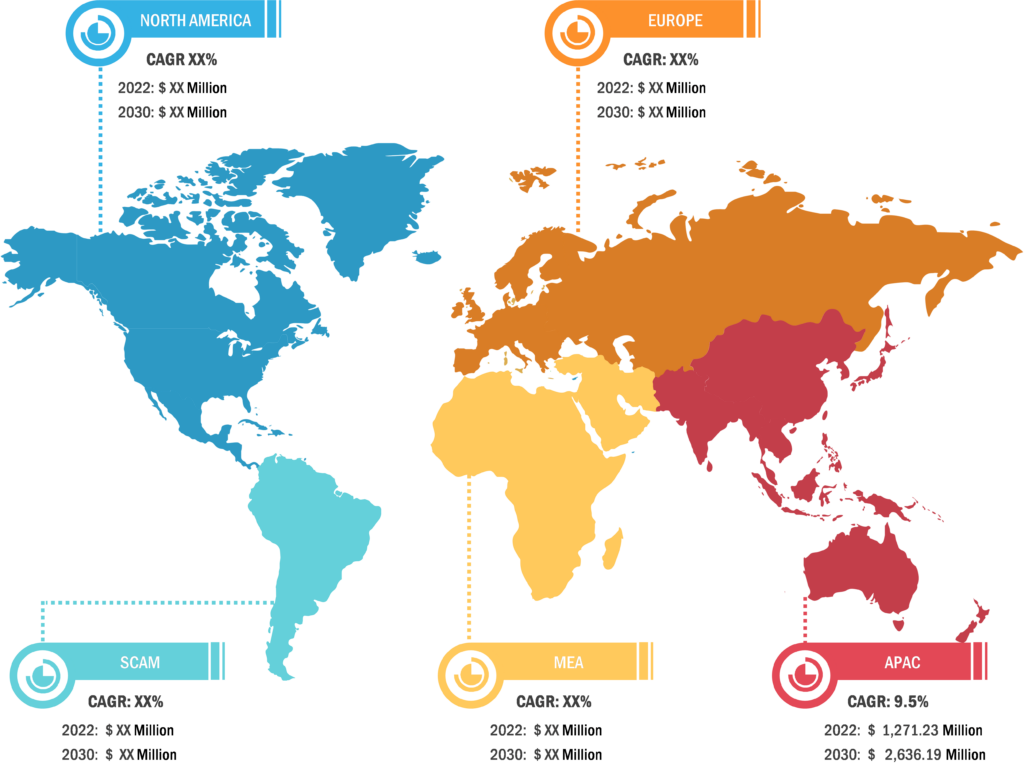

Lateral Flow Assay Market: Regional Overview

Based on region, the lateral flow assay market is primarily segmented into North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. Asia Pacific is anticipated to register the highest CAGR in the market from 2022 to 2030. In the region, China held the largest market share and is estimated to register the highest CAGR during the forecast period. In China, the prevalence of infectious diseases is rising, and it is anticipated to boost the growth of the market in the country. In China, from 2020 to 2021, there was an exponential rise in the incidence of human brucellosis. Per a report published by the Chinese Center for Disease Control and Prevention, in 2021, ~69,767 cases were reported from 2,083 countries in mainland China, a 47.7% increase from 2020—i.e., 47,425. In 2017, the Chinese Pathogen Identification Net (China PIN) was developed to collect data on bacterial pathogens from the network laboratories to support the early detection and tracing of infectious diseases. Furthermore, a study (2021) by the World Health Organization’s International Agency for Research on Cancer (IARC) and partner institutions in the UK and China found that H. pylori infection is highly prevalent in China. H. pylori infection was the prime reason for 62.1% of cardia gastric cancer cases and 78.5% of non-cardia gastric cancer cases in the population of adults over 30 years of age. This study by IARC estimated that ~340,000 cases of gastric cancer due to H. pylori infection are reported in China every year. The increasing H. pylori infection is fueling the demand for rapid test kits. Further, the impacts of the COVID-19 pandemic played a key role in driving the market in China. As per the report published in eClinicalMedicine, lateral flow device (LFD) viral antigen immunoassays have been developed as diagnostic tests for COVID-19. Thus, the fast-growing pharmaceutical industry, increasing bacterial infection and H. pylori cases in China, and rising demand for rapid test kits for COVID-19 propel the lateral flow assay market growth.

Lateral Flow Assay Market: Competitive Landscape and Key Developments

Abbott Laboratories; F. Hoffmann-La Roche Ltd.; Thermo Fisher Scientific Inc.; Bio-Rad Laboratories, Inc.; bioMerieux SA; Quidel Corporation; Hologic Inc.; PerkinElmer Inc.; Merck KGaA; Becton, Dickinson and Company; Siemens Healthineers AG; and QIAGEN are a few of the key companies operating in the lateral flow assay market. These companies focus on product innovation strategies to meet evolving customer demands, along with maintaining their brand name.

A few of the recent developments in the global lateral flow assay market are mentioned below:

- In July 2021, the Panbio COVID-19 Antigen Self-test (Abbott Laboratories) received CE Mark for over-the-counter use in adults and children, with or without symptoms. The self-test features a minimally invasive nasal swab and delivers results in 15 minutes, using proven Abbott lateral flow technology.

- In May 2020, Hologic, Inc. launched a new Aptima molecular assay for the detection of SARS-CoV-2 that labs can use for clinical testing on the company’s Panther system after completing performance verification testing.